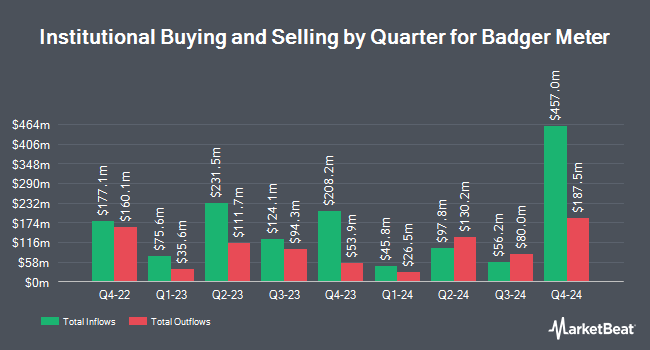

Ameriprise Financial Inc. raised its stake in shares of Badger Meter, Inc. (NYSE:BMI - Free Report) by 7.1% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 195,348 shares of the scientific and technical instruments company's stock after buying an additional 12,966 shares during the quarter. Ameriprise Financial Inc. owned about 0.66% of Badger Meter worth $37,165,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also added to or reduced their stakes in BMI. Westfield Capital Management Co. LP purchased a new stake in Badger Meter during the 1st quarter valued at approximately $65,448,000. Nuveen LLC purchased a new stake in Badger Meter during the 1st quarter valued at approximately $44,715,000. GAMMA Investing LLC grew its holdings in Badger Meter by 21,179.0% during the 1st quarter. GAMMA Investing LLC now owns 167,040 shares of the scientific and technical instruments company's stock valued at $31,779,000 after buying an additional 166,255 shares in the last quarter. Invesco Ltd. grew its holdings in shares of Badger Meter by 25.9% in the first quarter. Invesco Ltd. now owns 630,891 shares of the scientific and technical instruments company's stock valued at $120,027,000 after purchasing an additional 129,945 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH purchased a new position in shares of Badger Meter in the fourth quarter valued at $19,270,000. 89.01% of the stock is owned by hedge funds and other institutional investors.

Badger Meter Price Performance

Shares of NYSE:BMI traded down $0.18 on Wednesday, hitting $180.77. 112,222 shares of the company's stock were exchanged, compared to its average volume of 279,208. Badger Meter, Inc. has a 12 month low of $162.17 and a 12 month high of $256.08. The stock has a market capitalization of $5.33 billion, a price-to-earnings ratio of 39.38, a price-to-earnings-growth ratio of 3.22 and a beta of 0.87. The business's 50 day simple moving average is $208.69 and its two-hundred day simple moving average is $214.36.

Badger Meter (NYSE:BMI - Get Free Report) last released its earnings results on Tuesday, July 22nd. The scientific and technical instruments company reported $1.17 earnings per share for the quarter, missing the consensus estimate of $1.19 by ($0.02). Badger Meter had a return on equity of 21.57% and a net margin of 15.53%.The business had revenue of $238.10 million for the quarter, compared to the consensus estimate of $235.38 million. During the same quarter last year, the business posted $1.12 earnings per share. The firm's revenue for the quarter was up 9.9% compared to the same quarter last year. Equities analysts forecast that Badger Meter, Inc. will post 4.65 EPS for the current fiscal year.

Badger Meter Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 5th. Investors of record on Friday, August 22nd will be issued a $0.40 dividend. The ex-dividend date is Friday, August 22nd. This is an increase from Badger Meter's previous quarterly dividend of $0.34. This represents a $1.60 annualized dividend and a dividend yield of 0.9%. Badger Meter's dividend payout ratio is presently 34.86%.

Analysts Set New Price Targets

A number of research analysts recently weighed in on BMI shares. Royal Bank Of Canada cut their target price on shares of Badger Meter from $284.00 to $264.00 and set an "outperform" rating for the company in a report on Wednesday, July 23rd. Robert W. Baird raised their target price on shares of Badger Meter from $216.00 to $219.00 and gave the company a "neutral" rating in a report on Wednesday, July 23rd. Stifel Nicolaus set a $224.00 target price on shares of Badger Meter in a report on Wednesday, July 23rd. Finally, Raymond James Financial started coverage on shares of Badger Meter in a report on Tuesday, June 3rd. They issued a "market perform" rating for the company. Two research analysts have rated the stock with a Buy rating and three have issued a Hold rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $238.40.

Read Our Latest Report on BMI

Badger Meter Profile

(

Free Report)

Badger Meter, Inc manufactures and markets flow measurement, quality, control, and communication solutions worldwide. It offers mechanical or static water meters, and related radio and software technologies and services to municipal water utilities market. The company also provides flow instrumentation products, including meters, valves, and other sensing instruments to measure and control fluids going through a pipe or pipeline, including water, air, steam, and other liquids and gases to original equipment manufacturers as the primary flow measurement device within a product or system, as well as through manufacturers' representatives.

Read More

Before you consider Badger Meter, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Badger Meter wasn't on the list.

While Badger Meter currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.