American Century Companies Inc. raised its stake in shares of Nova Ltd. (NASDAQ:NVMI - Free Report) by 15.1% during the 1st quarter, according to its most recent filing with the SEC. The firm owned 134,700 shares of the semiconductor company's stock after acquiring an additional 17,702 shares during the period. American Century Companies Inc. owned approximately 0.46% of Nova worth $24,829,000 as of its most recent SEC filing.

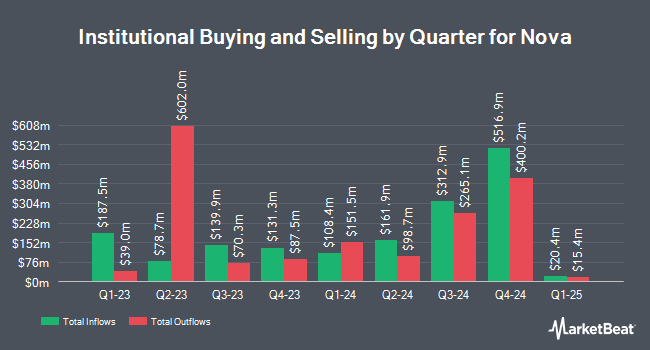

Other hedge funds and other institutional investors have also bought and sold shares of the company. ASR Vermogensbeheer N.V. bought a new position in Nova during the 1st quarter valued at about $26,000. Quarry LP lifted its stake in Nova by 187.1% during the 4th quarter. Quarry LP now owns 402 shares of the semiconductor company's stock valued at $79,000 after acquiring an additional 262 shares during the period. PNC Financial Services Group Inc. lifted its stake in Nova by 7.4% during the 1st quarter. PNC Financial Services Group Inc. now owns 1,269 shares of the semiconductor company's stock valued at $234,000 after acquiring an additional 87 shares during the period. Wellington Management Group LLP bought a new position in Nova during the 4th quarter valued at about $237,000. Finally, Janney Montgomery Scott LLC bought a new position in Nova during the 1st quarter valued at about $239,000. Institutional investors own 82.99% of the company's stock.

Analysts Set New Price Targets

Several equities analysts have issued reports on NVMI shares. Cantor Fitzgerald restated an "overweight" rating and set a $300.00 target price (up previously from $250.00) on shares of Nova in a research note on Tuesday, June 24th. Citigroup reduced their price target on shares of Nova from $290.00 to $280.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Bank of America upped their price target on shares of Nova from $250.00 to $270.00 and gave the company a "buy" rating in a research report on Tuesday, June 24th. Benchmark reduced their price target on shares of Nova from $295.00 to $280.00 and set a "buy" rating for the company in a research report on Friday, May 9th. Finally, Wall Street Zen lowered shares of Nova from a "buy" rating to a "hold" rating in a research report on Friday, May 30th. Four research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. According to MarketBeat.com, Nova presently has an average rating of "Moderate Buy" and a consensus price target of $282.50.

Get Our Latest Stock Analysis on NVMI

Nova Trading Up 2.3%

Shares of NASDAQ:NVMI opened at $252.80 on Friday. The stock has a 50 day moving average of $264.97 and a 200 day moving average of $228.36. The company has a market cap of $7.43 billion, a PE ratio of 34.39, a price-to-earnings-growth ratio of 2.06 and a beta of 1.67. Nova Ltd. has a 12-month low of $153.99 and a 12-month high of $291.99.

Nova (NASDAQ:NVMI - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The semiconductor company reported $2.20 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.05 by $0.15. The company had revenue of $219.99 million during the quarter, compared to the consensus estimate of $214.95 million. Nova had a return on equity of 24.36% and a net margin of 29.10%.The firm's revenue was up 40.2% on a year-over-year basis. During the same period in the previous year, the company posted $1.61 EPS. Nova has set its Q3 2025 guidance at 2.020-2.220 EPS. Equities research analysts predict that Nova Ltd. will post 7.52 earnings per share for the current fiscal year.

Nova Company Profile

(

Free Report)

Nova Ltd. designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally. Its product portfolio includes a set of metrology platforms for dimensional, films, and materials and chemical metrology measurements for process control for various semiconductor manufacturing process steps, including lithography, etch, chemical mechanical planarization, deposition, electrochemical plating, and advanced packaging.

Read More

Want to see what other hedge funds are holding NVMI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Nova Ltd. (NASDAQ:NVMI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nova wasn't on the list.

While Nova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.