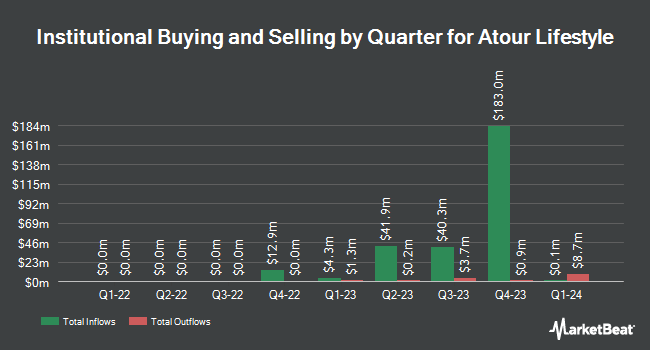

First Beijing Investment Ltd cut its holdings in Atour Lifestyle Holdings Limited Sponsored ADR (NASDAQ:ATAT - Free Report) by 7.3% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 5,036,355 shares of the company's stock after selling 395,551 shares during the period. Atour Lifestyle makes up approximately 9.8% of First Beijing Investment Ltd's portfolio, making the stock its 4th biggest position. First Beijing Investment Ltd owned approximately 3.66% of Atour Lifestyle worth $142,781,000 at the end of the most recent quarter.

Several other hedge funds have also recently made changes to their positions in the business. Woodline Partners LP raised its position in shares of Atour Lifestyle by 48.6% in the 1st quarter. Woodline Partners LP now owns 239,547 shares of the company's stock worth $6,791,000 after acquiring an additional 78,303 shares in the last quarter. Caxton Associates LLP bought a new position in shares of Atour Lifestyle in the 1st quarter worth about $658,000. Goldman Sachs Group Inc. raised its position in shares of Atour Lifestyle by 1.0% in the 1st quarter. Goldman Sachs Group Inc. now owns 1,437,014 shares of the company's stock worth $40,739,000 after acquiring an additional 14,453 shares in the last quarter. Think Investments LP grew its stake in shares of Atour Lifestyle by 264.1% in the 1st quarter. Think Investments LP now owns 695,487 shares of the company's stock valued at $19,717,000 after buying an additional 504,487 shares during the period. Finally, Millennium Management LLC grew its stake in shares of Atour Lifestyle by 4.4% in the 1st quarter. Millennium Management LLC now owns 921,837 shares of the company's stock valued at $26,134,000 after buying an additional 38,565 shares during the period. 17.79% of the stock is owned by institutional investors.

Atour Lifestyle Stock Down 0.8%

Shares of NASDAQ:ATAT traded down $0.32 during midday trading on Friday, hitting $39.67. 686,264 shares of the stock traded hands, compared to its average volume of 1,440,916. Atour Lifestyle Holdings Limited Sponsored ADR has a one year low of $19.54 and a one year high of $40.37. The stock has a market capitalization of $5.48 billion, a PE ratio of 28.75, a P/E/G ratio of 1.34 and a beta of 0.83. The business's 50 day moving average is $36.22 and its two-hundred day moving average is $31.45.

Atour Lifestyle (NASDAQ:ATAT - Get Free Report) last released its quarterly earnings results on Tuesday, August 26th. The company reported $0.42 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.41 by $0.01. The company had revenue of $344.49 million during the quarter, compared to the consensus estimate of $326.00 million. Atour Lifestyle had a net margin of 16.52% and a return on equity of 45.66%. Atour Lifestyle has set its FY 2025 guidance at EPS. As a group, sell-side analysts forecast that Atour Lifestyle Holdings Limited Sponsored ADR will post 1.24 earnings per share for the current year.

Atour Lifestyle announced that its board has approved a share buyback plan on Thursday, May 22nd that permits the company to buyback $0.00 in outstanding shares. This buyback authorization permits the company to reacquire shares of its stock through open market purchases. Stock buyback plans are typically an indication that the company's leadership believes its stock is undervalued.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on ATAT shares. Citigroup reiterated a "buy" rating and set a $38.00 price target (up previously from $36.50) on shares of Atour Lifestyle in a research note on Friday, May 23rd. Wall Street Zen raised shares of Atour Lifestyle from a "hold" rating to a "buy" rating in a report on Friday, September 5th. Four analysts have rated the stock with a Buy rating, According to data from MarketBeat, the stock presently has an average rating of "Buy" and a consensus target price of $36.63.

Check Out Our Latest Research Report on ATAT

Atour Lifestyle Profile

(

Free Report)

Atour Lifestyle Holdings Limited, through its subsidiaries, develops lifestyle brands around hotel offerings in the People's Republic of China. The company provides hotel management services, including day-to-day management services of the hotels for the franchisees; and sells hotel supplies and other products.

Featured Articles

Before you consider Atour Lifestyle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atour Lifestyle wasn't on the list.

While Atour Lifestyle currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.