Federated Hermes Inc. lifted its stake in shares of Astronics Corporation (NASDAQ:ATRO - Free Report) by 56.2% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 55,980 shares of the aerospace company's stock after buying an additional 20,136 shares during the quarter. Federated Hermes Inc. owned approximately 0.16% of Astronics worth $1,353,000 as of its most recent filing with the Securities and Exchange Commission.

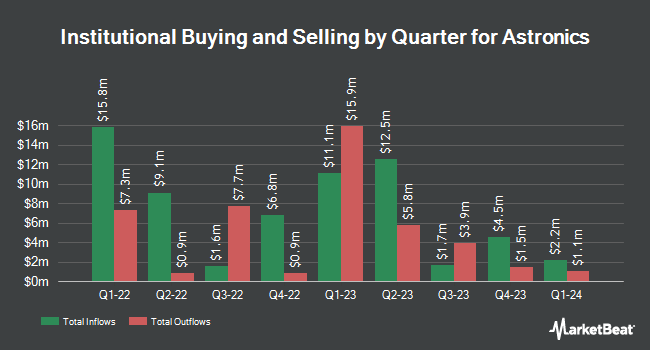

A number of other hedge funds have also made changes to their positions in the stock. Millennium Management LLC lifted its stake in Astronics by 881.6% in the fourth quarter. Millennium Management LLC now owns 414,823 shares of the aerospace company's stock valued at $6,621,000 after buying an additional 372,565 shares during the last quarter. Schonfeld Strategic Advisors LLC lifted its stake in Astronics by 58.7% in the fourth quarter. Schonfeld Strategic Advisors LLC now owns 881,504 shares of the aerospace company's stock valued at $14,069,000 after buying an additional 325,904 shares during the last quarter. Ameriprise Financial Inc. lifted its stake in Astronics by 493.7% in the fourth quarter. Ameriprise Financial Inc. now owns 363,286 shares of the aerospace company's stock valued at $5,798,000 after buying an additional 302,092 shares during the last quarter. Envestnet Asset Management Inc. bought a new stake in Astronics in the first quarter valued at $5,521,000. Finally, Renaissance Technologies LLC lifted its stake in Astronics by 139.3% in the fourth quarter. Renaissance Technologies LLC now owns 286,700 shares of the aerospace company's stock valued at $4,576,000 after buying an additional 166,900 shares during the last quarter. Institutional investors and hedge funds own 56.68% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on ATRO shares. Truist Financial upgraded shares of Astronics from a "hold" rating to a "buy" rating and set a $49.00 price objective on the stock in a research note on Friday, July 11th. Wall Street Zen lowered Astronics from a "strong-buy" rating to a "hold" rating in a research report on Saturday.

Get Our Latest Stock Report on Astronics

Astronics Stock Performance

NASDAQ ATRO traded up $0.50 during trading on Friday, hitting $30.51. The company's stock had a trading volume of 970,531 shares, compared to its average volume of 626,400. The firm has a market cap of $1.08 billion, a P/E ratio of -254.23 and a beta of 1.64. The company has a quick ratio of 1.49, a current ratio of 2.74 and a debt-to-equity ratio of 0.60. Astronics Corporation has a 52 week low of $14.13 and a 52 week high of $37.31. The firm has a 50 day moving average price of $33.74 and a 200 day moving average price of $26.88.

Astronics (NASDAQ:ATRO - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The aerospace company reported $0.38 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.05. The firm had revenue of $204.68 million for the quarter, compared to analysts' expectations of $208.29 million. Astronics had a positive return on equity of 23.21% and a negative net margin of 0.45%. Equities research analysts forecast that Astronics Corporation will post 0.82 earnings per share for the current fiscal year.

Astronics Profile

(

Free Report)

Astronics Corporation, through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally. The company operates in two segments, Aerospace and Test Systems. The Aerospace segment offers lighting and safety systems, electrical power generation systems, distribution and seat motions systems, aircraft structures, avionics products, system certification, and other products.

Further Reading

Before you consider Astronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astronics wasn't on the list.

While Astronics currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.