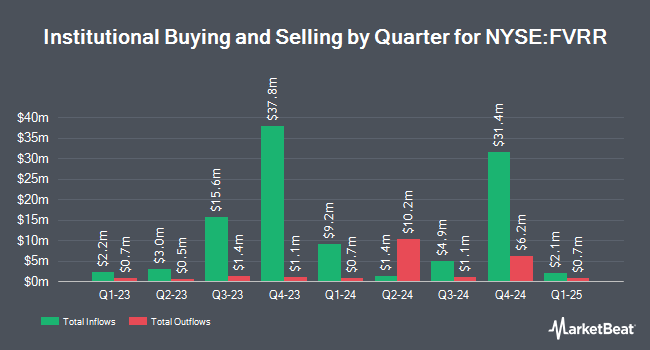

ARK Investment Management LLC lessened its position in shares of Fiverr International (NYSE:FVRR - Free Report) by 30.4% during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 55,682 shares of the company's stock after selling 24,267 shares during the quarter. ARK Investment Management LLC owned about 0.16% of Fiverr International worth $1,319,000 as of its most recent SEC filing.

A number of other hedge funds have also recently added to or reduced their stakes in FVRR. Huntington National Bank increased its stake in Fiverr International by 38.3% in the 4th quarter. Huntington National Bank now owns 1,465 shares of the company's stock valued at $46,000 after purchasing an additional 406 shares in the last quarter. KLP Kapitalforvaltning AS acquired a new stake in shares of Fiverr International during the fourth quarter worth $187,000. Legato Capital Management LLC acquired a new stake in shares of Fiverr International during the first quarter worth $516,000. Public Employees Retirement System of Ohio boosted its holdings in shares of Fiverr International by 60.5% during the fourth quarter. Public Employees Retirement System of Ohio now owns 42,336 shares of the company's stock worth $1,343,000 after purchasing an additional 15,951 shares during the last quarter. Finally, Jump Financial LLC boosted its holdings in shares of Fiverr International by 594.7% during the fourth quarter. Jump Financial LLC now owns 80,754 shares of the company's stock worth $2,562,000 after purchasing an additional 69,129 shares during the last quarter. Hedge funds and other institutional investors own 59.00% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on FVRR shares. Needham & Company LLC restated a "buy" rating and set a $36.00 price objective on shares of Fiverr International in a report on Thursday, May 8th. Citigroup lifted their price target on Fiverr International from $39.00 to $40.00 and gave the stock a "buy" rating in a research note on Friday, May 23rd. The Goldman Sachs Group lifted their price target on Fiverr International from $41.00 to $47.00 and gave the stock a "buy" rating in a research note on Thursday, May 8th. Scotiabank lifted their target price on Fiverr International from $31.00 to $34.00 and gave the company a "sector outperform" rating in a research note on Thursday, May 8th. Finally, JPMorgan Chase & Co. lifted their target price on Fiverr International from $27.00 to $32.00 and gave the company a "neutral" rating in a research note on Friday, May 9th. Six research analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $36.00.

Read Our Latest Analysis on Fiverr International

Fiverr International Stock Down 9.2%

NYSE:FVRR traded down $2.31 during trading hours on Wednesday, hitting $22.71. 1,857,491 shares of the stock traded hands, compared to its average volume of 672,095. Fiverr International has a fifty-two week low of $20.83 and a fifty-two week high of $36.11. The company has a current ratio of 1.20, a quick ratio of 1.20 and a debt-to-equity ratio of 0.06. The firm has a market cap of $813.75 million, a price-to-earnings ratio of 48.29 and a beta of 1.54. The firm has a 50 day moving average price of $29.47 and a 200 day moving average price of $28.48.

Fiverr International (NYSE:FVRR - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The company reported $0.69 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.72 by ($0.03). The firm had revenue of $108.65 million for the quarter, compared to the consensus estimate of $107.75 million. Fiverr International had a net margin of 4.51% and a return on equity of 10.28%. The firm's revenue was up 14.7% on a year-over-year basis. During the same quarter last year, the company earned $0.58 earnings per share. Equities research analysts anticipate that Fiverr International will post 1.04 earnings per share for the current year.

About Fiverr International

(

Free Report)

Fiverr International Ltd. operates an online marketplace worldwide. Its platform enables sellers to sell their services and buyers to buy them. The company's platform includes various categories in ten verticals, including graphic and design, digital marketing, writing and translation, video and animation, music and audio, programming and tech, business, data, lifestyle, and photography.

Further Reading

Before you consider Fiverr International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiverr International wasn't on the list.

While Fiverr International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.