Andar Capital Management HK Ltd reduced its holdings in Elastic N.V. (NYSE:ESTC - Free Report) by 72.2% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 25,000 shares of the company's stock after selling 65,000 shares during the period. Elastic comprises 4.3% of Andar Capital Management HK Ltd's holdings, making the stock its 13th largest position. Andar Capital Management HK Ltd's holdings in Elastic were worth $2,228,000 as of its most recent SEC filing.

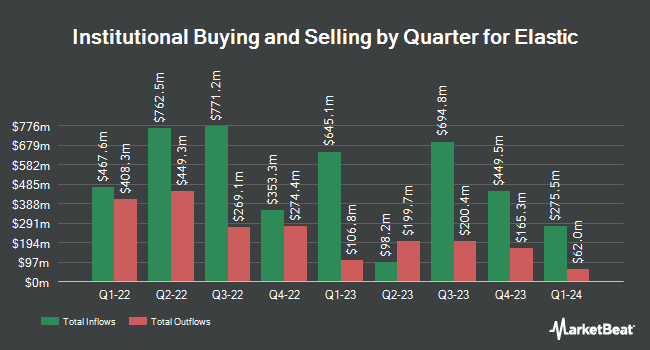

Other institutional investors also recently bought and sold shares of the company. LPL Financial LLC lifted its position in Elastic by 28.8% during the fourth quarter. LPL Financial LLC now owns 25,832 shares of the company's stock worth $2,559,000 after buying an additional 5,775 shares in the last quarter. Geode Capital Management LLC lifted its position in Elastic by 3.2% during the fourth quarter. Geode Capital Management LLC now owns 1,439,412 shares of the company's stock worth $142,663,000 after buying an additional 45,076 shares in the last quarter. ExodusPoint Capital Management LP lifted its position in Elastic by 125.3% during the fourth quarter. ExodusPoint Capital Management LP now owns 110,387 shares of the company's stock worth $10,937,000 after buying an additional 61,389 shares in the last quarter. Resolute Advisors LLC lifted its position in Elastic by 7.1% during the fourth quarter. Resolute Advisors LLC now owns 3,255 shares of the company's stock worth $323,000 after buying an additional 217 shares in the last quarter. Finally, Landscape Capital Management L.L.C. purchased a new position in Elastic during the fourth quarter worth approximately $330,000. 97.03% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

ESTC has been the topic of several research analyst reports. Robert W. Baird cut their price objective on Elastic from $125.00 to $115.00 and set an "outperform" rating on the stock in a report on Friday, May 30th. Canaccord Genuity Group cut their price objective on Elastic from $135.00 to $110.00 and set a "buy" rating on the stock in a report on Monday, June 2nd. Cantor Fitzgerald cut their price objective on Elastic from $109.00 to $92.00 and set a "neutral" rating on the stock in a report on Friday, May 30th. Guggenheim cut their price target on Elastic from $136.00 to $107.00 and set a "buy" rating on the stock in a report on Friday, May 30th. Finally, Jefferies Financial Group cut their price target on Elastic from $125.00 to $110.00 and set a "buy" rating on the stock in a report on Monday, April 7th. Eight investment analysts have rated the stock with a hold rating, twenty-one have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus price target of $112.72.

View Our Latest Stock Analysis on ESTC

Elastic Stock Performance

Shares of NYSE ESTC traded up $0.88 during mid-day trading on Monday, hitting $80.46. The company had a trading volume of 1,370,634 shares, compared to its average volume of 1,198,494. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.92 and a quick ratio of 1.92. The business's 50-day simple moving average is $85.13 and its 200-day simple moving average is $91.96. Elastic N.V. has a 12 month low of $69.00 and a 12 month high of $118.84. The firm has a market cap of $8.49 billion, a P/E ratio of -76.63 and a beta of 1.07.

Elastic (NYSE:ESTC - Get Free Report) last released its quarterly earnings data on Thursday, May 29th. The company reported $0.47 earnings per share for the quarter, beating analysts' consensus estimates of $0.37 by $0.10. Elastic had a negative return on equity of 4.46% and a negative net margin of 7.29%. The company had revenue of $388.43 million for the quarter, compared to the consensus estimate of $380.61 million. During the same period in the previous year, the business earned $0.21 earnings per share. The company's quarterly revenue was up 15.9% on a year-over-year basis. As a group, analysts predict that Elastic N.V. will post -0.77 earnings per share for the current fiscal year.

Insider Activity

In related news, insider Carolyn Herzog sold 5,702 shares of the business's stock in a transaction on Monday, June 9th. The shares were sold at an average price of $86.91, for a total value of $495,560.82. Following the sale, the insider directly owned 93,985 shares of the company's stock, valued at approximately $8,168,236.35. The trade was a 5.72% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CTO Shay Banon sold 5,117 shares of the business's stock in a transaction on Monday, June 9th. The shares were sold at an average price of $86.91, for a total transaction of $444,718.47. Following the completion of the sale, the chief technology officer directly owned 4,560,291 shares in the company, valued at $396,334,890.81. This represents a 0.11% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 50,913 shares of company stock worth $4,416,324. Corporate insiders own 15.90% of the company's stock.

About Elastic

(

Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

Read More

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.