Apollon Wealth Management LLC acquired a new stake in Robinhood Markets, Inc. (NASDAQ:HOOD - Free Report) in the second quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 10,867 shares of the company's stock, valued at approximately $1,017,000.

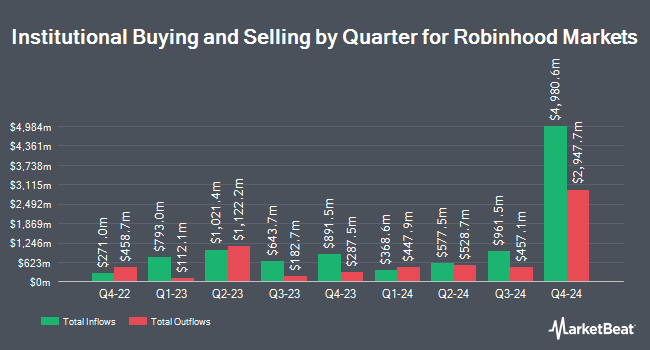

Other institutional investors have also recently bought and sold shares of the company. Farther Finance Advisors LLC boosted its stake in Robinhood Markets by 4.0% in the 1st quarter. Farther Finance Advisors LLC now owns 6,890 shares of the company's stock worth $290,000 after purchasing an additional 265 shares during the period. GAMMA Investing LLC raised its holdings in shares of Robinhood Markets by 40.2% during the 1st quarter. GAMMA Investing LLC now owns 8,210 shares of the company's stock valued at $342,000 after buying an additional 2,352 shares in the last quarter. CX Institutional purchased a new position in Robinhood Markets in the 1st quarter worth approximately $85,000. Ritholtz Wealth Management increased its stake in Robinhood Markets by 14.9% in the 1st quarter. Ritholtz Wealth Management now owns 11,559 shares of the company's stock worth $481,000 after purchasing an additional 1,503 shares during the period. Finally, Brighton Jones LLC purchased a new position in Robinhood Markets in the 1st quarter worth approximately $244,000. Institutional investors own 93.27% of the company's stock.

Insider Buying and Selling at Robinhood Markets

In other Robinhood Markets news, Director Baiju Bhatt sold 1,568,421 shares of the business's stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $99.98, for a total transaction of $156,810,731.58. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Vladimir Tenev sold 750,000 shares of the business's stock in a transaction that occurred on Wednesday, October 1st. The stock was sold at an average price of $139.73, for a total value of $104,797,500.00. The disclosure for this sale can be found here. In the last three months, insiders have sold 5,181,462 shares of company stock worth $567,328,871. Insiders own 19.95% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently weighed in on the company. Compass Point lifted their price objective on Robinhood Markets from $64.00 to $96.00 and gave the stock a "buy" rating in a research report on Friday, June 27th. Weiss Ratings restated a "hold (c)" rating on shares of Robinhood Markets in a research note on Wednesday, October 8th. Mizuho upped their price objective on Robinhood Markets from $120.00 to $145.00 and gave the company an "outperform" rating in a research report on Wednesday, September 10th. Keefe, Bruyette & Woods boosted their price target on Robinhood Markets from $89.00 to $106.00 and gave the company a "market perform" rating in a report on Thursday, July 31st. Finally, Citigroup upped their price objective on Robinhood Markets from $120.00 to $135.00 and gave the stock a "neutral" rating in a research note on Tuesday, September 23rd. Twelve equities research analysts have rated the stock with a Buy rating, seven have given a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, Robinhood Markets presently has a consensus rating of "Moderate Buy" and an average target price of $118.94.

Get Our Latest Stock Report on Robinhood Markets

Robinhood Markets Stock Down 4.1%

HOOD opened at $134.95 on Wednesday. Robinhood Markets, Inc. has a 52 week low of $23.00 and a 52 week high of $153.86. The stock's fifty day moving average is $119.98 and its two-hundred day moving average is $87.41. The company has a market capitalization of $119.93 billion, a P/E ratio of 68.50, a PEG ratio of 3.79 and a beta of 2.42.

Robinhood Markets (NASDAQ:HOOD - Get Free Report) last announced its quarterly earnings results on Wednesday, July 30th. The company reported $0.42 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.30 by $0.12. Robinhood Markets had a return on equity of 17.48% and a net margin of 50.13%.The business had revenue of $989.00 million for the quarter, compared to the consensus estimate of $893.93 million. During the same period last year, the business posted $0.21 EPS. The business's revenue was up 45.0% compared to the same quarter last year. Equities analysts anticipate that Robinhood Markets, Inc. will post 1.35 earnings per share for the current year.

Robinhood Markets Company Profile

(

Free Report)

Robinhood Markets, Inc operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds (ETFs), American depository receipts, options, gold, and cryptocurrencies. The company offers fractional trading, recurring investments, fully-paid securities lending, access to investing on margin, cash sweep, instant withdrawals, retirement program, around-the-clock trading, and initial public offerings participation services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Robinhood Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robinhood Markets wasn't on the list.

While Robinhood Markets currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.