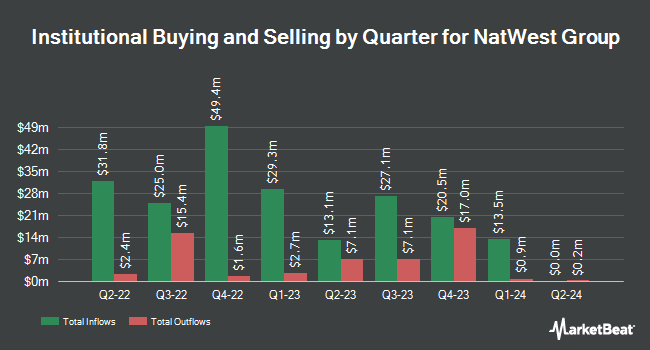

American Century Companies Inc. cut its position in NatWest Group plc (NYSE:NWG - Free Report) by 6.3% during the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,281,928 shares of the company's stock after selling 86,223 shares during the period. American Century Companies Inc.'s holdings in NatWest Group were worth $15,281,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Pacer Advisors Inc. boosted its position in NatWest Group by 3.0% in the first quarter. Pacer Advisors Inc. now owns 28,042 shares of the company's stock valued at $334,000 after buying an additional 807 shares in the last quarter. Commerce Bank boosted its position in NatWest Group by 5.2% in the first quarter. Commerce Bank now owns 16,511 shares of the company's stock valued at $197,000 after buying an additional 818 shares in the last quarter. Aaron Wealth Advisors LLC boosted its position in NatWest Group by 2.4% in the first quarter. Aaron Wealth Advisors LLC now owns 35,935 shares of the company's stock valued at $428,000 after buying an additional 831 shares in the last quarter. Checchi Capital Advisers LLC boosted its position in NatWest Group by 7.1% in the first quarter. Checchi Capital Advisers LLC now owns 12,555 shares of the company's stock valued at $150,000 after buying an additional 833 shares in the last quarter. Finally, Adero Partners LLC raised its stake in shares of NatWest Group by 8.4% in the first quarter. Adero Partners LLC now owns 12,723 shares of the company's stock worth $152,000 after acquiring an additional 985 shares during the last quarter. 1.27% of the stock is currently owned by institutional investors and hedge funds.

NatWest Group Price Performance

Shares of NYSE NWG traded down $0.65 during trading on Friday, reaching $13.96. The company had a trading volume of 6,085,633 shares, compared to its average volume of 3,178,545. The company has a debt-to-equity ratio of 0.14, a quick ratio of 1.06 and a current ratio of 1.05. The stock has a market cap of $56.50 billion, a PE ratio of 9.00, a PEG ratio of 0.80 and a beta of 1.07. The business's 50 day moving average price is $14.07 and its 200-day moving average price is $13.14. NatWest Group plc has a 52 week low of $8.55 and a 52 week high of $15.52.

NatWest Group (NYSE:NWG - Get Free Report) last posted its quarterly earnings results on Friday, July 25th. The company reported $0.41 earnings per share for the quarter, topping analysts' consensus estimates of $0.37 by $0.04. The business had revenue of $5.42 billion during the quarter, compared to the consensus estimate of $4.06 billion. NatWest Group had a net margin of 16.84% and a return on equity of 11.99%. Analysts expect that NatWest Group plc will post 1.35 earnings per share for the current year.

NatWest Group Cuts Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Friday, September 12th. Investors of record on Friday, August 8th will be paid a dividend of $0.255 per share. This represents a dividend yield of 390.0%. The ex-dividend date of this dividend is Friday, August 8th. NatWest Group's payout ratio is 32.26%.

Wall Street Analyst Weigh In

Separately, Zacks Research downgraded shares of NatWest Group from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 18th. Four equities research analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy".

Check Out Our Latest Stock Report on NWG

About NatWest Group

(

Free Report)

NatWest Group plc, together with its subsidiaries, provides banking and financial products and services to personal, commercial, corporate, and institutional customers in the United Kingdom and internationally. It operates through Retail Banking, Private Banking, and Commercial & Institutional segments.

Recommended Stories

Before you consider NatWest Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NatWest Group wasn't on the list.

While NatWest Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.