Armor Advisors L.L.C. raised its stake in Ferguson plc (NASDAQ:FERG - Free Report) by 14.3% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 68,136 shares of the company's stock after acquiring an additional 8,536 shares during the quarter. Ferguson comprises 8.7% of Armor Advisors L.L.C.'s holdings, making the stock its 4th largest position. Armor Advisors L.L.C.'s holdings in Ferguson were worth $10,917,000 as of its most recent filing with the Securities & Exchange Commission.

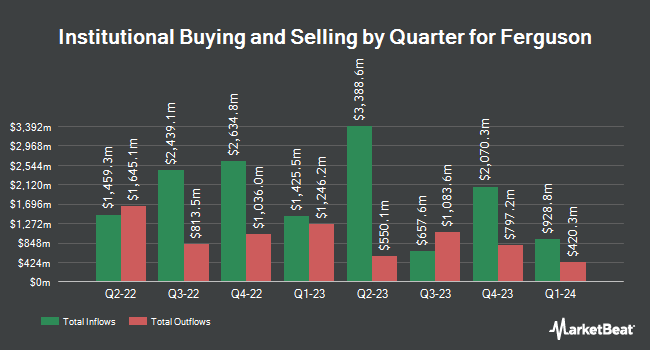

Several other large investors have also recently bought and sold shares of FERG. Barclays PLC increased its stake in Ferguson by 208.8% in the fourth quarter. Barclays PLC now owns 2,678,880 shares of the company's stock valued at $464,973,000 after acquiring an additional 1,811,287 shares during the last quarter. FMR LLC boosted its position in Ferguson by 18.2% in the fourth quarter. FMR LLC now owns 10,007,892 shares of the company's stock valued at $1,740,049,000 after buying an additional 1,539,889 shares in the last quarter. Bank of New York Mellon Corp boosted its position in Ferguson by 24.5% in the first quarter. Bank of New York Mellon Corp now owns 7,660,299 shares of the company's stock valued at $1,227,410,000 after buying an additional 1,506,024 shares in the last quarter. Invesco Ltd. boosted its position in Ferguson by 25.9% in the fourth quarter. Invesco Ltd. now owns 5,991,445 shares of the company's stock valued at $1,039,935,000 after buying an additional 1,231,120 shares in the last quarter. Finally, Vontobel Holding Ltd. boosted its position in Ferguson by 94.6% in the first quarter. Vontobel Holding Ltd. now owns 2,402,527 shares of the company's stock valued at $384,957,000 after buying an additional 1,167,751 shares in the last quarter. 81.98% of the stock is owned by institutional investors.

Ferguson Price Performance

Shares of NASDAQ:FERG traded down $1.48 during trading on Tuesday, reaching $223.84. The company had a trading volume of 244,015 shares, compared to its average volume of 1,749,361. The company has a fifty day moving average of $215.59 and a two-hundred day moving average of $186.74. The stock has a market capitalization of $44.14 billion, a P/E ratio of 26.86, a price-to-earnings-growth ratio of 1.69 and a beta of 1.16. Ferguson plc has a 12 month low of $146.00 and a 12 month high of $228.80. The company has a current ratio of 1.68, a quick ratio of 0.91 and a debt-to-equity ratio of 0.83.

Ferguson (NASDAQ:FERG - Get Free Report) last issued its quarterly earnings results on Tuesday, June 3rd. The company reported $2.50 EPS for the quarter, topping analysts' consensus estimates of $2.06 by $0.44. Ferguson had a net margin of 5.68% and a return on equity of 34.63%. The firm's revenue was up 4.3% compared to the same quarter last year. During the same period last year, the business posted $2.32 EPS. Equities research analysts forecast that Ferguson plc will post 9.4 earnings per share for the current year.

Ferguson Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, August 6th. Shareholders of record on Friday, June 20th will be issued a $0.83 dividend. This represents a $3.32 dividend on an annualized basis and a yield of 1.5%. The ex-dividend date of this dividend is Friday, June 20th. Ferguson's dividend payout ratio (DPR) is 41.40%.

Wall Street Analyst Weigh In

FERG has been the topic of several recent analyst reports. JPMorgan Chase & Co. boosted their target price on shares of Ferguson from $200.00 to $220.00 and gave the company an "overweight" rating in a report on Friday, June 6th. Berenberg Bank reiterated a "hold" rating and set a $215.00 price objective on shares of Ferguson in a report on Thursday, June 5th. Morgan Stanley reiterated an "overweight" rating and set a $220.00 price objective (up previously from $195.00) on shares of Ferguson in a report on Monday, June 9th. UBS Group boosted their target price on shares of Ferguson from $173.00 to $204.00 and gave the stock a "neutral" rating in a research report on Wednesday, June 4th. Finally, Wells Fargo & Company boosted their target price on shares of Ferguson from $230.00 to $250.00 and gave the stock an "overweight" rating in a research report on Tuesday, July 8th. Six investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $220.64.

Check Out Our Latest Stock Report on FERG

Ferguson Company Profile

(

Free Report)

Ferguson plc distributes plumbing and heating products in the United States and Canada. It offers plumbing and heating solutions to customers in the residential, commercial, civil/infrastructure, and industrial end markets. The company also provides expertise, solutions, and products, including infrastructure, plumbing, appliances, fire, fabrication, and others, as well as heating, ventilation, and air conditioning products under the Ferguson brand name.

See Also

Before you consider Ferguson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ferguson wasn't on the list.

While Ferguson currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.