Aurelius Capital Management LP bought a new stake in shares of IREN Limited (NASDAQ:IREN - Free Report) in the first quarter, according to its most recent Form 13F filing with the SEC. The fund bought 51,124 shares of the company's stock, valued at approximately $311,000. IREN accounts for 3.3% of Aurelius Capital Management LP's investment portfolio, making the stock its 5th largest position.

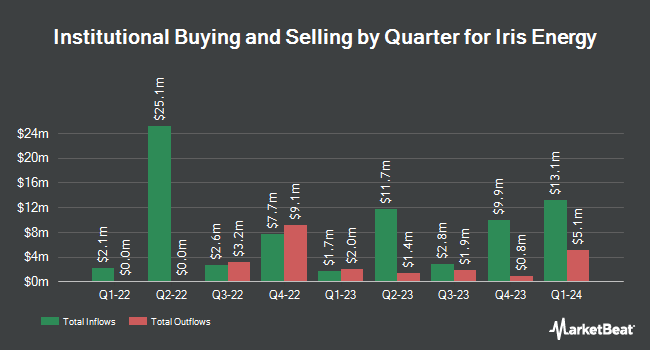

A number of other hedge funds and other institutional investors have also recently bought and sold shares of the company. Wellington Management Group LLP raised its holdings in shares of IREN by 11.7% in the 1st quarter. Wellington Management Group LLP now owns 13,212 shares of the company's stock worth $80,000 after purchasing an additional 1,387 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. increased its stake in IREN by 11.2% in the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 20,268 shares of the company's stock valued at $123,000 after buying an additional 2,035 shares during the period. TRU Independence Asset Management 2 LLC increased its stake in IREN by 22.1% in the 1st quarter. TRU Independence Asset Management 2 LLC now owns 20,241 shares of the company's stock valued at $123,000 after buying an additional 3,670 shares during the period. Apollon Wealth Management LLC increased its stake in IREN by 28.9% in the 1st quarter. Apollon Wealth Management LLC now owns 20,471 shares of the company's stock valued at $125,000 after buying an additional 4,587 shares during the period. Finally, Main Management LLC acquired a new position in IREN in the 4th quarter valued at approximately $49,000. 41.08% of the stock is owned by institutional investors and hedge funds.

IREN Stock Performance

NASDAQ:IREN traded up $1.13 on Thursday, reaching $23.49. 17,573,029 shares of the stock traded hands, compared to its average volume of 18,984,146. The company's 50 day moving average is $17.06 and its 200-day moving average is $11.14. IREN Limited has a 1-year low of $5.13 and a 1-year high of $24.29.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. B. Riley restated a "buy" rating and issued a $22.00 price objective (up from $15.00) on shares of IREN in a research note on Thursday, July 10th. Macquarie increased their target price on shares of IREN from $15.50 to $20.00 and gave the stock an "outperform" rating in a research report on Thursday, May 15th. HC Wainwright decreased their price objective on shares of IREN from $22.00 to $21.00 and set a "buy" rating on the stock in a report on Thursday, May 15th. JPMorgan Chase & Co. reissued a "neutral" rating and set a $16.00 price objective (up previously from $12.00) on shares of IREN in a report on Monday, July 28th. Finally, Canaccord Genuity Group reissued a "buy" rating and set a $23.00 price objective on shares of IREN in a report on Friday, May 16th. One equities research analyst has rated the stock with a Strong Buy rating, eight have assigned a Buy rating and two have issued a Hold rating to the company. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $20.89.

Read Our Latest Report on IREN

About IREN

(

Free Report)

IREN Limited, formerly known as Iris Energy Limited, owns and operates bitcoin mining data centers. The company was incorporated in 2018 and is headquartered in Sydney, Australia.

Further Reading

Before you consider IREN, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IREN wasn't on the list.

While IREN currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.