Ancora Advisors LLC lifted its holdings in shares of Cleveland-Cliffs Inc. (NYSE:CLF - Free Report) by 209.2% during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 87,681 shares of the mining company's stock after purchasing an additional 59,324 shares during the quarter. Ancora Advisors LLC's holdings in Cleveland-Cliffs were worth $721,000 at the end of the most recent quarter.

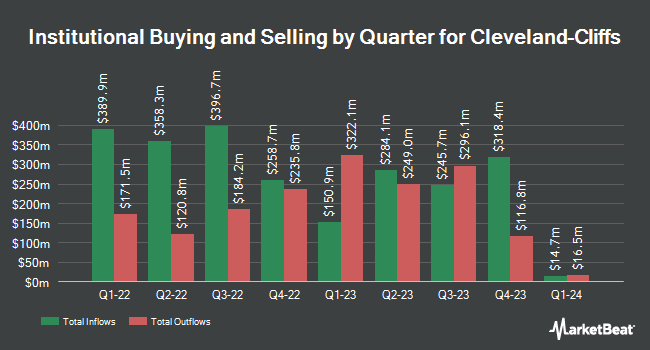

Other institutional investors have also added to or reduced their stakes in the company. Louisiana State Employees Retirement System boosted its stake in shares of Cleveland-Cliffs by 0.9% during the 1st quarter. Louisiana State Employees Retirement System now owns 135,600 shares of the mining company's stock worth $1,115,000 after acquiring an additional 1,200 shares during the period. Pinnacle Holdings LLC lifted its holdings in Cleveland-Cliffs by 1.3% during the 1st quarter. Pinnacle Holdings LLC now owns 105,791 shares of the mining company's stock valued at $870,000 after purchasing an additional 1,371 shares during the last quarter. State of Alaska Department of Revenue boosted its position in Cleveland-Cliffs by 2.7% during the first quarter. State of Alaska Department of Revenue now owns 56,665 shares of the mining company's stock worth $465,000 after purchasing an additional 1,475 shares during the period. Hunter Associates Investment Management LLC increased its holdings in shares of Cleveland-Cliffs by 3.1% in the first quarter. Hunter Associates Investment Management LLC now owns 49,400 shares of the mining company's stock valued at $406,000 after purchasing an additional 1,500 shares during the last quarter. Finally, Capital Investment Advisory Services LLC raised its position in shares of Cleveland-Cliffs by 7.1% in the first quarter. Capital Investment Advisory Services LLC now owns 24,125 shares of the mining company's stock valued at $198,000 after purchasing an additional 1,600 shares during the period. 67.68% of the stock is owned by institutional investors.

Cleveland-Cliffs Price Performance

Shares of NYSE CLF traded up $0.45 during mid-day trading on Thursday, reaching $11.82. The company had a trading volume of 24,310,578 shares, compared to its average volume of 15,268,008. The firm has a market cap of $5.85 billion, a price-to-earnings ratio of -3.47 and a beta of 1.93. The business's 50-day simple moving average is $10.26 and its 200 day simple moving average is $8.81. Cleveland-Cliffs Inc. has a one year low of $5.63 and a one year high of $14.34. The company has a debt-to-equity ratio of 1.28, a quick ratio of 0.61 and a current ratio of 2.04.

Cleveland-Cliffs (NYSE:CLF - Get Free Report) last released its earnings results on Monday, July 21st. The mining company reported ($0.50) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.68) by $0.18. The firm had revenue of $4.93 billion for the quarter, compared to analysts' expectations of $4.90 billion. Cleveland-Cliffs had a negative return on equity of 17.97% and a negative net margin of 9.03%.The business's revenue for the quarter was up 7.5% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.11 earnings per share. On average, research analysts predict that Cleveland-Cliffs Inc. will post -0.79 earnings per share for the current fiscal year.

Analysts Set New Price Targets

A number of research analysts recently commented on the stock. JPMorgan Chase & Co. upped their price target on shares of Cleveland-Cliffs from $7.50 to $10.00 and gave the company a "neutral" rating in a research note on Thursday, July 24th. KeyCorp upgraded Cleveland-Cliffs from a "sector weight" rating to an "overweight" rating and set a $14.00 price objective for the company in a report on Tuesday, July 22nd. Citigroup increased their target price on Cleveland-Cliffs from $7.50 to $11.00 and gave the stock a "neutral" rating in a research note on Monday, July 21st. Wells Fargo & Company upgraded Cleveland-Cliffs to a "hold" rating in a research note on Thursday, August 14th. Finally, Glj Research lowered Cleveland-Cliffs from a "strong-buy" rating to a "strong sell" rating and set a $3.91 price objective on the stock. in a report on Wednesday, May 28th. Three research analysts have rated the stock with a Buy rating, four have assigned a Hold rating and one has given a Sell rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $10.96.

Get Our Latest Stock Analysis on CLF

Cleveland-Cliffs Company Profile

(

Free Report)

Cleveland-Cliffs is the largest flat-rolled steel company and the largest iron ore pellet producer in North America. The company is vertically integrated from mining through iron making, steelmaking, rolling, finishing and downstream with hot and cold stamping of steel parts and components. The company was formerly known as Cliffs Natural Resources Inc and changed its name to Cleveland-Cliffs Inc in August 2017.

Featured Articles

Before you consider Cleveland-Cliffs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleveland-Cliffs wasn't on the list.

While Cleveland-Cliffs currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.