ASR Vermogensbeheer N.V. acquired a new position in shares of Airbnb, Inc. (NASDAQ:ABNB - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 40,605 shares of the company's stock, valued at approximately $4,850,000.

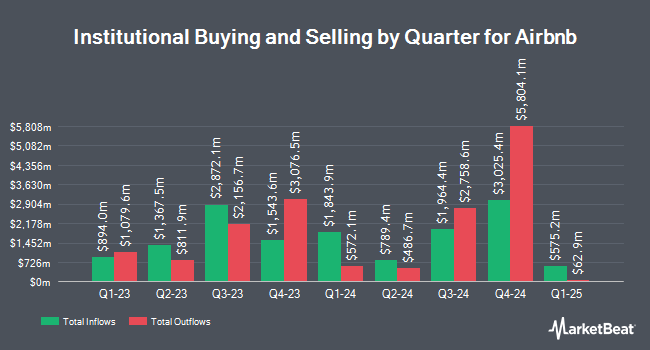

Several other institutional investors have also modified their holdings of the stock. Vanguard Group Inc. raised its position in Airbnb by 1.6% in the 1st quarter. Vanguard Group Inc. now owns 37,462,629 shares of the company's stock valued at $4,475,286,000 after purchasing an additional 604,120 shares during the last quarter. Northern Trust Corp raised its position in Airbnb by 8.4% in the 4th quarter. Northern Trust Corp now owns 4,296,835 shares of the company's stock valued at $564,647,000 after purchasing an additional 331,607 shares during the last quarter. Principal Financial Group Inc. raised its position in Airbnb by 74.4% in the 1st quarter. Principal Financial Group Inc. now owns 3,255,682 shares of the company's stock valued at $388,924,000 after purchasing an additional 1,389,251 shares during the last quarter. Two Sigma Advisers LP raised its position in Airbnb by 512.0% in the 4th quarter. Two Sigma Advisers LP now owns 3,080,300 shares of the company's stock valued at $404,782,000 after purchasing an additional 2,577,000 shares during the last quarter. Finally, Pacer Advisors Inc. raised its position in Airbnb by 2,297.4% in the 1st quarter. Pacer Advisors Inc. now owns 2,801,899 shares of the company's stock valued at $334,715,000 after purchasing an additional 2,685,026 shares during the last quarter. Hedge funds and other institutional investors own 80.76% of the company's stock.

Analyst Ratings Changes

Several analysts recently commented on ABNB shares. JPMorgan Chase & Co. upped their price target on shares of Airbnb from $120.00 to $130.00 and gave the company a "neutral" rating in a research report on Thursday. Evercore ISI reduced their price target on shares of Airbnb from $165.00 to $145.00 and set an "in-line" rating for the company in a research report on Friday, May 2nd. Canaccord Genuity Group reduced their price target on shares of Airbnb from $190.00 to $180.00 and set a "buy" rating for the company in a research report on Monday, April 28th. Royal Bank Of Canada upped their price objective on shares of Airbnb from $140.00 to $145.00 and gave the stock a "sector perform" rating in a research report on Thursday. Finally, Truist Financial restated a "sell" rating and set a $106.00 price objective (down previously from $112.00) on shares of Airbnb in a research report on Friday, May 30th. Five research analysts have rated the stock with a sell rating, sixteen have issued a hold rating, thirteen have assigned a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average target price of $143.59.

View Our Latest Analysis on Airbnb

Insider Activity

In other Airbnb news, CTO Aristotle N. Balogh sold 600 shares of the firm's stock in a transaction dated Thursday, July 24th. The shares were sold at an average price of $139.39, for a total transaction of $83,634.00. Following the sale, the chief technology officer directly owned 209,777 shares of the company's stock, valued at $29,240,816.03. This trade represents a 0.29% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Joseph Gebbia sold 236,000 shares of the firm's stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $129.71, for a total transaction of $30,611,560.00. Following the sale, the director directly owned 236,015 shares in the company, valued at $30,613,505.65. This represents a 50.00% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 1,671,023 shares of company stock valued at $223,195,427 over the last quarter. 27.91% of the stock is currently owned by company insiders.

Airbnb Trading Down 8.0%

Shares of NASDAQ ABNB opened at $120.03 on Friday. Airbnb, Inc. has a 52 week low of $99.88 and a 52 week high of $163.93. The stock has a market cap of $75.19 billion, a price-to-earnings ratio of 29.06, a PEG ratio of 2.43 and a beta of 1.13. The company's 50-day moving average price is $135.10 and its 200 day moving average price is $131.06.

Airbnb (NASDAQ:ABNB - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The company reported $1.03 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.92 by $0.11. Airbnb had a net margin of 22.67% and a return on equity of 31.71%. The company had revenue of $3.10 billion for the quarter, compared to analysts' expectations of $3.02 billion. During the same period last year, the company earned $0.86 EPS. The firm's revenue for the quarter was up 12.7% compared to the same quarter last year. As a group, research analysts expect that Airbnb, Inc. will post 4.31 earnings per share for the current year.

Airbnb Company Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.