Atria Wealth Solutions Inc. cut its holdings in Bristol Myers Squibb Company (NYSE:BMY - Free Report) by 15.1% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 161,837 shares of the biopharmaceutical company's stock after selling 28,841 shares during the period. Atria Wealth Solutions Inc.'s holdings in Bristol Myers Squibb were worth $9,870,000 at the end of the most recent reporting period.

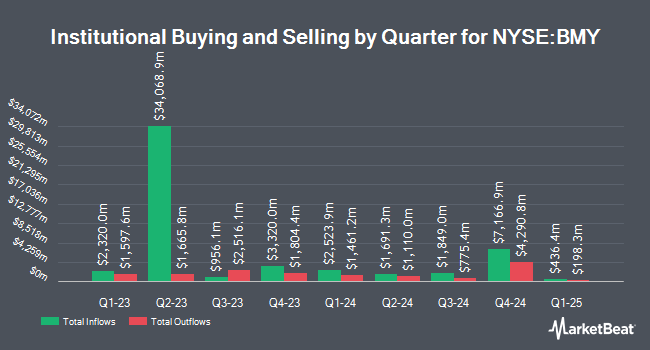

A number of other large investors have also recently made changes to their positions in the business. Capital International Investors grew its holdings in Bristol Myers Squibb by 7.5% during the 4th quarter. Capital International Investors now owns 45,866,624 shares of the biopharmaceutical company's stock valued at $2,593,940,000 after purchasing an additional 3,218,865 shares during the last quarter. Ameriprise Financial Inc. grew its holdings in Bristol Myers Squibb by 59.9% during the 4th quarter. Ameriprise Financial Inc. now owns 32,079,246 shares of the biopharmaceutical company's stock valued at $1,814,341,000 after purchasing an additional 12,011,983 shares during the last quarter. Bank of New York Mellon Corp grew its holdings in Bristol Myers Squibb by 8.6% during the 1st quarter. Bank of New York Mellon Corp now owns 26,865,073 shares of the biopharmaceutical company's stock valued at $1,638,501,000 after purchasing an additional 2,131,205 shares during the last quarter. Northern Trust Corp grew its holdings in Bristol Myers Squibb by 16.2% during the 4th quarter. Northern Trust Corp now owns 24,658,360 shares of the biopharmaceutical company's stock valued at $1,394,677,000 after purchasing an additional 3,431,248 shares during the last quarter. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in Bristol Myers Squibb by 16.8% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 22,271,742 shares of the biopharmaceutical company's stock valued at $1,259,690,000 after purchasing an additional 3,196,919 shares during the last quarter. 76.41% of the stock is currently owned by institutional investors.

Bristol Myers Squibb Stock Up 1.1%

NYSE:BMY traded up $0.50 during midday trading on Thursday, reaching $45.32. 11,839,864 shares of the stock traded hands, compared to its average volume of 13,897,906. Bristol Myers Squibb Company has a 12-month low of $42.96 and a 12-month high of $63.33. The business has a 50-day moving average of $47.36 and a two-hundred day moving average of $51.98. The company has a debt-to-equity ratio of 2.54, a quick ratio of 1.11 and a current ratio of 1.21. The stock has a market capitalization of $92.24 billion, a PE ratio of 18.27, a price-to-earnings-growth ratio of 2.29 and a beta of 0.36.

Bristol Myers Squibb (NYSE:BMY - Get Free Report) last posted its earnings results on Thursday, July 31st. The biopharmaceutical company reported $1.46 EPS for the quarter, beating analysts' consensus estimates of $1.07 by $0.39. Bristol Myers Squibb had a net margin of 10.58% and a return on equity of 80.04%. The company had revenue of $12.27 billion during the quarter, compared to analysts' expectations of $11.32 billion. During the same quarter in the prior year, the company posted $2.07 earnings per share. Bristol Myers Squibb's revenue for the quarter was up .6% compared to the same quarter last year. On average, equities analysts forecast that Bristol Myers Squibb Company will post 6.74 earnings per share for the current fiscal year.

Bristol Myers Squibb Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, August 1st. Shareholders of record on Thursday, July 3rd were paid a dividend of $0.62 per share. The ex-dividend date was Thursday, July 3rd. This represents a $2.48 dividend on an annualized basis and a yield of 5.5%. Bristol Myers Squibb's dividend payout ratio is presently 100.00%.

Analyst Upgrades and Downgrades

Several research firms have issued reports on BMY. Morgan Stanley reissued a "hold" rating on shares of Bristol Myers Squibb in a research report on Thursday, July 31st. Jefferies Financial Group lowered their price objective on shares of Bristol Myers Squibb from $70.00 to $68.00 and set a "buy" rating for the company in a research report on Wednesday, April 23rd. UBS Group lowered their price objective on shares of Bristol Myers Squibb from $60.00 to $54.00 and set a "neutral" rating for the company in a research report on Friday, April 11th. Daiwa Capital Markets cut shares of Bristol Myers Squibb from an "outperform" rating to a "neutral" rating and set a $42.00 price objective for the company. in a research report on Tuesday. Finally, William Blair reissued a "market perform" rating on shares of Bristol Myers Squibb in a research report on Friday, April 25th. One analyst has rated the stock with a sell rating, fifteen have given a hold rating, five have assigned a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $56.38.

View Our Latest Research Report on Bristol Myers Squibb

Bristol Myers Squibb Company Profile

(

Free Report)

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers products for hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience diseases. The company's products include Eliquis for reduction in risk of stroke/systemic embolism in non-valvular atrial fibrillation, and for the treatment of DVT/PE; Opdivo for various anti-cancer indications, including bladder, blood, CRC, head and neck, RCC, HCC, lung, melanoma, MPM, stomach and esophageal cancer; Pomalyst/Imnovid for multiple myeloma; Orencia for active rheumatoid arthritis and psoriatic arthritis; and Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia.

Further Reading

Before you consider Bristol Myers Squibb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bristol Myers Squibb wasn't on the list.

While Bristol Myers Squibb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report