Atria Wealth Solutions Inc. cut its stake in Texas Instruments Incorporated (NASDAQ:TXN - Free Report) by 34.3% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 17,800 shares of the semiconductor company's stock after selling 9,280 shares during the quarter. Atria Wealth Solutions Inc.'s holdings in Texas Instruments were worth $3,199,000 at the end of the most recent reporting period.

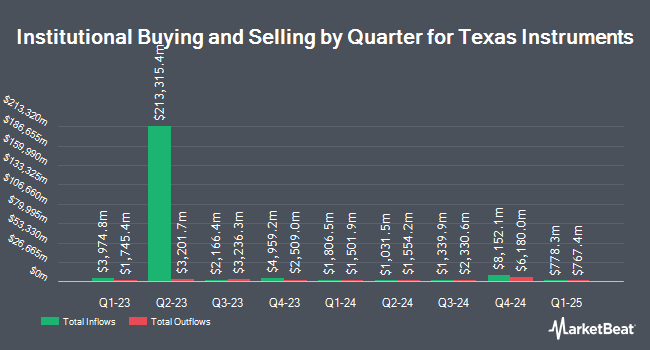

A number of other hedge funds and other institutional investors have also recently bought and sold shares of TXN. Kestra Private Wealth Services LLC lifted its stake in Texas Instruments by 10.9% in the 1st quarter. Kestra Private Wealth Services LLC now owns 63,786 shares of the semiconductor company's stock worth $11,462,000 after purchasing an additional 6,267 shares in the last quarter. Gries Financial LLC purchased a new position in Texas Instruments in the 1st quarter worth approximately $243,000. Brighton Jones LLC lifted its stake in Texas Instruments by 33.4% in the 4th quarter. Brighton Jones LLC now owns 16,840 shares of the semiconductor company's stock worth $3,158,000 after purchasing an additional 4,218 shares in the last quarter. JARISLOWSKY FRASER Ltd lifted its stake in Texas Instruments by 7.4% in the 4th quarter. JARISLOWSKY FRASER Ltd now owns 2,390 shares of the semiconductor company's stock worth $448,000 after purchasing an additional 165 shares in the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its stake in Texas Instruments by 2.3% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 495,548 shares of the semiconductor company's stock worth $89,050,000 after purchasing an additional 11,057 shares in the last quarter. 84.99% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

TXN has been the topic of a number of research reports. Cantor Fitzgerald reissued a "neutral" rating on shares of Texas Instruments in a research note on Tuesday, July 22nd. Summit Insights lowered shares of Texas Instruments from a "buy" rating to a "hold" rating in a research note on Thursday, April 24th. DZ Bank reissued a "sell" rating and issued a $158.00 target price on shares of Texas Instruments in a research note on Wednesday, July 23rd. UBS Group set a $255.00 price target on shares of Texas Instruments in a report on Tuesday, July 22nd. Finally, Benchmark raised their price target on shares of Texas Instruments from $200.00 to $220.00 and gave the stock a "buy" rating in a report on Wednesday, July 23rd. Four analysts have rated the stock with a sell rating, thirteen have issued a hold rating, twelve have assigned a buy rating and two have issued a strong buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $212.21.

Check Out Our Latest Stock Report on TXN

Texas Instruments Stock Performance

NASDAQ:TXN opened at $185.91 on Friday. The company has a fifty day simple moving average of $200.78 and a two-hundred day simple moving average of $185.13. The company has a market cap of $169.02 billion, a price-to-earnings ratio of 34.05, a price-to-earnings-growth ratio of 3.03 and a beta of 1.03. The company has a quick ratio of 3.88, a current ratio of 5.81 and a debt-to-equity ratio of 0.86. Texas Instruments Incorporated has a 52 week low of $139.95 and a 52 week high of $221.69.

Texas Instruments (NASDAQ:TXN - Get Free Report) last posted its quarterly earnings results on Tuesday, July 22nd. The semiconductor company reported $1.41 EPS for the quarter, topping the consensus estimate of $1.32 by $0.09. The business had revenue of $4.45 billion during the quarter, compared to the consensus estimate of $4.31 billion. Texas Instruments had a net margin of 30.23% and a return on equity of 30.10%. The company's quarterly revenue was up 16.4% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $1.17 earnings per share. As a group, equities analysts anticipate that Texas Instruments Incorporated will post 5.35 earnings per share for the current fiscal year.

Texas Instruments Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, August 12th. Shareholders of record on Thursday, July 31st will be paid a $1.36 dividend. The ex-dividend date is Thursday, July 31st. This represents a $5.44 annualized dividend and a dividend yield of 2.9%. Texas Instruments's payout ratio is 99.63%.

Texas Instruments Profile

(

Free Report)

Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products.

See Also

Want to see what other hedge funds are holding TXN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Texas Instruments Incorporated (NASDAQ:TXN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Texas Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Instruments wasn't on the list.

While Texas Instruments currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.