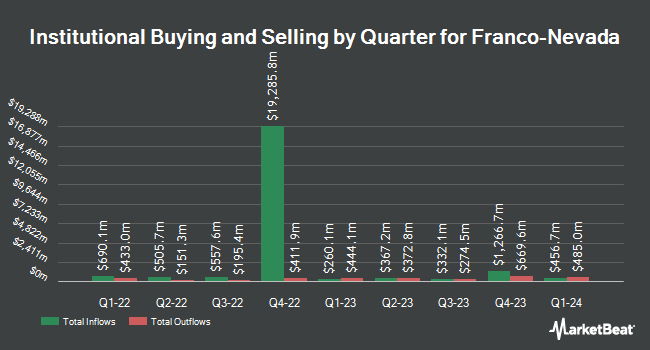

Armor Advisors L.L.C. trimmed its stake in Franco-Nevada Corporation (NYSE:FNV - Free Report) TSE: FNV by 19.0% during the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 78,770 shares of the basic materials company's stock after selling 18,472 shares during the quarter. Franco-Nevada accounts for 9.9% of Armor Advisors L.L.C.'s portfolio, making the stock its 3rd biggest holding. Armor Advisors L.L.C.'s holdings in Franco-Nevada were worth $12,411,000 as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds have also added to or reduced their stakes in the stock. Massachusetts Financial Services Co. MA raised its stake in shares of Franco-Nevada by 1.7% in the first quarter. Massachusetts Financial Services Co. MA now owns 12,207,413 shares of the basic materials company's stock worth $1,923,400,000 after purchasing an additional 207,232 shares during the last quarter. Capital World Investors raised its stake in shares of Franco-Nevada by 9.8% in the fourth quarter. Capital World Investors now owns 7,948,917 shares of the basic materials company's stock worth $934,106,000 after purchasing an additional 711,591 shares during the last quarter. Bank of Montreal Can raised its stake in shares of Franco-Nevada by 0.3% in the fourth quarter. Bank of Montreal Can now owns 5,300,880 shares of the basic materials company's stock worth $622,124,000 after purchasing an additional 15,273 shares during the last quarter. EdgePoint Investment Group Inc. raised its stake in shares of Franco-Nevada by 49.9% in the fourth quarter. EdgePoint Investment Group Inc. now owns 4,959,851 shares of the basic materials company's stock worth $582,100,000 after purchasing an additional 1,650,358 shares during the last quarter. Finally, Price T Rowe Associates Inc. MD raised its stake in shares of Franco-Nevada by 10.3% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 4,286,661 shares of the basic materials company's stock worth $504,069,000 after purchasing an additional 400,384 shares during the last quarter. 77.06% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of analysts recently commented on FNV shares. Wall Street Zen upgraded Franco-Nevada from a "hold" rating to a "buy" rating in a research report on Monday, April 7th. Scotiabank upped their price objective on Franco-Nevada from $165.00 to $169.00 and gave the company a "sector perform" rating in a research report on Monday, May 12th. Raymond James Financial set a $186.00 price objective on Franco-Nevada and gave the company an "outperform" rating in a research report on Wednesday, May 28th. Royal Bank Of Canada upped their price objective on Franco-Nevada from $160.00 to $190.00 and gave the company a "sector perform" rating in a research report on Wednesday, June 4th. Finally, National Bankshares reiterated a "sector perform" rating on shares of Franco-Nevada in a research report on Tuesday, June 24th. Six investment analysts have rated the stock with a hold rating and nine have given a buy rating to the company. According to data from MarketBeat.com, Franco-Nevada has an average rating of "Moderate Buy" and an average price target of $172.13.

Read Our Latest Stock Analysis on Franco-Nevada

Franco-Nevada Stock Performance

NYSE:FNV opened at $161.61 on Friday. The stock has a 50-day simple moving average of $164.51 and a two-hundred day simple moving average of $155.89. Franco-Nevada Corporation has a 52-week low of $112.70 and a 52-week high of $179.99. The firm has a market capitalization of $31.13 billion, a PE ratio of 50.50, a P/E/G ratio of 2.15 and a beta of 0.36.

Franco-Nevada (NYSE:FNV - Get Free Report) TSE: FNV last released its quarterly earnings results on Thursday, May 8th. The basic materials company reported $1.07 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.00 by $0.07. Franco-Nevada had a return on equity of 11.40% and a net margin of 50.39%. The business had revenue of $368.40 million during the quarter, compared to analyst estimates of $328.79 million. During the same quarter in the previous year, the company posted $0.76 earnings per share. Franco-Nevada's revenue for the quarter was up 43.5% on a year-over-year basis. Equities analysts forecast that Franco-Nevada Corporation will post 3.09 earnings per share for the current fiscal year.

Franco-Nevada Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, June 26th. Stockholders of record on Thursday, June 12th were paid a $0.38 dividend. The ex-dividend date of this dividend was Thursday, June 12th. This represents a $1.52 dividend on an annualized basis and a dividend yield of 0.9%. Franco-Nevada's dividend payout ratio is 47.50%.

About Franco-Nevada

(

Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

Recommended Stories

Want to see what other hedge funds are holding FNV? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Franco-Nevada Corporation (NYSE:FNV - Free Report) TSE: FNV.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.