American Century Companies Inc. lifted its holdings in Wipro Limited (NYSE:WIT - Free Report) by 6.7% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,930,631 shares of the information technology services provider's stock after acquiring an additional 120,750 shares during the period. American Century Companies Inc.'s holdings in Wipro were worth $5,908,000 at the end of the most recent quarter.

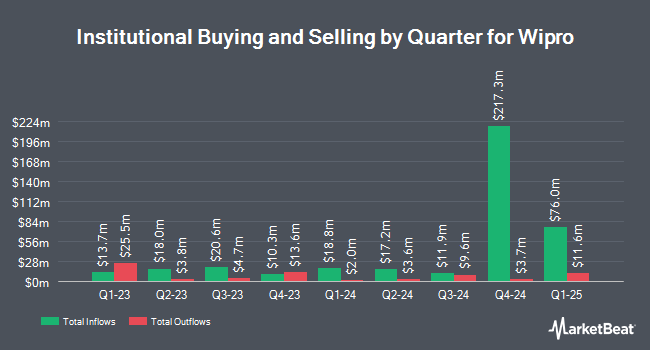

A number of other institutional investors have also recently made changes to their positions in the business. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of Wipro by 5.9% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 91,692 shares of the information technology services provider's stock valued at $278,000 after acquiring an additional 5,103 shares during the last quarter. PNC Financial Services Group Inc. lifted its holdings in shares of Wipro by 2.7% in the 1st quarter. PNC Financial Services Group Inc. now owns 215,015 shares of the information technology services provider's stock valued at $658,000 after acquiring an additional 5,618 shares during the last quarter. Geode Capital Management LLC lifted its holdings in shares of Wipro by 10.1% in the 4th quarter. Geode Capital Management LLC now owns 68,860 shares of the information technology services provider's stock valued at $244,000 after acquiring an additional 6,323 shares during the last quarter. Optas LLC lifted its stake in Wipro by 19.7% in the first quarter. Optas LLC now owns 41,314 shares of the information technology services provider's stock worth $126,000 after purchasing an additional 6,801 shares during the last quarter. Finally, Empirical Financial Services LLC d.b.a. Empirical Wealth Management lifted its stake in Wipro by 44.4% in the first quarter. Empirical Financial Services LLC d.b.a. Empirical Wealth Management now owns 27,272 shares of the information technology services provider's stock worth $83,000 after purchasing an additional 8,392 shares during the last quarter. Institutional investors own 2.36% of the company's stock.

Wipro Trading Up 0.2%

Shares of Wipro stock traded up $0.01 on Wednesday, hitting $2.77. 2,733,797 shares of the company traded hands, compared to its average volume of 6,744,125. The stock's 50 day moving average price is $2.86 and its 200-day moving average price is $2.96. Wipro Limited has a 52 week low of $2.62 and a 52 week high of $3.79. The company has a market cap of $28.95 billion, a PE ratio of 17.84, a PEG ratio of 10.06 and a beta of 0.96.

Wipro (NYSE:WIT - Get Free Report) last posted its quarterly earnings results on Thursday, July 17th. The information technology services provider reported $0.04 earnings per share for the quarter, meeting the consensus estimate of $0.04. Wipro had a net margin of 15.07% and a return on equity of 15.94%. The firm had revenue of $2.58 billion during the quarter, compared to the consensus estimate of $219.23 billion. As a group, research analysts anticipate that Wipro Limited will post 0.14 EPS for the current fiscal year.

Wipro Cuts Dividend

The business also recently declared a dividend, which was paid on Monday, August 18th. Stockholders of record on Monday, July 28th were paid a dividend of $0.057 per share. This represents a dividend yield of 409.9%. The ex-dividend date of this dividend was Monday, July 28th. Wipro's payout ratio is currently 62.50%.

Wall Street Analysts Forecast Growth

Separately, Morgan Stanley raised shares of Wipro from an "underweight" rating to an "equal weight" rating in a research note on Friday, June 20th. Three equities research analysts have rated the stock with a Hold rating and two have assigned a Sell rating to the stock. Based on data from MarketBeat.com, the company has an average rating of "Reduce".

Read Our Latest Report on WIT

Wipro Profile

(

Free Report)

Wipro Limited operates as an information technology (IT), consulting, and business process services company worldwide. It operates through IT Services and IT Products segments. The IT Services segment offers IT and IT-enabled services, including digital strategy advisory, customer-centric design, technology and IT consulting, custom application design, development, re-engineering and maintenance, systems integration, package implementation, cloud and infrastructure, business process, cloud, mobility and analytics, research and development, and hardware and software design services to enterprises.

See Also

Before you consider Wipro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wipro wasn't on the list.

While Wipro currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.