Koa Wealth Management LLC raised its position in shares of American Tower Corporation (NYSE:AMT - Free Report) by 17.4% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 17,947 shares of the real estate investment trust's stock after purchasing an additional 2,657 shares during the period. American Tower makes up approximately 3.2% of Koa Wealth Management LLC's holdings, making the stock its 7th largest holding. Koa Wealth Management LLC's holdings in American Tower were worth $3,905,000 at the end of the most recent reporting period.

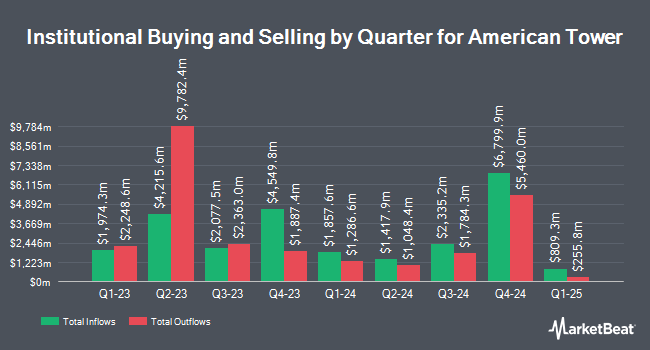

A number of other large investors have also added to or reduced their stakes in the company. North Capital Inc. bought a new stake in shares of American Tower in the first quarter worth about $25,000. Hopwood Financial Services Inc. grew its stake in shares of American Tower by 100.0% in the first quarter. Hopwood Financial Services Inc. now owns 120 shares of the real estate investment trust's stock worth $26,000 after purchasing an additional 60 shares during the last quarter. E Fund Management Hong Kong Co. Ltd. bought a new stake in American Tower during the 1st quarter valued at approximately $31,000. Lowe Wealth Advisors LLC boosted its position in American Tower by 218.0% during the 1st quarter. Lowe Wealth Advisors LLC now owns 159 shares of the real estate investment trust's stock valued at $35,000 after acquiring an additional 109 shares in the last quarter. Finally, Minot DeBlois Advisors LLC bought a new stake in American Tower during the 4th quarter valued at approximately $29,000. Hedge funds and other institutional investors own 92.69% of the company's stock.

Analyst Ratings Changes

Several research firms have weighed in on AMT. The Goldman Sachs Group reaffirmed a "buy" rating on shares of American Tower in a research report on Tuesday, July 29th. Barclays boosted their price target on American Tower from $223.00 to $246.00 and gave the stock an "overweight" rating in a research report on Wednesday, July 23rd. JPMorgan Chase & Co. boosted their price objective on shares of American Tower from $250.00 to $255.00 and gave the stock an "overweight" rating in a report on Wednesday, July 30th. UBS Group boosted their price objective on shares of American Tower from $250.00 to $260.00 and gave the stock a "buy" rating in a report on Tuesday, July 8th. Finally, JMP Securities boosted their price objective on shares of American Tower from $248.00 to $260.00 and gave the stock a "market outperform" rating in a report on Wednesday, April 30th. Four equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and two have given a strong buy rating to the company. Based on data from MarketBeat, American Tower currently has an average rating of "Moderate Buy" and a consensus price target of $243.88.

View Our Latest Stock Analysis on AMT

American Tower Stock Performance

Shares of AMT stock traded down $0.51 during mid-day trading on Monday, reaching $206.00. 2,339,182 shares of the company's stock traded hands, compared to its average volume of 2,134,941. American Tower Corporation has a 12 month low of $172.51 and a 12 month high of $243.56. The firm has a 50 day moving average price of $218.37 and a two-hundred day moving average price of $211.41. The company has a debt-to-equity ratio of 3.36, a quick ratio of 0.95 and a current ratio of 0.95. The firm has a market capitalization of $96.46 billion, a PE ratio of 74.91, a price-to-earnings-growth ratio of 1.18 and a beta of 0.82.

American Tower (NYSE:AMT - Get Free Report) last issued its earnings results on Tuesday, July 29th. The real estate investment trust reported $2.60 earnings per share for the quarter, topping the consensus estimate of $2.59 by $0.01. The company had revenue of $2.63 billion during the quarter, compared to the consensus estimate of $2.58 billion. American Tower had a net margin of 12.60% and a return on equity of 24.85%. American Tower's quarterly revenue was down 9.4% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.79 EPS. On average, research analysts forecast that American Tower Corporation will post 10.14 EPS for the current year.

American Tower Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, July 11th. Investors of record on Friday, June 13th were issued a $1.70 dividend. The ex-dividend date of this dividend was Friday, June 13th. This represents a $6.80 annualized dividend and a yield of 3.3%. American Tower's dividend payout ratio is currently 247.27%.

Insiders Place Their Bets

In related news, CEO Juan Font sold 720 shares of the company's stock in a transaction on Thursday, July 31st. The shares were sold at an average price of $208.33, for a total value of $149,997.60. Following the completion of the transaction, the chief executive officer owned 23,425 shares of the company's stock, valued at approximately $4,880,130.25. This represents a 2.98% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. Corporate insiders own 0.18% of the company's stock.

American Tower Company Profile

(

Free Report)

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

See Also

Before you consider American Tower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Tower wasn't on the list.

While American Tower currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.