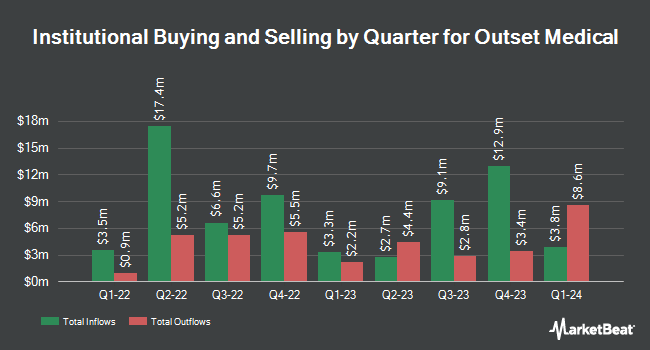

Alyeska Investment Group L.P. purchased a new position in Outset Medical, Inc. (NASDAQ:OM - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 1,703,083 shares of the company's stock, valued at approximately $18,836,000. Alyeska Investment Group L.P. owned about 47.37% of Outset Medical as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds have also recently added to or reduced their stakes in the business. Durable Capital Partners LP acquired a new position in Outset Medical in the first quarter worth approximately $19,247,000. T. Rowe Price Investment Management Inc. acquired a new position in Outset Medical in the first quarter worth approximately $17,730,000. Massachusetts Financial Services Co. MA acquired a new position in Outset Medical in the first quarter worth approximately $9,293,000. Two Sigma Investments LP grew its position in Outset Medical by 36.0% in the fourth quarter. Two Sigma Investments LP now owns 488,602 shares of the company's stock worth $542,000 after buying an additional 129,334 shares during the last quarter. Finally, Squarepoint Ops LLC acquired a new position in Outset Medical in the fourth quarter worth approximately $174,000.

Analysts Set New Price Targets

Several research firms have weighed in on OM. Royal Bank Of Canada reiterated a "sector perform" rating and set a $22.00 price objective on shares of Outset Medical in a research report on Tuesday, August 19th. BTIG Research set a $37.00 price objective on shares of Outset Medical and gave the stock a "buy" rating in a research report on Monday, July 14th. Scotiabank upgraded shares of Outset Medical to a "strong-buy" rating in a research report on Thursday, May 15th. Finally, Wall Street Zen upgraded shares of Outset Medical from a "sell" rating to a "hold" rating in a report on Saturday, June 7th. One analyst has rated the stock with a Strong Buy rating, one has assigned a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat.com, Outset Medical presently has a consensus rating of "Buy" and an average price target of $24.67.

View Our Latest Report on OM

Outset Medical Stock Down 3.7%

Shares of OM stock traded down $0.53 on Wednesday, hitting $13.66. The company's stock had a trading volume of 19,967 shares, compared to its average volume of 220,927. The company has a debt-to-equity ratio of 0.63, a current ratio of 7.47 and a quick ratio of 6.05. Outset Medical, Inc. has a fifty-two week low of $5.85 and a fifty-two week high of $25.35. The firm's fifty day moving average price is $15.94 and its 200-day moving average price is $14.71. The stock has a market capitalization of $242.68 million, a price-to-earnings ratio of -0.67 and a beta of 2.14.

About Outset Medical

(

Free Report)

Outset Medical, Inc, a medical technology company, engages in the development of a hemodialysis system for hemodialysis in the United States. The company offers Tablo Hemodialysis System, a compact console with integrated water purification, on-demand dialysate production, and software and connectivity capabilities for dialysis care in acute and home settings; and manufactures, supports, and distributes for Tablo console, Tablo cartridge, and other consumables.

Featured Stories

Before you consider Outset Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Outset Medical wasn't on the list.

While Outset Medical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.