American Century Companies Inc. increased its holdings in shares of Driven Brands Holdings Inc. (NASDAQ:DRVN - Free Report) by 19.5% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 105,872 shares of the company's stock after acquiring an additional 17,272 shares during the period. American Century Companies Inc. owned approximately 0.06% of Driven Brands worth $1,815,000 as of its most recent SEC filing.

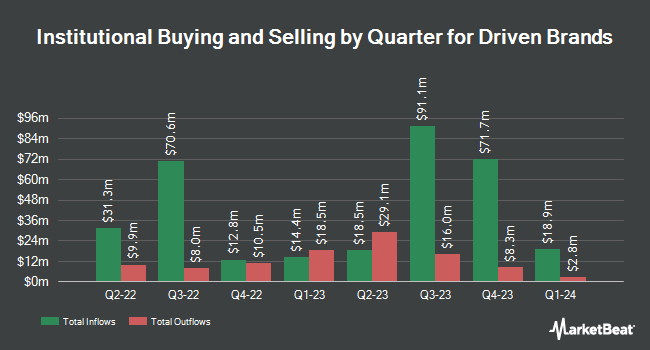

Other institutional investors and hedge funds have also recently bought and sold shares of the company. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in Driven Brands by 3.3% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 34,104 shares of the company's stock valued at $550,000 after purchasing an additional 1,079 shares during the last quarter. MetLife Investment Management LLC grew its holdings in Driven Brands by 5.7% in the fourth quarter. MetLife Investment Management LLC now owns 37,161 shares of the company's stock valued at $600,000 after purchasing an additional 2,003 shares during the last quarter. SG Americas Securities LLC grew its holdings in Driven Brands by 25.3% in the first quarter. SG Americas Securities LLC now owns 17,194 shares of the company's stock valued at $295,000 after purchasing an additional 3,474 shares during the last quarter. Price T Rowe Associates Inc. MD grew its holdings in Driven Brands by 20.0% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 23,760 shares of the company's stock valued at $384,000 after purchasing an additional 3,952 shares during the last quarter. Finally, Rhumbline Advisers grew its holdings in Driven Brands by 5.2% in the first quarter. Rhumbline Advisers now owns 86,478 shares of the company's stock valued at $1,482,000 after purchasing an additional 4,243 shares during the last quarter. Institutional investors and hedge funds own 77.08% of the company's stock.

Driven Brands Price Performance

Shares of DRVN stock traded down $0.33 during mid-day trading on Friday, hitting $18.88. 818,515 shares of the stock traded hands, compared to its average volume of 720,465. The company has a debt-to-equity ratio of 2.82, a quick ratio of 1.01 and a current ratio of 1.11. Driven Brands Holdings Inc. has a twelve month low of $13.35 and a twelve month high of $19.74. The firm has a market cap of $3.10 billion, a price-to-earnings ratio of -11.10, a price-to-earnings-growth ratio of 1.15 and a beta of 1.09. The company's 50-day simple moving average is $17.51 and its 200-day simple moving average is $17.14.

Driven Brands (NASDAQ:DRVN - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported $0.36 earnings per share for the quarter, beating analysts' consensus estimates of $0.34 by $0.02. Driven Brands had a positive return on equity of 21.17% and a negative net margin of 12.32%.The business had revenue of $550.99 million during the quarter, compared to analyst estimates of $540.12 million. During the same quarter last year, the company posted $0.35 EPS. Driven Brands's revenue for the quarter was up 6.2% on a year-over-year basis. Driven Brands has set its FY 2025 guidance at 1.150-1.25 EPS. As a group, equities research analysts expect that Driven Brands Holdings Inc. will post 0.85 earnings per share for the current year.

Analyst Upgrades and Downgrades

DRVN has been the topic of several recent research reports. JPMorgan Chase & Co. upgraded Driven Brands from a "neutral" rating to an "overweight" rating and upped their price objective for the company from $17.00 to $23.00 in a research report on Wednesday, August 6th. The Goldman Sachs Group assumed coverage on Driven Brands in a research report on Tuesday, June 3rd. They set a "neutral" rating and a $20.00 target price on the stock. Wall Street Zen downgraded Driven Brands from a "buy" rating to a "hold" rating in a report on Saturday, August 9th. Zacks Research upgraded Driven Brands to a "hold" rating in a research note on Friday, August 8th. Finally, Canaccord Genuity Group raised their price objective on Driven Brands from $23.00 to $24.00 and gave the company a "buy" rating in a research note on Friday, June 27th. Seven research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the stock. According to data from MarketBeat, Driven Brands presently has a consensus rating of "Moderate Buy" and an average target price of $21.60.

Check Out Our Latest Stock Analysis on DRVN

Driven Brands Company Profile

(

Free Report)

Driven Brands Holdings Inc, together with its subsidiaries, provides automotive services to retail and commercial customers in the United States, Canada, and internationally. It offers various services, such as paint, collision, glass, repair, car wash, oil change, and maintenance services. The company also distributes automotive parts, including radiators, air conditioning components, and exhaust products to automotive repair shops, auto parts stores, body shops, and other auto repair outlets; windshields and glass accessories through a network of distribution centers; and consumable products, such as oil filters and wiper blades, as well as training services to repair and maintenance, and paint and collision shops.

Further Reading

Before you consider Driven Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Driven Brands wasn't on the list.

While Driven Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.