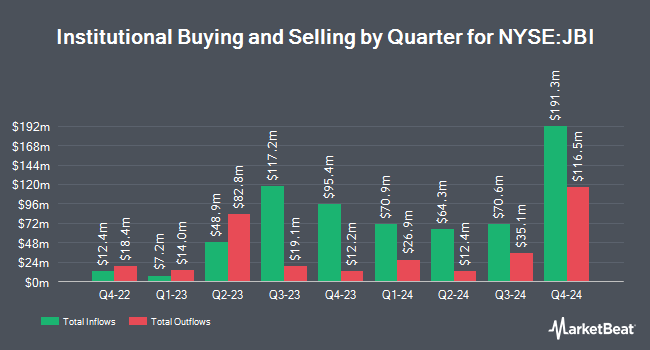

Applied Fundamental Research LLC decreased its stake in shares of Janus International Group, Inc. (NYSE:JBI - Free Report) by 12.2% during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 304,542 shares of the company's stock after selling 42,132 shares during the period. Janus International Group comprises 2.2% of Applied Fundamental Research LLC's portfolio, making the stock its 11th largest holding. Applied Fundamental Research LLC owned about 0.22% of Janus International Group worth $2,479,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. GAMMA Investing LLC lifted its holdings in shares of Janus International Group by 787.5% during the 1st quarter. GAMMA Investing LLC now owns 17,813 shares of the company's stock valued at $128,000 after buying an additional 15,806 shares during the period. Wealth Enhancement Advisory Services LLC bought a new position in Janus International Group in the first quarter valued at about $72,000. Exchange Traded Concepts LLC bought a new position in Janus International Group in the first quarter valued at about $228,000. Janney Montgomery Scott LLC bought a new position in Janus International Group in the first quarter valued at about $355,000. Finally, Yorktown Management & Research Co Inc bought a new position in Janus International Group in the first quarter valued at about $205,000. Institutional investors own 88.78% of the company's stock.

Wall Street Analysts Forecast Growth

JBI has been the topic of several recent research reports. UBS Group increased their price objective on shares of Janus International Group from $9.00 to $10.00 and gave the stock a "neutral" rating in a research note on Friday, August 8th. Jefferies Financial Group increased their price objective on shares of Janus International Group from $9.00 to $10.00 and gave the stock a "hold" rating in a research note on Wednesday, August 20th. KeyCorp increased their price target on shares of Janus International Group from $10.00 to $12.00 and gave the stock an "overweight" rating in a research report on Friday, August 8th. Wall Street Zen upgraded shares of Janus International Group from a "hold" rating to a "buy" rating in a research report on Saturday, August 9th. Finally, Weiss Ratings reiterated a "hold (c)" rating on shares of Janus International Group in a research report on Wednesday, October 8th. One analyst has rated the stock with a Buy rating and three have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $10.67.

View Our Latest Report on Janus International Group

Janus International Group Price Performance

NYSE JBI opened at $9.87 on Wednesday. Janus International Group, Inc. has a 12 month low of $5.99 and a 12 month high of $10.80. The stock has a market cap of $1.37 billion, a price-to-earnings ratio of 31.82 and a beta of 1.34. The company's 50 day moving average is $10.07 and its two-hundred day moving average is $8.67. The company has a current ratio of 2.61, a quick ratio of 2.26 and a debt-to-equity ratio of 1.00.

Janus International Group (NYSE:JBI - Get Free Report) last announced its quarterly earnings data on Monday, March 28th. The company reported $0.24 EPS for the quarter. The firm had revenue of $148.59 million for the quarter. Janus International Group had a net margin of 4.85% and a return on equity of 13.10%. As a group, research analysts anticipate that Janus International Group, Inc. will post 0.54 earnings per share for the current year.

Janus International Group Company Profile

(

Free Report)

Janus International Group, Inc manufacturers and supplies turn-key self-storage, and commercial and industrial building solutions in North America and internationally. The company offers roll up and swing doors, hallway systems, relocatable storage moveable additional storage structures units, and other solutions.

Featured Stories

Want to see what other hedge funds are holding JBI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Janus International Group, Inc. (NYSE:JBI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Janus International Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Janus International Group wasn't on the list.

While Janus International Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.