Alyeska Investment Group L.P. reduced its stake in Five9, Inc. (NASDAQ:FIVN - Free Report) by 42.5% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,831,815 shares of the software maker's stock after selling 1,351,600 shares during the period. Alyeska Investment Group L.P. owned 2.40% of Five9 worth $49,734,000 at the end of the most recent reporting period.

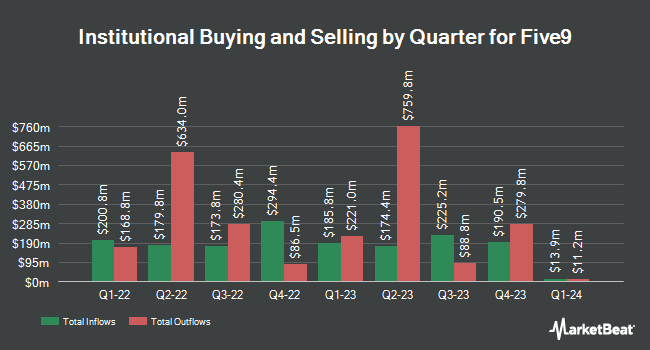

A number of other institutional investors also recently bought and sold shares of FIVN. Ameriprise Financial Inc. raised its stake in Five9 by 353.3% in the fourth quarter. Ameriprise Financial Inc. now owns 2,395,566 shares of the software maker's stock worth $97,356,000 after buying an additional 1,867,137 shares in the last quarter. Sylebra Capital LLC raised its stake in Five9 by 59.4% in the fourth quarter. Sylebra Capital LLC now owns 3,745,778 shares of the software maker's stock worth $152,228,000 after buying an additional 1,396,496 shares in the last quarter. Voss Capital LP bought a new position in Five9 in the first quarter worth about $28,340,000. Wellington Management Group LLP raised its stake in Five9 by 50.9% in the fourth quarter. Wellington Management Group LLP now owns 1,783,870 shares of the software maker's stock worth $72,496,000 after buying an additional 601,348 shares in the last quarter. Finally, Assenagon Asset Management S.A. bought a new position in Five9 in the first quarter worth about $15,777,000. 96.64% of the stock is owned by institutional investors.

Insider Buying and Selling

In related news, insider Tiffany N. Meriweather sold 7,861 shares of the firm's stock in a transaction that occurred on Thursday, September 4th. The shares were sold at an average price of $25.72, for a total value of $202,184.92. Following the sale, the insider owned 218,978 shares in the company, valued at approximately $5,632,114.16. This trade represents a 3.47% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, President Andy Dignan sold 7,614 shares of the firm's stock in a transaction that occurred on Thursday, September 4th. The stock was sold at an average price of $25.48, for a total transaction of $194,004.72. Following the completion of the sale, the president owned 218,125 shares in the company, valued at $5,557,825. This represents a 3.37% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 60,781 shares of company stock valued at $1,565,453 in the last ninety days. Corporate insiders own 1.60% of the company's stock.

Five9 Stock Down 0.9%

Shares of NASDAQ:FIVN traded down $0.23 during trading on Tuesday, reaching $26.43. 381,575 shares of the stock traded hands, compared to its average volume of 1,905,192. The stock has a 50-day moving average of $26.67 and a two-hundred day moving average of $27.29. Five9, Inc. has a 52-week low of $21.04 and a 52-week high of $49.90. The company has a debt-to-equity ratio of 1.04, a quick ratio of 4.44 and a current ratio of 4.44. The stock has a market cap of $2.04 billion, a P/E ratio of 293.45, a price-to-earnings-growth ratio of 2.52 and a beta of 1.17.

Five9 (NASDAQ:FIVN - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The software maker reported $0.76 EPS for the quarter, beating analysts' consensus estimates of $0.65 by $0.11. Five9 had a net margin of 0.80% and a return on equity of 8.91%. The firm had revenue of $283.27 million for the quarter, compared to analysts' expectations of $275.18 million. During the same quarter in the prior year, the company posted $0.52 earnings per share. The business's revenue for the quarter was up 12.4% on a year-over-year basis. Five9 has set its Q3 2025 guidance at 0.720-0.740 EPS. FY 2025 guidance at 2.860-2.900 EPS. As a group, sell-side analysts expect that Five9, Inc. will post 0.28 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on the stock. Piper Sandler decreased their price target on shares of Five9 from $36.00 to $31.00 and set an "overweight" rating for the company in a research note on Monday, July 14th. KeyCorp began coverage on shares of Five9 in a research note on Friday, June 6th. They set an "overweight" rating and a $35.00 target price for the company. Rosenblatt Securities reaffirmed a "buy" rating and set a $36.00 target price on shares of Five9 in a research note on Friday, August 1st. DA Davidson raised shares of Five9 to a "hold" rating in a research note on Monday, August 4th. Finally, Canaccord Genuity Group reaffirmed a "buy" rating and set a $40.00 target price on shares of Five9 in a research note on Friday, August 1st. Thirteen analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company's stock. According to data from MarketBeat, Five9 has a consensus rating of "Moderate Buy" and a consensus target price of $37.59.

View Our Latest Stock Report on FIVN

Five9 Company Profile

(

Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Featured Articles

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report