American Century Companies Inc. raised its holdings in Liberty Media Corporation - Liberty Live Series A (NASDAQ:LLYVA - Free Report) by 100.9% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 6,793 shares of the company's stock after purchasing an additional 3,412 shares during the quarter. American Century Companies Inc.'s holdings in Liberty Media Corporation - Liberty Live Series A were worth $457,000 as of its most recent SEC filing.

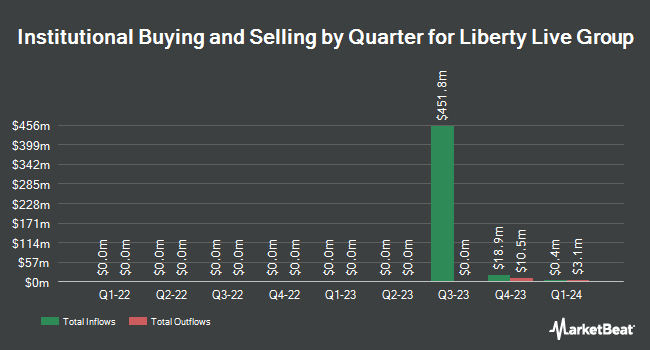

Several other institutional investors and hedge funds have also recently modified their holdings of LLYVA. Parallel Advisors LLC raised its holdings in shares of Liberty Media Corporation - Liberty Live Series A by 170.8% in the 1st quarter. Parallel Advisors LLC now owns 566 shares of the company's stock valued at $38,000 after buying an additional 357 shares during the period. Tower Research Capital LLC TRC raised its holdings in shares of Liberty Media Corporation - Liberty Live Series A by 215.0% in the 4th quarter. Tower Research Capital LLC TRC now owns 1,361 shares of the company's stock valued at $91,000 after buying an additional 929 shares during the period. JNE Partners LLP purchased a new stake in shares of Liberty Media Corporation - Liberty Live Series A in the 4th quarter valued at $222,000. Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in shares of Liberty Media Corporation - Liberty Live Series A in the 1st quarter valued at $234,000. Finally, HB Wealth Management LLC raised its holdings in shares of Liberty Media Corporation - Liberty Live Series A by 4.9% in the 1st quarter. HB Wealth Management LLC now owns 3,841 shares of the company's stock valued at $258,000 after buying an additional 179 shares during the period. Hedge funds and other institutional investors own 25.07% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Zacks Research upgraded Liberty Media Corporation - Liberty Live Series A to a "hold" rating in a report on Tuesday. One research analyst has rated the stock with a Hold rating, According to MarketBeat, Liberty Media Corporation - Liberty Live Series A presently has a consensus rating of "Hold".

Get Our Latest Report on Liberty Media Corporation - Liberty Live Series A

Liberty Media Corporation - Liberty Live Series A Trading Up 1.2%

LLYVA traded up $1.14 on Thursday, hitting $98.96. 182,594 shares of the company were exchanged, compared to its average volume of 124,890. Liberty Media Corporation - Liberty Live Series A has a twelve month low of $39.10 and a twelve month high of $99.15. The company has a market cap of $9.09 billion, a price-to-earnings ratio of -31.72 and a beta of 1.39. The firm has a 50-day moving average price of $86.71 and a two-hundred day moving average price of $76.61.

Liberty Media Corporation - Liberty Live Series A (NASDAQ:LLYVA - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported ($1.93) EPS for the quarter, missing the consensus estimate of $1.22 by ($3.15).

Liberty Media Corporation - Liberty Live Series A Profile

(

Free Report)

Liberty Live Group operates in the media, communications, and entertainment industries primarily in North America and the United Kingdom. The company is headquartered in Englewood, Colorado.

Read More

Before you consider Liberty Media Corporation - Liberty Live Series A, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Liberty Media Corporation - Liberty Live Series A wasn't on the list.

While Liberty Media Corporation - Liberty Live Series A currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.