ASR Vermogensbeheer N.V. purchased a new stake in shares of Live Nation Entertainment, Inc. (NYSE:LYV - Free Report) in the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor purchased 5,815 shares of the company's stock, valued at approximately $759,000.

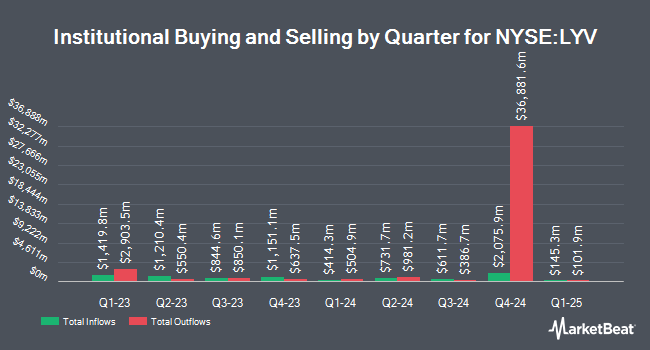

Other institutional investors have also added to or reduced their stakes in the company. Measured Risk Portfolios Inc. purchased a new stake in Live Nation Entertainment in the fourth quarter worth about $29,000. Wayfinding Financial LLC bought a new stake in shares of Live Nation Entertainment during the first quarter valued at approximately $30,000. Chilton Capital Management LLC bought a new stake in shares of Live Nation Entertainment during the first quarter valued at approximately $33,000. N.E.W. Advisory Services LLC bought a new stake in shares of Live Nation Entertainment during the first quarter valued at approximately $42,000. Finally, GW&K Investment Management LLC increased its position in shares of Live Nation Entertainment by 690.2% during the first quarter. GW&K Investment Management LLC now owns 324 shares of the company's stock valued at $42,000 after acquiring an additional 283 shares in the last quarter. 74.52% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Live Nation Entertainment news, EVP John Hopmans sold 34,808 shares of the business's stock in a transaction dated Friday, May 16th. The shares were sold at an average price of $147.38, for a total value of $5,130,003.04. Following the completion of the sale, the executive vice president directly owned 189,456 shares of the company's stock, valued at $27,922,025.28. The trade was a 15.52% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 2.72% of the stock is owned by company insiders.

Live Nation Entertainment Price Performance

NYSE LYV traded up $4.16 on Tuesday, reaching $158.63. The company had a trading volume of 1,906,911 shares, compared to its average volume of 2,129,774. The firm's 50 day moving average price is $148.16 and its 200 day moving average price is $140.25. Live Nation Entertainment, Inc. has a 12 month low of $91.52 and a 12 month high of $159.00. The company has a quick ratio of 0.88, a current ratio of 0.88 and a debt-to-equity ratio of 5.38. The stock has a market capitalization of $37.19 billion, a PE ratio of 68.67, a price-to-earnings-growth ratio of 6.97 and a beta of 1.46.

Live Nation Entertainment (NYSE:LYV - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported $0.41 earnings per share for the quarter, missing analysts' consensus estimates of $1.08 by ($0.67). The business had revenue of $7.01 billion during the quarter, compared to the consensus estimate of $6.93 billion. Live Nation Entertainment had a return on equity of 105.85% and a net margin of 3.88%. The business's quarterly revenue was up 16.3% on a year-over-year basis. During the same quarter last year, the firm earned $1.03 earnings per share. As a group, equities analysts predict that Live Nation Entertainment, Inc. will post 2.38 earnings per share for the current year.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on LYV. Benchmark raised their price target on shares of Live Nation Entertainment from $178.00 to $180.00 and gave the company a "buy" rating in a research report on Friday. Oppenheimer raised their target price on shares of Live Nation Entertainment from $165.00 to $180.00 and gave the stock an "outperform" rating in a report on Tuesday. Morgan Stanley set a $180.00 target price on shares of Live Nation Entertainment in a report on Thursday, July 24th. Roth Mkm dropped their target price on shares of Live Nation Entertainment from $174.00 to $164.00 and set a "buy" rating on the stock in a report on Friday, May 2nd. Finally, Wolfe Research lifted their price target on shares of Live Nation Entertainment from $160.00 to $168.00 and gave the stock an "outperform" rating in a research note on Tuesday, June 10th. One equities research analyst has rated the stock with a hold rating and seventeen have given a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $167.41.

Read Our Latest Report on Live Nation Entertainment

Live Nation Entertainment Profile

(

Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

Further Reading

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.