AQR Capital Management LLC lifted its holdings in shares of Appian Corporation (NASDAQ:APPN - Free Report) by 368.8% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 199,869 shares of the company's stock after purchasing an additional 157,233 shares during the quarter. AQR Capital Management LLC owned about 0.27% of Appian worth $5,758,000 as of its most recent SEC filing.

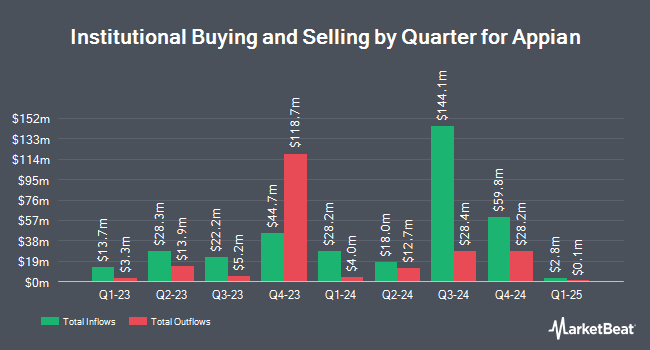

Several other hedge funds have also made changes to their positions in APPN. GAMMA Investing LLC boosted its holdings in Appian by 2,716.2% in the first quarter. GAMMA Investing LLC now owns 6,252 shares of the company's stock valued at $1,800,000 after acquiring an additional 6,030 shares during the last quarter. Teacher Retirement System of Texas acquired a new position in Appian in the first quarter valued at $373,000. Hsbc Holdings PLC acquired a new position in Appian in the first quarter valued at $533,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in Appian by 9.5% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 87,836 shares of the company's stock valued at $2,897,000 after acquiring an additional 7,594 shares during the last quarter. Finally, Deutsche Bank AG boosted its holdings in Appian by 144.6% in the first quarter. Deutsche Bank AG now owns 84,975 shares of the company's stock valued at $2,448,000 after acquiring an additional 50,240 shares during the last quarter. Institutional investors and hedge funds own 52.70% of the company's stock.

Appian Stock Performance

Shares of NASDAQ APPN traded up $1.67 during midday trading on Thursday, reaching $33.16. 1,282,630 shares of the company's stock were exchanged, compared to its average volume of 849,543. Appian Corporation has a 52-week low of $24.00 and a 52-week high of $43.33. The stock has a market capitalization of $2.45 billion, a PE ratio of -144.17 and a beta of 1.71. The business's fifty day moving average price is $29.66 and its two-hundred day moving average price is $29.95.

Appian (NASDAQ:APPN - Get Free Report) last announced its earnings results on Thursday, August 7th. The company reported ($0.14) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.13) by ($0.01). The firm had revenue of $170.64 million during the quarter, compared to analyst estimates of $160.01 million. During the same quarter last year, the firm posted ($0.26) earnings per share. The business's revenue was up 16.5% on a year-over-year basis. Appian has set its FY 2025 guidance at 0.280-0.360 EPS. Q3 2025 guidance at 0.030-0.070 EPS. Analysts predict that Appian Corporation will post -0.28 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

A number of research analysts recently weighed in on the company. Zacks Research cut Appian from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 9th. DA Davidson initiated coverage on Appian in a report on Friday, August 8th. They issued a "neutral" rating and a $30.00 target price on the stock. One equities research analyst has rated the stock with a Buy rating, five have issued a Hold rating and one has assigned a Sell rating to the company's stock. According to data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $33.40.

Read Our Latest Research Report on APPN

Appian Profile

(

Free Report)

Appian Corporation, a software company that provides low-code design platform in the United States, Mexico, Portugal, and internationally. The company's platform offers artificial intelligence, process automation, data fabric, and process mining. It provides The Appian Platform, an integrated automation platform that enables organizations to design, automate, and optimize mission-critical business processes.

Featured Articles

Before you consider Appian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Appian wasn't on the list.

While Appian currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.