AQR Capital Management LLC increased its position in Crane (NYSE:CR - Free Report) by 9.5% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 58,577 shares of the conglomerate's stock after buying an additional 5,065 shares during the quarter. AQR Capital Management LLC owned about 0.10% of Crane worth $8,742,000 as of its most recent filing with the Securities and Exchange Commission.

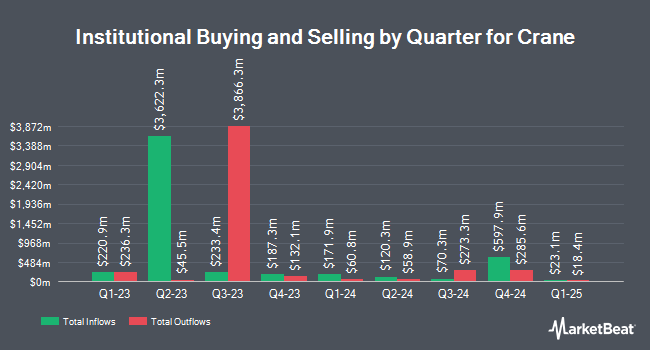

Other large investors have also made changes to their positions in the company. Golden State Wealth Management LLC raised its position in shares of Crane by 104.8% in the 1st quarter. Golden State Wealth Management LLC now owns 256 shares of the conglomerate's stock worth $39,000 after buying an additional 131 shares during the period. Westpac Banking Corp purchased a new position in shares of Crane in the 1st quarter worth $76,000. Fifth Third Bancorp raised its position in shares of Crane by 31.4% in the 1st quarter. Fifth Third Bancorp now owns 569 shares of the conglomerate's stock worth $87,000 after buying an additional 136 shares during the period. UMB Bank n.a. raised its position in shares of Crane by 84.7% in the 1st quarter. UMB Bank n.a. now owns 687 shares of the conglomerate's stock worth $105,000 after buying an additional 315 shares during the period. Finally, Wayfinding Financial LLC purchased a new position in shares of Crane in the 1st quarter worth $105,000. 75.14% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on the company. DA Davidson increased their price target on Crane from $200.00 to $230.00 and gave the company a "buy" rating in a report on Wednesday, July 30th. UBS Group reiterated a "buy" rating and issued a $230.00 price target (up from $215.00) on shares of Crane in a report on Wednesday, July 30th. Deutsche Bank Aktiengesellschaft increased their price target on Crane from $187.00 to $226.00 and gave the company a "buy" rating in a report on Tuesday, June 10th. Bank of America increased their price target on Crane from $220.00 to $225.00 and gave the company a "buy" rating in a report on Thursday, August 21st. Finally, Stifel Nicolaus increased their price target on Crane from $189.00 to $200.00 and gave the company a "hold" rating in a report on Wednesday, July 30th. Four research analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $222.20.

Read Our Latest Analysis on CR

Crane Stock Down 1.3%

Shares of Crane stock traded down $2.46 during trading hours on Wednesday, hitting $180.34. 366,783 shares of the company's stock traded hands, compared to its average volume of 312,473. The stock has a 50 day simple moving average of $189.46 and a 200-day simple moving average of $173.19. The company has a quick ratio of 0.88, a current ratio of 1.18 and a debt-to-equity ratio of 0.29. The company has a market cap of $10.38 billion, a PE ratio of 23.89, a PEG ratio of 1.93 and a beta of 1.25. Crane has a twelve month low of $127.04 and a twelve month high of $203.89.

Crane (NYSE:CR - Get Free Report) last announced its earnings results on Monday, July 28th. The conglomerate reported $1.49 earnings per share for the quarter, beating the consensus estimate of $1.34 by $0.15. The company had revenue of $577.20 million during the quarter, compared to the consensus estimate of $567.70 million. Crane had a return on equity of 24.45% and a net margin of 13.10%.The company's revenue was up 9.2% on a year-over-year basis. During the same period last year, the firm earned $1.20 earnings per share. Crane has set its FY 2025 guidance at 5.500-5.800 EPS. Equities research analysts anticipate that Crane will post 7.87 earnings per share for the current fiscal year.

Crane Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, September 10th. Investors of record on Friday, August 29th were paid a $0.23 dividend. This represents a $0.92 dividend on an annualized basis and a yield of 0.5%. The ex-dividend date was Friday, August 29th. Crane's dividend payout ratio (DPR) is 15.31%.

Insider Buying and Selling

In other Crane news, VP Alejandro Alcala sold 20,791 shares of the firm's stock in a transaction dated Monday, August 25th. The shares were sold at an average price of $192.74, for a total value of $4,007,257.34. Following the transaction, the vice president owned 33,526 shares of the company's stock, valued at $6,461,801.24. This trade represents a 38.28% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Company insiders own 2.12% of the company's stock.

About Crane

(

Free Report)

Crane Company, together with its subsidiaries, manufactures and sells engineered industrial products in the United States, Canada, the United Kingdom, Continental Europe, and internationally. The company operates in three segments: Aerospace & Electronics, Process Flow Technologies, and Engineered Materials.

Recommended Stories

Before you consider Crane, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crane wasn't on the list.

While Crane currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.