Ariose Capital Management Ltd boosted its position in Li Auto Inc. Sponsored ADR (NASDAQ:LI - Free Report) by 67.3% during the 2nd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 358,086 shares of the company's stock after acquiring an additional 143,986 shares during the period. Li Auto accounts for 6.2% of Ariose Capital Management Ltd's portfolio, making the stock its 6th largest position. Ariose Capital Management Ltd's holdings in Li Auto were worth $9,708,000 at the end of the most recent reporting period.

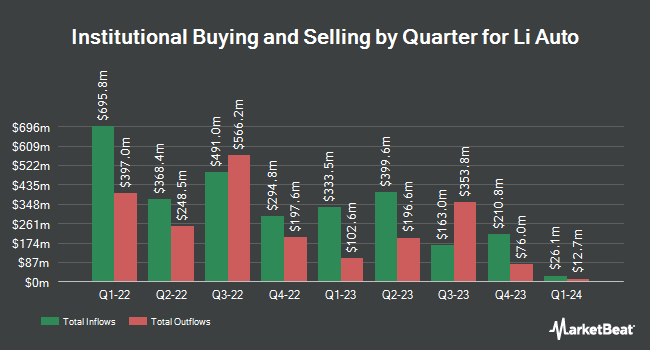

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Mirae Asset Global Investments Co. Ltd. lifted its position in Li Auto by 459.3% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 16,923,620 shares of the company's stock valued at $426,475,000 after purchasing an additional 13,897,555 shares during the period. Goldman Sachs Group Inc. raised its stake in shares of Li Auto by 133.3% during the first quarter. Goldman Sachs Group Inc. now owns 2,636,156 shares of the company's stock worth $66,431,000 after buying an additional 1,505,991 shares during the last quarter. Canada Pension Plan Investment Board acquired a new position in Li Auto in the first quarter valued at approximately $41,076,000. American Century Companies Inc. boosted its stake in Li Auto by 14.4% in the first quarter. American Century Companies Inc. now owns 1,150,819 shares of the company's stock valued at $29,001,000 after acquiring an additional 145,295 shares during the last quarter. Finally, Assenagon Asset Management S.A. acquired a new position in shares of Li Auto in the 2nd quarter valued at $30,055,000. 9.88% of the stock is currently owned by institutional investors and hedge funds.

Li Auto Stock Performance

Shares of LI stock opened at $24.36 on Friday. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.57 and a current ratio of 1.73. The company has a market capitalization of $25.51 billion, a P/E ratio of 23.20 and a beta of 0.97. The company's 50 day moving average price is $25.30 and its two-hundred day moving average price is $26.11. Li Auto Inc. Sponsored ADR has a 52 week low of $19.10 and a 52 week high of $33.12.

Analysts Set New Price Targets

A number of brokerages recently commented on LI. CLSA raised Li Auto to a "strong-buy" rating in a research note on Monday, September 22nd. JPMorgan Chase & Co. restated a "neutral" rating and set a $28.00 target price (down previously from $33.00) on shares of Li Auto in a report on Thursday, August 14th. BNP Paribas Exane assumed coverage on Li Auto in a research report on Monday, August 18th. They set an "underperform" rating and a $18.00 target price for the company. Wall Street Zen downgraded shares of Li Auto from a "hold" rating to a "sell" rating in a research report on Saturday, August 30th. Finally, Sanford C. Bernstein reduced their price objective on shares of Li Auto from $26.00 to $25.00 and set a "market perform" rating on the stock in a research note on Friday, August 29th. Two analysts have rated the stock with a Strong Buy rating, one has given a Buy rating, eight have issued a Hold rating and four have given a Sell rating to the company. According to MarketBeat.com, Li Auto currently has an average rating of "Hold" and an average price target of $26.26.

Read Our Latest Analysis on Li Auto

About Li Auto

(

Free Report)

Li Auto Inc operates in the energy vehicle market in the People's Republic of China. It designs, develops, manufactures, and sells premium smart electric vehicles. The company's product line comprises MPVs and sport utility vehicles. It offers sales and after sales management, and technology development and corporate management services, as well as purchases manufacturing equipment.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Li Auto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Li Auto wasn't on the list.

While Li Auto currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.