American Assets Investment Management LLC increased its position in FTAI Aviation Ltd. (NASDAQ:FTAI - Free Report) by 1,579.5% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 149,929 shares of the financial services provider's stock after acquiring an additional 141,002 shares during the period. FTAI Aviation comprises about 1.2% of American Assets Investment Management LLC's investment portfolio, making the stock its 14th biggest holding. American Assets Investment Management LLC owned 0.15% of FTAI Aviation worth $16,647,000 at the end of the most recent reporting period.

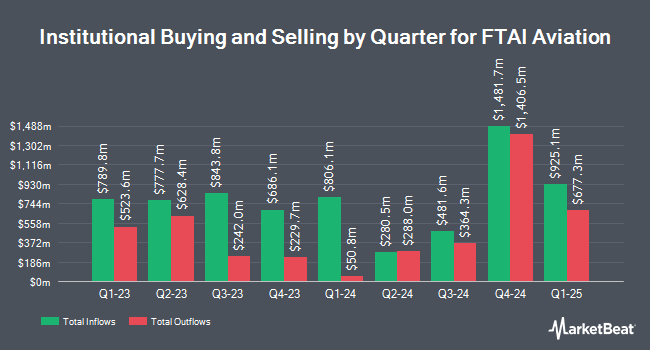

Other large investors also recently modified their holdings of the company. Amalgamated Bank lifted its position in shares of FTAI Aviation by 3.5% in the first quarter. Amalgamated Bank now owns 3,518 shares of the financial services provider's stock worth $391,000 after buying an additional 120 shares in the last quarter. Scotia Capital Inc. raised its position in FTAI Aviation by 0.5% during the first quarter. Scotia Capital Inc. now owns 25,428 shares of the financial services provider's stock valued at $2,823,000 after purchasing an additional 122 shares during the period. AE Wealth Management LLC raised its position in FTAI Aviation by 6.3% during the first quarter. AE Wealth Management LLC now owns 2,430 shares of the financial services provider's stock valued at $270,000 after purchasing an additional 145 shares during the period. Virtus Fund Advisers LLC purchased a new stake in FTAI Aviation during the fourth quarter valued at approximately $26,000. Finally, Versant Capital Management Inc raised its position in FTAI Aviation by 420.9% during the first quarter. Versant Capital Management Inc now owns 224 shares of the financial services provider's stock valued at $25,000 after purchasing an additional 181 shares during the period. Institutional investors own 88.96% of the company's stock.

Analysts Set New Price Targets

FTAI has been the topic of several recent analyst reports. Citizens Jmp upgraded FTAI Aviation to a "strong-buy" rating in a report on Thursday, May 8th. Stifel Nicolaus upgraded FTAI Aviation from a "hold" rating to a "buy" rating and set a $123.00 price target on the stock in a report on Friday, May 2nd. Morgan Stanley reduced their price target on FTAI Aviation from $168.00 to $138.00 and set an "overweight" rating on the stock in a report on Friday, April 11th. Royal Bank Of Canada increased their price target on FTAI Aviation from $130.00 to $160.00 and gave the stock an "outperform" rating in a report on Thursday, July 31st. Finally, Citigroup restated a "buy" rating on shares of FTAI Aviation in a report on Thursday, July 10th. Thirteen research analysts have rated the stock with a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average target price of $176.42.

Read Our Latest Report on FTAI Aviation

FTAI Aviation Price Performance

FTAI traded up $0.44 on Thursday, reaching $138.07. 966,682 shares of the stock were exchanged, compared to its average volume of 1,599,261. The company's 50-day moving average price is $121.71 and its 200 day moving average price is $113.13. FTAI Aviation Ltd. has a fifty-two week low of $75.06 and a fifty-two week high of $181.64. The firm has a market capitalization of $14.16 billion, a PE ratio of 34.18 and a beta of 1.61.

FTAI Aviation (NASDAQ:FTAI - Get Free Report) last announced its quarterly earnings results on Tuesday, July 29th. The financial services provider reported $1.57 earnings per share for the quarter, beating the consensus estimate of $1.33 by $0.24. FTAI Aviation had a return on equity of 465.13% and a net margin of 21.31%. The firm had revenue of $676.24 million during the quarter, compared to analyst estimates of $754.75 million. During the same quarter in the previous year, the business earned ($2.26) EPS. FTAI Aviation's revenue for the quarter was up 52.4% compared to the same quarter last year. As a group, equities analysts forecast that FTAI Aviation Ltd. will post 2.2 earnings per share for the current fiscal year.

FTAI Aviation Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, August 19th. Stockholders of record on Tuesday, August 12th will be given a dividend of $0.30 per share. The ex-dividend date of this dividend is Tuesday, August 12th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 0.9%. FTAI Aviation's dividend payout ratio is currently 29.70%.

About FTAI Aviation

(

Free Report)

FTAI Aviation Ltd. owns and acquires aviation and offshore energy equipment for the transportation of goods and people worldwide. It operates through two segments, Aviation Leasing and Aerospace Products. The Aviation Leasing segment owns and manages aviation assets, including aircraft and aircraft engines, which it leases and sells to customers.

See Also

Before you consider FTAI Aviation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FTAI Aviation wasn't on the list.

While FTAI Aviation currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.