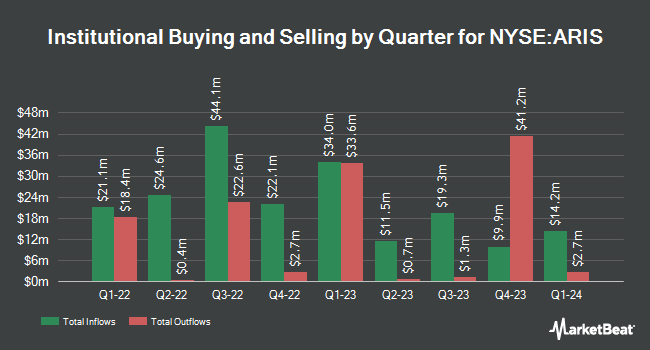

Jump Financial LLC boosted its position in Aris Water Solutions, Inc. (NYSE:ARIS - Free Report) by 759.3% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 116,000 shares of the company's stock after acquiring an additional 102,500 shares during the period. Jump Financial LLC owned about 0.20% of Aris Water Solutions worth $3,717,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Cambridge Investment Research Advisors Inc. purchased a new stake in Aris Water Solutions in the 1st quarter worth approximately $867,000. Janney Montgomery Scott LLC grew its stake in Aris Water Solutions by 233.8% in the 1st quarter. Janney Montgomery Scott LLC now owns 38,898 shares of the company's stock worth $1,246,000 after acquiring an additional 27,246 shares during the period. GAMMA Investing LLC grew its stake in Aris Water Solutions by 4,584.0% in the 1st quarter. GAMMA Investing LLC now owns 29,509 shares of the company's stock worth $921,000 after acquiring an additional 28,879 shares during the period. Farther Finance Advisors LLC grew its stake in Aris Water Solutions by 3,062.6% in the 1st quarter. Farther Finance Advisors LLC now owns 3,637 shares of the company's stock worth $119,000 after acquiring an additional 3,522 shares during the period. Finally, Envestnet Asset Management Inc. grew its stake in Aris Water Solutions by 11.2% in the 1st quarter. Envestnet Asset Management Inc. now owns 20,599 shares of the company's stock worth $660,000 after acquiring an additional 2,070 shares during the period. 39.71% of the stock is owned by hedge funds and other institutional investors.

Aris Water Solutions Stock Up 1.1%

Shares of NYSE:ARIS traded up $0.28 during midday trading on Friday, hitting $24.27. 714,168 shares of the company's stock traded hands, compared to its average volume of 1,626,409. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.73 and a current ratio of 1.73. The company has a market cap of $1.44 billion, a PE ratio of 29.23 and a beta of 1.68. The firm's fifty day moving average price is $22.88 and its two-hundred day moving average price is $25.19. Aris Water Solutions, Inc. has a twelve month low of $14.46 and a twelve month high of $33.95.

Aris Water Solutions (NYSE:ARIS - Get Free Report) last posted its earnings results on Monday, August 11th. The company reported $0.19 earnings per share for the quarter, missing the consensus estimate of $0.24 by ($0.05). The business had revenue of $124.09 million for the quarter, compared to analyst estimates of $120.68 million. Aris Water Solutions had a net margin of 6.00% and a return on equity of 3.77%. On average, equities research analysts anticipate that Aris Water Solutions, Inc. will post 0.91 EPS for the current fiscal year.

Aris Water Solutions Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Thursday, September 18th. Investors of record on Thursday, September 4th will be issued a dividend of $0.14 per share. The ex-dividend date is Thursday, September 4th. This represents a $0.56 annualized dividend and a dividend yield of 2.3%. Aris Water Solutions's payout ratio is presently 67.47%.

Analysts Set New Price Targets

Several research firms have commented on ARIS. Evercore ISI lowered their target price on shares of Aris Water Solutions from $26.00 to $25.00 and set an "in-line" rating for the company in a research note on Monday, August 18th. Wells Fargo & Company set a $27.00 target price on shares of Aris Water Solutions in a research note on Tuesday, August 19th. Capital One Financial cut shares of Aris Water Solutions from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 11th. The Goldman Sachs Group lowered their price objective on shares of Aris Water Solutions from $34.00 to $30.00 and set a "buy" rating for the company in a research note on Thursday, May 8th. Finally, Wall Street Zen cut shares of Aris Water Solutions from a "hold" rating to a "sell" rating in a research note on Tuesday, May 13th. Two equities research analysts have rated the stock with a Buy rating and six have given a Hold rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and a consensus target price of $26.50.

Check Out Our Latest Research Report on ARIS

Aris Water Solutions Profile

(

Free Report)

Aris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

Further Reading

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.