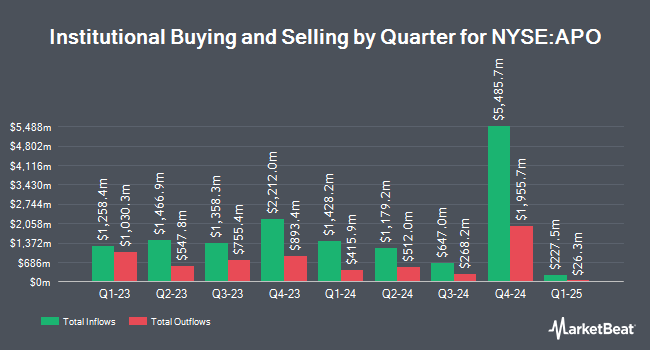

Tealwood Asset Management Inc. trimmed its stake in shares of Apollo Global Management, Inc. (NYSE:APO - Free Report) by 26.4% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 15,360 shares of the financial services provider's stock after selling 5,520 shares during the period. Tealwood Asset Management Inc.'s holdings in Apollo Global Management were worth $2,103,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors also recently modified their holdings of APO. Retirement Systems of Alabama acquired a new stake in shares of Apollo Global Management during the 4th quarter valued at approximately $15,984,000. Stratos Wealth Partners LTD. lifted its position in shares of Apollo Global Management by 4.1% during the 4th quarter. Stratos Wealth Partners LTD. now owns 6,930 shares of the financial services provider's stock valued at $1,145,000 after acquiring an additional 270 shares during the period. Confluence Wealth Services Inc. acquired a new stake in shares of Apollo Global Management during the 4th quarter valued at approximately $202,000. State of Alaska Department of Revenue acquired a new stake in shares of Apollo Global Management during the 4th quarter valued at approximately $8,417,000. Finally, Leo Wealth LLC acquired a new stake in shares of Apollo Global Management during the 4th quarter valued at approximately $215,000. 77.06% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of brokerages have recently weighed in on APO. Morgan Stanley dropped their price objective on shares of Apollo Global Management from $170.00 to $131.00 and set an "equal weight" rating for the company in a research note on Monday, April 14th. Bank of America boosted their price objective on shares of Apollo Global Management from $186.00 to $190.00 and gave the stock a "buy" rating in a report on Friday, April 4th. Barclays boosted their price objective on shares of Apollo Global Management from $145.00 to $156.00 and gave the company an "overweight" rating in a research report on Monday, May 5th. Cowen restated a "buy" rating on shares of Apollo Global Management in a research report on Monday, May 5th. Finally, TD Cowen decreased their price objective on shares of Apollo Global Management from $214.00 to $144.00 and set a "buy" rating for the company in a report on Wednesday, April 9th. One research analyst has rated the stock with a sell rating, two have issued a hold rating, seventeen have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Apollo Global Management presently has a consensus rating of "Moderate Buy" and an average price target of $159.00.

Get Our Latest Analysis on Apollo Global Management

Apollo Global Management Stock Up 2.4%

Shares of NYSE APO opened at $133.45 on Friday. The firm has a market cap of $76.27 billion, a PE ratio of 18.26, a price-to-earnings-growth ratio of 1.17 and a beta of 1.59. The company has a 50 day simple moving average of $130.66 and a 200 day simple moving average of $149.90. The company has a debt-to-equity ratio of 0.33, a current ratio of 1.44 and a quick ratio of 1.44. Apollo Global Management, Inc. has a 1 year low of $95.11 and a 1 year high of $189.49.

Apollo Global Management (NYSE:APO - Get Free Report) last announced its quarterly earnings data on Friday, May 2nd. The financial services provider reported $1.82 EPS for the quarter, missing the consensus estimate of $1.84 by ($0.02). Apollo Global Management had a return on equity of 13.97% and a net margin of 17.53%. The company had revenue of $5.55 billion for the quarter, compared to analyst estimates of $977.14 million. During the same period last year, the business earned $1.72 EPS. The business's quarterly revenue was down 21.2% compared to the same quarter last year. On average, research analysts forecast that Apollo Global Management, Inc. will post 8 EPS for the current year.

Apollo Global Management Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, May 30th. Shareholders of record on Friday, May 16th were paid a dividend of $0.51 per share. The ex-dividend date of this dividend was Friday, May 16th. This is a boost from Apollo Global Management's previous quarterly dividend of $0.46. This represents a $2.04 annualized dividend and a yield of 1.53%. Apollo Global Management's dividend payout ratio (DPR) is 35.73%.

Insider Transactions at Apollo Global Management

In related news, insider Lb 2018 Gst Trust bought 607,725 shares of the business's stock in a transaction dated Friday, April 4th. The shares were purchased at an average cost of $111.39 per share, with a total value of $67,694,487.75. Following the completion of the purchase, the insider now owns 621,754 shares in the company, valued at approximately $69,257,178.06. The trade was a 4,331.92% increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Martin Kelly sold 4,000 shares of the stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $132.57, for a total value of $530,280.00. Following the completion of the sale, the chief financial officer now directly owns 373,164 shares in the company, valued at approximately $49,470,351.48. This represents a 1.06% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 8.20% of the company's stock.

Apollo Global Management Profile

(

Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

See Also

Want to see what other hedge funds are holding APO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Apollo Global Management, Inc. (NYSE:APO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report