Appian Way Asset Management LP bought a new position in shares of Target Hospitality Corp. (NASDAQ:TH - Free Report) during the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm bought 1,804,184 shares of the company's stock, valued at approximately $11,872,000. Target Hospitality accounts for approximately 2.7% of Appian Way Asset Management LP's investment portfolio, making the stock its 10th largest holding. Appian Way Asset Management LP owned 1.82% of Target Hospitality as of its most recent filing with the Securities & Exchange Commission.

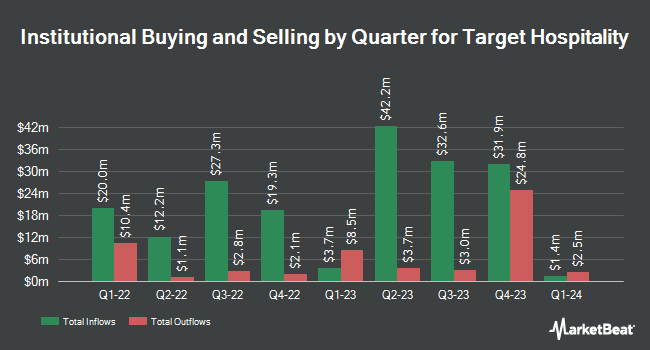

A number of other large investors also recently made changes to their positions in the company. PDT Partners LLC acquired a new stake in Target Hospitality during the first quarter worth approximately $1,155,000. Royal Bank of Canada grew its position in Target Hospitality by 3,549.2% during the first quarter. Royal Bank of Canada now owns 43,863 shares of the company's stock worth $289,000 after buying an additional 42,661 shares in the last quarter. Kore Advisors LP acquired a new stake in shares of Target Hospitality in the 1st quarter valued at $1,589,000. Aristides Capital LLC acquired a new stake in shares of Target Hospitality in the 1st quarter valued at $332,000. Finally, EntryPoint Capital LLC acquired a new stake in shares of Target Hospitality in the 1st quarter valued at $108,000. Institutional investors own 32.40% of the company's stock.

Target Hospitality Price Performance

TH traded up $0.09 during trading on Friday, reaching $8.78. The stock had a trading volume of 209,121 shares, compared to its average volume of 437,185. The stock has a market cap of $876.07 million, a PE ratio of 87.80 and a beta of 2.00. The company has a debt-to-equity ratio of 0.07, a quick ratio of 1.47 and a current ratio of 1.47. Target Hospitality Corp. has a one year low of $4.00 and a one year high of $11.10. The business has a 50-day moving average of $8.05 and a 200-day moving average of $7.14.

Target Hospitality (NASDAQ:TH - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported ($0.15) EPS for the quarter, missing analysts' consensus estimates of ($0.11) by ($0.04). Target Hospitality had a net margin of 3.58% and a return on equity of 3.26%. The firm had revenue of $61.61 million during the quarter, compared to the consensus estimate of $56.43 million. Target Hospitality has set its FY 2025 guidance at EPS. As a group, equities research analysts anticipate that Target Hospitality Corp. will post 0.65 EPS for the current fiscal year.

Wall Street Analyst Weigh In

TH has been the topic of several recent research reports. Stifel Nicolaus raised Target Hospitality from a "hold" rating to a "buy" rating and raised their price objective for the company from $7.50 to $11.00 in a report on Tuesday, August 19th. Wall Street Zen raised Target Hospitality from a "sell" rating to a "hold" rating in a research report on Friday, August 22nd. One research analyst has rated the stock with a Strong Buy rating, two have given a Buy rating and one has issued a Hold rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Buy" and an average price target of $13.00.

Get Our Latest Stock Report on Target Hospitality

About Target Hospitality

(

Free Report)

Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America. The company operates through two segments, Hospitality & Facilities Services - South and Government. It owns a network of specialty rental accommodation units. In addition, the company provides catering and food, maintenance, housekeeping, grounds-keeping, security, health and recreation facilities, workforce community management, concierge, and laundry services.

Further Reading

Before you consider Target Hospitality, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target Hospitality wasn't on the list.

While Target Hospitality currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.