Mitsubishi UFJ Asset Management Co. Ltd. raised its holdings in shares of Astera Labs, Inc. (NASDAQ:ALAB - Free Report) by 11.5% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 56,300 shares of the company's stock after purchasing an additional 5,800 shares during the period. Mitsubishi UFJ Asset Management Co. Ltd.'s holdings in Astera Labs were worth $3,359,000 at the end of the most recent quarter.

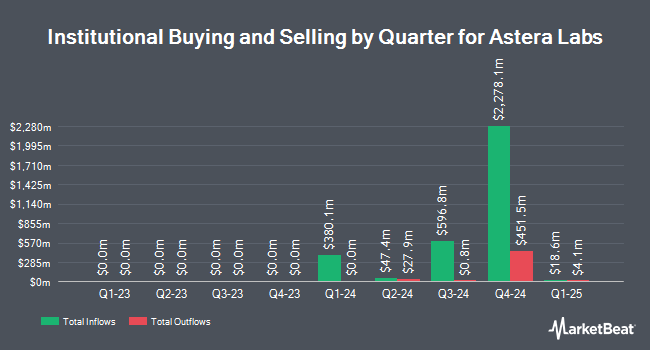

Other large investors have also made changes to their positions in the company. NewEdge Advisors LLC acquired a new position in shares of Astera Labs during the fourth quarter worth $63,000. Banque Transatlantique SA acquired a new position in shares of Astera Labs during the fourth quarter worth $86,000. Emerald Mutual Fund Advisers Trust increased its position in shares of Astera Labs by 429.3% during the fourth quarter. Emerald Mutual Fund Advisers Trust now owns 704 shares of the company's stock worth $93,000 after purchasing an additional 571 shares in the last quarter. Gen Wealth Partners Inc acquired a new position in shares of Astera Labs during the fourth quarter worth $105,000. Finally, Sound Income Strategies LLC increased its position in shares of Astera Labs by 34.7% during the first quarter. Sound Income Strategies LLC now owns 792 shares of the company's stock worth $47,000 after purchasing an additional 204 shares in the last quarter. 60.47% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

A number of equities analysts have recently issued reports on ALAB shares. Jefferies Financial Group upped their price target on Astera Labs from $95.00 to $130.00 and gave the stock a "buy" rating in a research report on Tuesday, July 22nd. Northland Capmk lowered shares of Astera Labs from a "strong-buy" rating to a "hold" rating in a report on Tuesday, July 22nd. Northland Securities lowered shares of Astera Labs from an "outperform" rating to a "market perform" rating and set a $120.00 price objective on the stock. in a report on Tuesday, July 22nd. Wall Street Zen lowered shares of Astera Labs from a "buy" rating to a "hold" rating in a report on Saturday, July 12th. Finally, Roth Capital set a $100.00 price objective on shares of Astera Labs and gave the company a "buy" rating in a report on Wednesday, May 7th. Four investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $129.13.

View Our Latest Stock Analysis on Astera Labs

Insider Buying and Selling

In other Astera Labs news, COO Sanjay Gajendra sold 280,000 shares of the company's stock in a transaction dated Thursday, August 7th. The shares were sold at an average price of $170.02, for a total value of $47,605,600.00. Following the completion of the transaction, the chief operating officer owned 5,525,545 shares in the company, valued at approximately $939,453,160.90. This represents a 4.82% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Manuel Alba sold 13,259 shares of the company's stock in a transaction dated Monday, July 21st. The stock was sold at an average price of $111.00, for a total transaction of $1,471,749.00. Following the completion of the transaction, the director owned 1,874,498 shares of the company's stock, valued at approximately $208,069,278. This trade represents a 0.70% decrease in their position. The disclosure for this sale can be found here. Insiders sold 2,425,276 shares of company stock valued at $272,127,521 in the last 90 days. 12.50% of the stock is currently owned by insiders.

Astera Labs Stock Performance

NASDAQ:ALAB opened at $192.00 on Wednesday. Astera Labs, Inc. has a one year low of $36.85 and a one year high of $193.77. The firm has a market cap of $31.91 billion, a price-to-earnings ratio of 342.86, a PEG ratio of 7.64 and a beta of 1.39. The firm's fifty day moving average is $109.62 and its two-hundred day moving average is $88.04.

Astera Labs (NASDAQ:ALAB - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The company reported $0.44 EPS for the quarter, beating the consensus estimate of $0.33 by $0.11. Astera Labs had a net margin of 16.54% and a return on equity of 9.53%. The company had revenue of $191.93 million for the quarter, compared to analyst estimates of $172.46 million. During the same period in the prior year, the company earned $0.13 earnings per share. The firm's revenue was up 149.5% on a year-over-year basis. As a group, equities research analysts predict that Astera Labs, Inc. will post 0.34 earnings per share for the current fiscal year.

Astera Labs Company Profile

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.