Arkadios Wealth Advisors increased its holdings in Sanofi (NASDAQ:SNY - Free Report) by 359.1% in the 1st quarter, according to its most recent disclosure with the SEC. The firm owned 21,621 shares of the company's stock after acquiring an additional 16,912 shares during the period. Arkadios Wealth Advisors' holdings in Sanofi were worth $1,199,000 at the end of the most recent quarter.

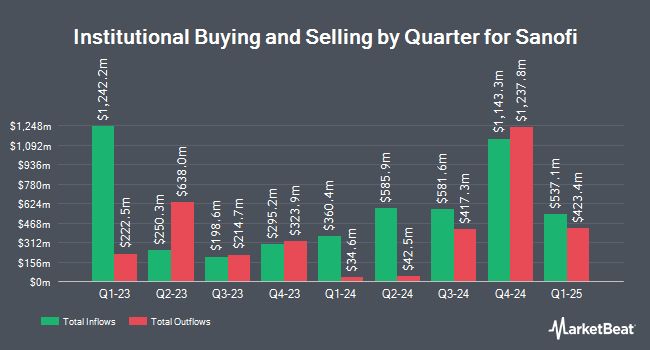

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Eastern Bank boosted its stake in shares of Sanofi by 121.0% in the first quarter. Eastern Bank now owns 548 shares of the company's stock valued at $30,000 after purchasing an additional 300 shares during the period. Federated Hermes Inc. raised its position in shares of Sanofi by 58.5% during the 1st quarter. Federated Hermes Inc. now owns 3,947,583 shares of the company's stock worth $218,933,000 after acquiring an additional 1,456,269 shares in the last quarter. Fiera Capital Corp purchased a new stake in shares of Sanofi during the 1st quarter worth approximately $248,000. Fielder Capital Group LLC acquired a new position in Sanofi in the first quarter valued at $206,000. Finally, Pinnacle West Asset Management Inc. grew its stake in Sanofi by 6.5% during the 1st quarter. Pinnacle West Asset Management Inc. now owns 4,900 shares of the company's stock worth $272,000 after buying an additional 300 shares during the last quarter. 14.04% of the stock is owned by institutional investors and hedge funds.

Sanofi Trading Up 2.4%

Shares of SNY stock traded up $1.11 on Friday, reaching $46.75. 2,518,877 shares of the stock were exchanged, compared to its average volume of 2,247,996. The stock has a market cap of $114.80 billion, a P/E ratio of 11.24, a price-to-earnings-growth ratio of 1.12 and a beta of 0.48. The company has a quick ratio of 0.94, a current ratio of 1.27 and a debt-to-equity ratio of 0.19. The firm has a 50 day moving average of $49.10 and a two-hundred day moving average of $52.11. Sanofi has a 1-year low of $44.73 and a 1-year high of $60.12.

Sanofi (NASDAQ:SNY - Get Free Report) last issued its earnings results on Thursday, July 31st. The company reported $0.90 EPS for the quarter, missing analysts' consensus estimates of $0.96 by ($0.06). The business had revenue of $11.34 billion during the quarter, compared to analysts' expectations of $9.91 billion. Sanofi had a net margin of 21.47% and a return on equity of 16.86%. The business's revenue was down 7.0% on a year-over-year basis. During the same period in the prior year, the business posted $1.73 EPS. On average, research analysts anticipate that Sanofi will post 4.36 EPS for the current year.

Wall Street Analyst Weigh In

A number of research analysts have commented on the stock. Barclays restated an "overweight" rating on shares of Sanofi in a research note on Wednesday, July 2nd. BNP Paribas started coverage on Sanofi in a report on Tuesday, April 15th. They issued an "outperform" rating and a $65.00 target price for the company. Morgan Stanley set a $56.00 price target on Sanofi in a report on Monday, June 2nd. Hsbc Global Res upgraded shares of Sanofi to a "strong-buy" rating in a research report on Monday, April 28th. Finally, Wall Street Zen raised Sanofi from a "hold" rating to a "buy" rating in a research note on Saturday. Two analysts have rated the stock with a hold rating, four have assigned a buy rating and three have issued a strong buy rating to the stock. According to data from MarketBeat, Sanofi has an average rating of "Buy" and an average price target of $62.00.

Read Our Latest Report on SNY

Sanofi Company Profile

(

Free Report)

Sanofi, a healthcare company, engages in the research, development, manufacture, and marketing of therapeutic solutions in the United States, Europe, Canada, and internationally. It operates through Pharmaceuticals, Vaccines, and Consumer Healthcare segments. The company provides specialty care, such as DUPIXENT, neurology and immunology, rare diseases, oncology, and rare blood disorders; medicines for diabetes and cardiovascular diseases; and established prescription products.

Featured Articles

Before you consider Sanofi, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sanofi wasn't on the list.

While Sanofi currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.