Roubaix Capital LLC increased its holdings in shares of Arteris, Inc. (NASDAQ:AIP - Free Report) by 33.2% in the 1st quarter, according to its most recent filing with the SEC. The fund owned 281,450 shares of the company's stock after purchasing an additional 70,111 shares during the period. Roubaix Capital LLC owned approximately 0.68% of Arteris worth $1,945,000 at the end of the most recent reporting period.

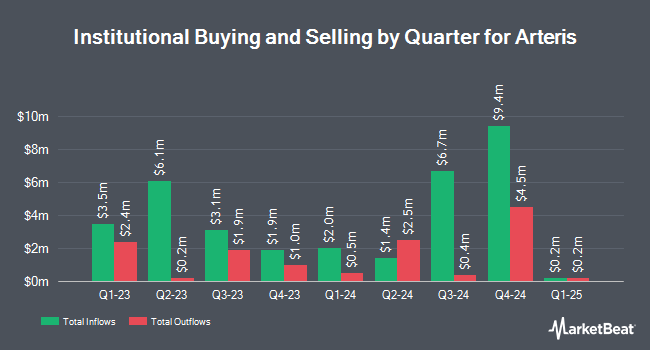

Other large investors have also made changes to their positions in the company. Quarry LP acquired a new position in Arteris in the 4th quarter valued at approximately $46,000. GAMMA Investing LLC raised its holdings in Arteris by 11,823.3% in the 1st quarter. GAMMA Investing LLC now owns 5,127 shares of the company's stock valued at $350,000 after acquiring an additional 5,084 shares in the last quarter. CWM LLC raised its holdings in Arteris by 4,810.1% in the 1st quarter. CWM LLC now owns 10,213 shares of the company's stock valued at $71,000 after acquiring an additional 10,005 shares in the last quarter. D. E. Shaw & Co. Inc. acquired a new position in Arteris in the 4th quarter valued at approximately $110,000. Finally, Price T Rowe Associates Inc. MD acquired a new position in Arteris in the 4th quarter valued at approximately $117,000. Institutional investors and hedge funds own 64.36% of the company's stock.

Analyst Ratings Changes

Several equities analysts have commented on the company. Rosenblatt Securities reaffirmed a "buy" rating and issued a $14.00 price target on shares of Arteris in a report on Wednesday, May 21st. TD Cowen upped their price target on Arteris from $12.00 to $15.00 and gave the company a "buy" rating in a report on Wednesday, August 6th. Three investment analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, Arteris currently has an average rating of "Buy" and an average price target of $15.00.

View Our Latest Analysis on AIP

Insider Activity

In other Arteris news, COO Laurent R. Moll sold 34,400 shares of the company's stock in a transaction on Tuesday, August 5th. The stock was sold at an average price of $13.57, for a total transaction of $466,808.00. Following the transaction, the chief operating officer owned 442,071 shares of the company's stock, valued at approximately $5,998,903.47. This represents a 7.22% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, major shareholder Bayview Legacy, Llc sold 50,000 shares of the company's stock in a transaction on Tuesday, August 5th. The stock was sold at an average price of $13.12, for a total value of $656,000.00. Following the transaction, the insider directly owned 9,839,071 shares in the company, valued at approximately $129,088,611.52. This represents a 0.51% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 456,043 shares of company stock worth $5,484,028. 29.10% of the stock is owned by company insiders.

Arteris Stock Performance

Shares of AIP stock traded down $0.10 during trading hours on Wednesday, hitting $8.98. The company had a trading volume of 631,034 shares, compared to its average volume of 549,705. Arteris, Inc. has a 12 month low of $5.46 and a 12 month high of $14.29. The firm has a market capitalization of $383.00 million, a price-to-earnings ratio of -10.95 and a beta of 1.45. The firm's fifty day moving average is $9.38 and its 200 day moving average is $8.27.

Arteris (NASDAQ:AIP - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported ($0.11) EPS for the quarter, hitting analysts' consensus estimates of ($0.11). The business had revenue of $16,502 billion for the quarter, compared to analyst estimates of $16.35 million. Arteris had a negative return on equity of 8,546.17% and a negative net margin of 52.41%. Arteris has set its FY 2025 guidance at EPS. Q3 2025 guidance at EPS. On average, sell-side analysts expect that Arteris, Inc. will post -0.73 EPS for the current fiscal year.

About Arteris

(

Free Report)

Arteris, Inc provides semiconductor interconnect intellectual property (IP) and System-on-Chip (Soc) Integration Automation software solutions (SIA) in the Americas, the Asia Pacific, Europe, and the Middle East. The company develops, licenses, and supports the on-chip interconnect fabric technology used in Soc designs and Network-on-Chip (NoC) interconnect IP.

See Also

Before you consider Arteris, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arteris wasn't on the list.

While Arteris currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.