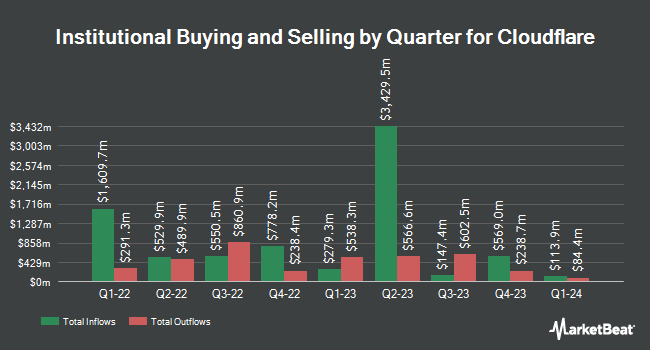

APG Asset Management N.V. trimmed its holdings in Cloudflare, Inc. (NYSE:NET - Free Report) by 2.3% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 175,071 shares of the company's stock after selling 4,200 shares during the quarter. APG Asset Management N.V. owned about 0.05% of Cloudflare worth $18,264,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Mather Group LLC. lifted its stake in shares of Cloudflare by 1,188.2% in the 1st quarter. Mather Group LLC. now owns 219 shares of the company's stock valued at $25,000 after purchasing an additional 202 shares during the period. NBC Securities Inc. acquired a new position in Cloudflare during the 1st quarter worth approximately $27,000. GPS Wealth Strategies Group LLC raised its stake in Cloudflare by 213.4% during the 1st quarter. GPS Wealth Strategies Group LLC now owns 257 shares of the company's stock worth $29,000 after buying an additional 175 shares during the period. MassMutual Private Wealth & Trust FSB raised its stake in Cloudflare by 115.4% during the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 265 shares of the company's stock worth $30,000 after buying an additional 142 shares during the period. Finally, Gordian Capital Singapore Pte Ltd acquired a new position in Cloudflare during the 4th quarter worth approximately $43,000. 82.68% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on NET. Guggenheim upped their price target on Cloudflare from $70.00 to $111.00 and gave the stock a "sell" rating in a research note on Friday, August 1st. UBS Group upped their price target on Cloudflare from $145.00 to $200.00 and gave the stock a "neutral" rating in a research note on Thursday, July 24th. Morgan Stanley upped their price target on Cloudflare from $225.00 to $235.00 and gave the stock an "overweight" rating in a research note on Friday, August 1st. Jefferies Financial Group dropped their price target on Cloudflare from $170.00 to $150.00 and set a "hold" rating on the stock in a research note on Friday, May 9th. Finally, JMP Securities upped their price target on Cloudflare from $180.00 to $225.00 and gave the stock a "market outperform" rating in a research note on Monday, July 28th. One research analyst has rated the stock with a Strong Buy rating, fifteen have issued a Buy rating, nine have given a Hold rating and three have given a Sell rating to the company's stock. According to data from MarketBeat, Cloudflare presently has an average rating of "Moderate Buy" and an average price target of $191.28.

Read Our Latest Report on NET

Cloudflare Stock Performance

Shares of Cloudflare stock opened at $195.9330 on Monday. The company has a market cap of $68.28 billion, a PE ratio of -576.27 and a beta of 1.84. Cloudflare, Inc. has a 52 week low of $74.88 and a 52 week high of $219.00. The business has a 50 day moving average price of $193.75 and a 200-day moving average price of $156.93. The company has a quick ratio of 5.14, a current ratio of 5.14 and a debt-to-equity ratio of 2.63.

Cloudflare (NYSE:NET - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The company reported $0.21 EPS for the quarter, topping the consensus estimate of $0.18 by $0.03. The firm had revenue of $512.32 million during the quarter, compared to the consensus estimate of $501.58 million. Cloudflare had a negative return on equity of 8.42% and a negative net margin of 6.22%.The company's quarterly revenue was up 27.8% compared to the same quarter last year. During the same period in the prior year, the business posted $0.20 earnings per share. Cloudflare has set its FY 2025 guidance at 0.850-0.860 EPS. Q3 2025 guidance at 0.230-0.23 EPS. Equities analysts anticipate that Cloudflare, Inc. will post -0.11 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CEO Matthew Prince sold 52,384 shares of the stock in a transaction that occurred on Friday, June 13th. The stock was sold at an average price of $171.25, for a total transaction of $8,970,760.00. Following the completion of the sale, the chief executive officer directly owned 381,213 shares of the company's stock, valued at approximately $65,282,726.25. This trade represents a 12.08% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, CFO Thomas J. Seifert sold 34,270 shares of the business's stock in a transaction on Monday, July 21st. The stock was sold at an average price of $200.17, for a total value of $6,859,825.90. Following the completion of the transaction, the chief financial officer directly owned 241,550 shares in the company, valued at approximately $48,351,063.50. This represents a 12.42% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 630,323 shares of company stock valued at $118,661,105. Insiders own 10.89% of the company's stock.

About Cloudflare

(

Free Report)

Cloudflare, Inc operates as a cloud services provider that delivers a range of services to businesses worldwide. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and IoT devices; and website and application security products comprising web application firewall, bot management, distributed denial of service, API gateways, SSL/TLS encryption, script management, security center, and rate limiting products.

Read More

Want to see what other hedge funds are holding NET? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cloudflare, Inc. (NYSE:NET - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cloudflare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cloudflare wasn't on the list.

While Cloudflare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.