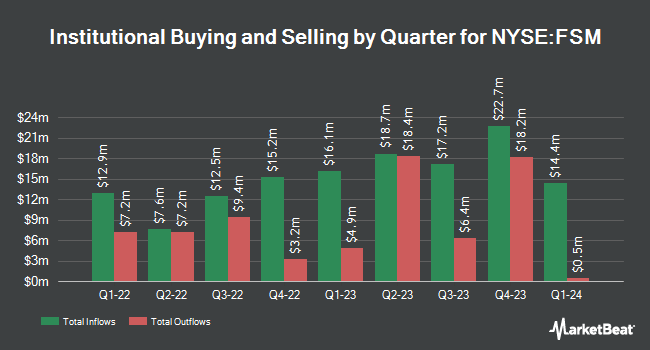

American Century Companies Inc. raised its position in Fortuna Mining Corp. (NYSE:FSM - Free Report) TSE: FVI by 17.7% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 5,928,763 shares of the basic materials company's stock after purchasing an additional 889,933 shares during the period. American Century Companies Inc. owned about 1.93% of Fortuna Mining worth $36,075,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Sumitomo Mitsui Trust Group Inc. purchased a new position in Fortuna Mining in the 1st quarter valued at about $445,000. Cambridge Investment Research Advisors Inc. lifted its holdings in Fortuna Mining by 16.9% in the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 73,951 shares of the basic materials company's stock valued at $451,000 after purchasing an additional 10,690 shares in the last quarter. Bank of America Corp DE lifted its holdings in Fortuna Mining by 15.4% in the 4th quarter. Bank of America Corp DE now owns 927,264 shares of the basic materials company's stock valued at $3,978,000 after purchasing an additional 123,720 shares in the last quarter. Legal & General Group Plc lifted its holdings in Fortuna Mining by 10.0% in the 4th quarter. Legal & General Group Plc now owns 863,406 shares of the basic materials company's stock valued at $3,704,000 after purchasing an additional 78,284 shares in the last quarter. Finally, Nuveen Asset Management LLC lifted its holdings in Fortuna Mining by 29.0% in the 4th quarter. Nuveen Asset Management LLC now owns 303,857 shares of the basic materials company's stock valued at $1,304,000 after purchasing an additional 68,350 shares in the last quarter. 33.80% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of research analysts have issued reports on FSM shares. Scotiabank upped their target price on shares of Fortuna Mining from $7.50 to $8.00 and gave the company a "sector perform" rating in a report on Wednesday, August 6th. BMO Capital Markets restated an "outperform" rating on shares of Fortuna Mining in a report on Friday, August 8th. CIBC upped their price objective on shares of Fortuna Mining from $7.00 to $8.00 and gave the company an "underperformer" rating in a research note on Tuesday, July 15th. Zacks Research downgraded shares of Fortuna Mining from a "strong-buy" rating to a "hold" rating in a research note on Friday, August 15th. Finally, Wall Street Zen downgraded shares of Fortuna Mining from a "strong-buy" rating to a "hold" rating in a research note on Saturday, August 9th. One equities research analyst has rated the stock with a Buy rating, four have issued a Hold rating and one has given a Sell rating to the company. According to MarketBeat.com, Fortuna Mining currently has a consensus rating of "Hold" and an average price target of $8.00.

Read Our Latest Report on Fortuna Mining

Fortuna Mining Trading Up 0.5%

FSM traded up $0.04 on Tuesday, reaching $7.53. 13,995,926 shares of the company's stock were exchanged, compared to its average volume of 12,071,862. The company's 50 day moving average is $6.78 and its 200-day moving average is $6.12. The company has a market cap of $2.31 billion, a price-to-earnings ratio of 15.05 and a beta of 0.85. Fortuna Mining Corp. has a twelve month low of $4.13 and a twelve month high of $7.67. The company has a debt-to-equity ratio of 0.13, a quick ratio of 2.15 and a current ratio of 2.71.

Fortuna Mining (NYSE:FSM - Get Free Report) TSE: FVI last posted its earnings results on Wednesday, August 6th. The basic materials company reported $0.14 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.22 by ($0.08). The business had revenue of $230.42 million for the quarter, compared to analyst estimates of $220.00 million. Fortuna Mining had a return on equity of 12.74% and a net margin of 14.36%. Equities analysts predict that Fortuna Mining Corp. will post 0.51 earnings per share for the current year.

Fortuna Mining Profile

(

Free Report)

Fortuna Mining Corp. engages in the precious and base metal mining in Argentina, Burkina Faso, Mexico, Peru, and Côte d'Ivoire. It operates through Mansfield, Sanu, Sango, Cuzcatlan, Bateas, and Corporate segments. The company primarily explores for silver, lead, zinc, and gold. Its flagship project is the Séguéla gold mine, which consists of approximately 62,000 hectares and is located in the Worodougou Region of the Woroba District, Côte d'Ivoire.

Featured Articles

Before you consider Fortuna Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortuna Mining wasn't on the list.

While Fortuna Mining currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.