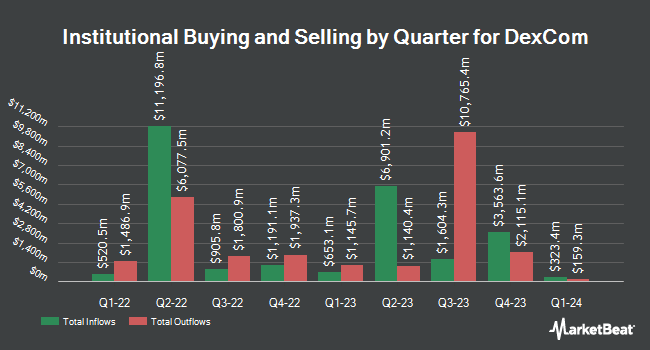

Assenagon Asset Management S.A. lifted its stake in shares of DexCom, Inc. (NASDAQ:DXCM - Free Report) by 85.7% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 1,208,255 shares of the medical device company's stock after buying an additional 557,576 shares during the quarter. Assenagon Asset Management S.A. owned about 0.31% of DexCom worth $105,469,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Golden State Wealth Management LLC grew its stake in DexCom by 211.2% in the 1st quarter. Golden State Wealth Management LLC now owns 389 shares of the medical device company's stock valued at $27,000 after acquiring an additional 264 shares during the last quarter. Zions Bancorporation National Association UT acquired a new stake in shares of DexCom during the first quarter worth approximately $27,000. Anderson Financial Strategies LLC acquired a new position in DexCom in the first quarter worth $37,000. Heck Capital Advisors LLC acquired a new position in shares of DexCom during the fourth quarter valued at $38,000. Finally, Alpine Bank Wealth Management bought a new stake in shares of DexCom during the first quarter valued at about $40,000. Hedge funds and other institutional investors own 97.75% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have weighed in on DXCM. Barclays lifted their target price on DexCom from $93.00 to $98.00 and gave the company an "equal weight" rating in a research note on Wednesday, July 30th. Wall Street Zen cut DexCom from a "strong-buy" rating to a "buy" rating in a research report on Sunday, August 10th. Raymond James Financial upped their price target on DexCom from $99.00 to $102.00 and gave the company a "strong-buy" rating in a research note on Thursday, July 31st. William Blair raised DexCom to a "strong-buy" rating in a research report on Thursday, July 31st. Finally, Argus started coverage on DexCom in a research note on Thursday, August 21st. They issued a "buy" rating and a $100.00 price target for the company. Three investment analysts have rated the stock with a Strong Buy rating, fourteen have issued a Buy rating and five have issued a Hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $99.89.

Read Our Latest Report on DXCM

Insider Activity at DexCom

In other news, Director Mark G. Foletta sold 2,750 shares of the firm's stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $81.06, for a total transaction of $222,915.00. Following the transaction, the director directly owned 51,121 shares of the company's stock, valued at approximately $4,143,868.26. This trade represents a 5.10% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, EVP Sadie Stern sold 1,466 shares of the firm's stock in a transaction that occurred on Thursday, September 4th. The shares were sold at an average price of $80.00, for a total transaction of $117,280.00. Following the completion of the sale, the executive vice president owned 105,223 shares of the company's stock, valued at approximately $8,417,840. This trade represents a 1.37% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 8,315 shares of company stock valued at $689,431 in the last quarter. 0.32% of the stock is currently owned by corporate insiders.

DexCom Stock Performance

Shares of DXCM traded down $0.47 on Tuesday, reaching $69.04. 2,262,419 shares of the company's stock traded hands, compared to its average volume of 4,111,305. The stock's 50 day simple moving average is $79.59 and its two-hundred day simple moving average is $78.19. DexCom, Inc. has a 52-week low of $57.52 and a 52-week high of $93.25. The stock has a market cap of $27.07 billion, a PE ratio of 48.01, a PEG ratio of 1.41 and a beta of 1.48. The company has a current ratio of 1.52, a quick ratio of 1.35 and a debt-to-equity ratio of 0.48.

DexCom (NASDAQ:DXCM - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The medical device company reported $0.48 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.45 by $0.03. DexCom had a return on equity of 30.41% and a net margin of 13.29%.The company had revenue of $1.16 billion during the quarter, compared to analyst estimates of $1.13 billion. During the same quarter last year, the company earned $0.43 earnings per share. The firm's quarterly revenue was up 15.2% on a year-over-year basis. DexCom has set its FY 2025 guidance at EPS. On average, analysts forecast that DexCom, Inc. will post 2.03 earnings per share for the current fiscal year.

DexCom Profile

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Read More

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.