Beck Bode LLC increased its holdings in shares of Ameren Corporation (NYSE:AEE - Free Report) by 2,004.9% in the 1st quarter, according to its most recent filing with the SEC. The fund owned 179,931 shares of the utilities provider's stock after purchasing an additional 171,383 shares during the period. Ameren makes up approximately 3.4% of Beck Bode LLC's holdings, making the stock its 5th largest position. Beck Bode LLC owned 0.07% of Ameren worth $18,065,000 at the end of the most recent quarter.

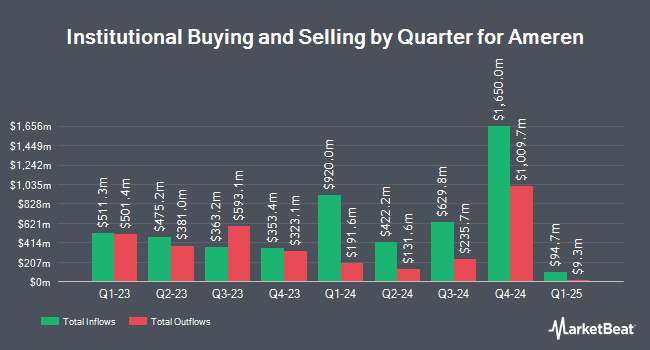

Several other large investors have also made changes to their positions in the business. Ceredex Value Advisors LLC acquired a new position in shares of Ameren during the 1st quarter worth about $50,693,000. Comerica Bank raised its holdings in Ameren by 12.2% in the 1st quarter. Comerica Bank now owns 72,272 shares of the utilities provider's stock valued at $7,256,000 after acquiring an additional 7,866 shares in the last quarter. Freedom Investment Management Inc. raised its holdings in Ameren by 57.8% in the 1st quarter. Freedom Investment Management Inc. now owns 3,859 shares of the utilities provider's stock valued at $387,000 after acquiring an additional 1,414 shares in the last quarter. Jump Financial LLC raised its holdings in Ameren by 375.5% in the 1st quarter. Jump Financial LLC now owns 28,509 shares of the utilities provider's stock valued at $2,862,000 after acquiring an additional 22,514 shares in the last quarter. Finally, SVB Wealth LLC raised its holdings in Ameren by 154.2% in the 1st quarter. SVB Wealth LLC now owns 13,152 shares of the utilities provider's stock valued at $1,320,000 after acquiring an additional 7,979 shares in the last quarter. Institutional investors and hedge funds own 79.09% of the company's stock.

Ameren Price Performance

NYSE AEE traded up $0.07 during trading hours on Monday, reaching $99.81. 985,850 shares of the company's stock were exchanged, compared to its average volume of 1,376,645. The stock has a market cap of $26.99 billion, a PE ratio of 21.94, a price-to-earnings-growth ratio of 2.56 and a beta of 0.47. Ameren Corporation has a one year low of $81.31 and a one year high of $104.10. The firm has a fifty day moving average of $98.96 and a 200-day moving average of $98.19. The company has a current ratio of 0.80, a quick ratio of 0.56 and a debt-to-equity ratio of 1.51.

Ameren (NYSE:AEE - Get Free Report) last released its quarterly earnings results on Thursday, July 31st. The utilities provider reported $1.01 EPS for the quarter, topping analysts' consensus estimates of $1.00 by $0.01. The business had revenue of $2.22 billion for the quarter, compared to analyst estimates of $1.82 billion. Ameren had a return on equity of 10.38% and a net margin of 14.55%.Ameren's revenue for the quarter was up 31.2% on a year-over-year basis. During the same period in the prior year, the company earned $0.97 EPS. Ameren has set its FY 2025 guidance at 4.850-5.050 EPS. On average, equities research analysts predict that Ameren Corporation will post 4.93 earnings per share for the current fiscal year.

Ameren Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Tuesday, September 9th will be given a $0.71 dividend. This represents a $2.84 dividend on an annualized basis and a yield of 2.8%. The ex-dividend date is Tuesday, September 9th. Ameren's dividend payout ratio (DPR) is presently 62.42%.

Analyst Upgrades and Downgrades

Several research firms have commented on AEE. UBS Group upped their price target on Ameren from $111.00 to $114.00 and gave the company a "buy" rating in a report on Friday, July 11th. The Goldman Sachs Group raised Ameren from a "sell" rating to a "neutral" rating and upped their price target for the company from $91.00 to $100.00 in a report on Wednesday, June 25th. Wells Fargo & Company upped their price objective on Ameren from $108.00 to $112.00 and gave the company an "overweight" rating in a research note on Wednesday, May 14th. Barclays lowered their price objective on Ameren from $104.00 to $100.00 and set an "equal weight" rating on the stock in a research note on Thursday, July 10th. Finally, Morgan Stanley reiterated an "outperform" rating on shares of Ameren in a research note on Thursday, August 21st. One equities research analyst has rated the stock with a Strong Buy rating, eight have given a Buy rating and three have given a Hold rating to the company. According to data from MarketBeat, Ameren presently has a consensus rating of "Moderate Buy" and an average target price of $102.80.

View Our Latest Analysis on Ameren

Insider Buying and Selling

In other Ameren news, SVP Gwendolyn G. Mizell sold 1,000 shares of the stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $101.79, for a total value of $101,790.00. Following the transaction, the senior vice president directly owned 9,129 shares in the company, valued at approximately $929,240.91. This trade represents a 9.87% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 0.42% of the company's stock.

About Ameren

(

Free Report)

Ameren Corporation, together with its subsidiaries, operates as a public utility holding company in the United States. The company operates through four segments: Ameren Missouri, Ameren Illinois Electric Distribution, Ameren Illinois Natural Gas, and Ameren Transmission. It engages in the rate-regulated electric generation, transmission, and distribution activities; and rate-regulated natural gas distribution business.

Further Reading

Before you consider Ameren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ameren wasn't on the list.

While Ameren currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.