Amanah Holdings Trust acquired a new stake in Cameco Corporation (NYSE:CCJ - Free Report) TSE: CCO in the 2nd quarter, according to its most recent filing with the SEC. The fund acquired 441,120 shares of the basic materials company's stock, valued at approximately $32,744,000. Cameco accounts for about 8.2% of Amanah Holdings Trust's investment portfolio, making the stock its 6th biggest holding. Amanah Holdings Trust owned about 0.10% of Cameco as of its most recent SEC filing.

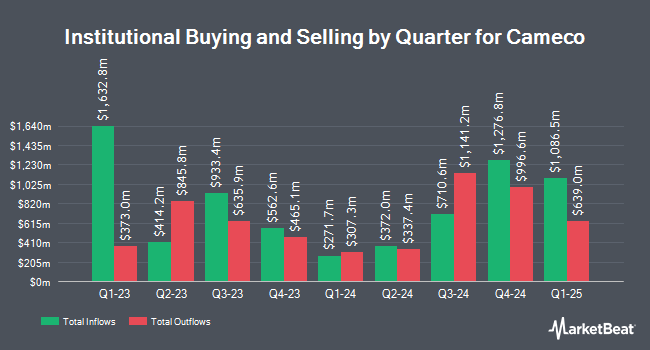

Several other institutional investors and hedge funds have also modified their holdings of CCJ. Alliancebernstein L.P. grew its position in shares of Cameco by 39.3% in the 1st quarter. Alliancebernstein L.P. now owns 14,048,244 shares of the basic materials company's stock valued at $578,226,000 after purchasing an additional 3,959,837 shares during the period. Canada Pension Plan Investment Board grew its position in shares of Cameco by 215.7% in the 1st quarter. Canada Pension Plan Investment Board now owns 2,031,332 shares of the basic materials company's stock valued at $83,636,000 after purchasing an additional 1,387,797 shares during the period. Temasek Holdings Private Ltd acquired a new position in shares of Cameco in the 1st quarter valued at approximately $55,513,000. Nuveen LLC acquired a new position in Cameco during the 1st quarter worth approximately $29,290,000. Finally, AGF Management Ltd. boosted its position in Cameco by 19.0% during the 1st quarter. AGF Management Ltd. now owns 4,037,646 shares of the basic materials company's stock worth $166,206,000 after acquiring an additional 644,413 shares during the last quarter. 70.21% of the stock is currently owned by institutional investors and hedge funds.

Cameco Trading Down 2.3%

NYSE CCJ opened at $78.07 on Monday. The company has a market cap of $33.99 billion, a PE ratio of 89.74 and a beta of 1.04. The company has a current ratio of 2.96, a quick ratio of 2.00 and a debt-to-equity ratio of 0.15. Cameco Corporation has a 12 month low of $35.00 and a 12 month high of $83.02. The stock has a 50 day moving average of $76.21 and a 200-day moving average of $60.12.

Cameco (NYSE:CCJ - Get Free Report) TSE: CCO last posted its quarterly earnings results on Thursday, July 31st. The basic materials company reported $0.51 earnings per share for the quarter, beating analysts' consensus estimates of $0.29 by $0.22. Cameco had a return on equity of 8.21% and a net margin of 14.97%.The business had revenue of $467.72 million for the quarter, compared to analysts' expectations of $819.79 million. During the same quarter in the prior year, the business earned $0.14 EPS. The firm's revenue for the quarter was up 46.7% on a year-over-year basis. Cameco has set its FY 2025 guidance at EPS. On average, equities research analysts anticipate that Cameco Corporation will post 1.27 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of equities analysts have weighed in on CCJ shares. UBS Group set a $102.00 price target on Cameco in a research report on Tuesday, September 9th. Scotiabank reaffirmed an "outperform" rating on shares of Cameco in a research report on Tuesday, July 8th. Royal Bank Of Canada upped their price target on Cameco from $100.00 to $110.00 and gave the stock an "outperform" rating in a research report on Friday, August 1st. BMO Capital Markets reaffirmed an "outperform" rating on shares of Cameco in a research report on Friday, August 29th. Finally, CLSA began coverage on Cameco in a research report on Tuesday, September 9th. They set an "outperform" rating and a $102.00 price target for the company. Two investment analysts have rated the stock with a Strong Buy rating and thirteen have issued a Buy rating to the company's stock. According to data from MarketBeat, Cameco has a consensus rating of "Buy" and an average target price of $89.55.

View Our Latest Analysis on CCJ

Cameco Company Profile

(

Free Report)

Cameco Corporation provides uranium for the generation of electricity. It operates through Uranium, Fuel Services, Westinghouse segments. The Uranium segment is involved in the exploration for, mining, and milling, purchase, and sale of uranium concentrate. The Fuel Services segment engages in the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cameco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cameco wasn't on the list.

While Cameco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.