Durable Capital Partners LP lifted its holdings in shares of Aurora Innovation, Inc. (NASDAQ:AUR - Free Report) by 17.0% during the 1st quarter, according to its most recent disclosure with the SEC. The fund owned 14,922,269 shares of the company's stock after purchasing an additional 2,165,114 shares during the period. Durable Capital Partners LP owned 0.86% of Aurora Innovation worth $100,352,000 at the end of the most recent reporting period.

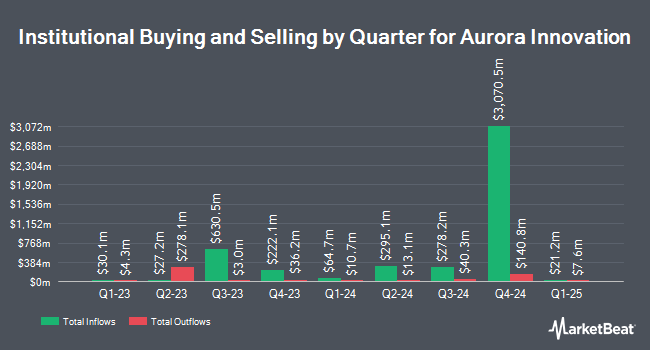

Other large investors also recently made changes to their positions in the company. Toyota Motor Corp bought a new stake in shares of Aurora Innovation during the fourth quarter worth $298,294,000. Cornerstone Wealth Management LLC grew its holdings in shares of Aurora Innovation by 153.3% during the first quarter. Cornerstone Wealth Management LLC now owns 185,457 shares of the company's stock worth $1,247,000 after purchasing an additional 112,237 shares during the last quarter. Lightspeed Management Company L.L.C. bought a new stake in shares of Aurora Innovation during the fourth quarter worth $74,003,000. Teacher Retirement System of Texas bought a new stake in shares of Aurora Innovation during the first quarter worth $929,000. Finally, Oppenheimer & Co. Inc. bought a new stake in shares of Aurora Innovation during the first quarter worth $349,000. Institutional investors own 44.71% of the company's stock.

Insiders Place Their Bets

In related news, Director John J. Donahoe bought 162,337 shares of the business's stock in a transaction on Wednesday, August 6th. The shares were purchased at an average price of $6.10 per share, with a total value of $990,255.70. Following the completion of the purchase, the director owned 162,337 shares of the company's stock, valued at $990,255.70. This represents a ∞ increase in their position. The acquisition was disclosed in a legal filing with the SEC, which is available at this hyperlink. Insiders own 11.85% of the company's stock.

Aurora Innovation Trading Up 2.5%

Aurora Innovation stock traded up $0.14 during mid-day trading on Friday, hitting $5.73. The stock had a trading volume of 14,599,011 shares, compared to its average volume of 20,378,608. The stock has a 50-day simple moving average of $5.87 and a two-hundred day simple moving average of $6.30. The stock has a market capitalization of $10.57 billion, a PE ratio of -12.19 and a beta of 2.48. Aurora Innovation, Inc. has a 12 month low of $3.81 and a 12 month high of $10.77.

Aurora Innovation (NASDAQ:AUR - Get Free Report) last released its earnings results on Wednesday, July 30th. The company reported ($0.11) earnings per share for the quarter, beating the consensus estimate of ($0.12) by $0.01. The company had revenue of $1.00 million during the quarter, compared to analyst estimates of $0.50 million. Sell-side analysts expect that Aurora Innovation, Inc. will post -0.49 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

AUR has been the topic of several research analyst reports. The Goldman Sachs Group increased their target price on Aurora Innovation from $6.00 to $7.00 and gave the stock a "neutral" rating in a report on Monday, May 12th. Needham & Company LLC raised their price target on Aurora Innovation from $10.00 to $13.00 and gave the company a "buy" rating in a report on Friday, May 9th. Five equities research analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $10.75.

Check Out Our Latest Stock Analysis on Aurora Innovation

Aurora Innovation Profile

(

Free Report)

Aurora Innovation, Inc operates as a self-driving technology company in the United States. It focuses on developing Aurora Driver, a platform that brings a suite of self-driving hardware, software, and data services together to adapt and interoperate vehicles. The company was founded in 2017 and is headquartered in Pittsburgh, Pennsylvania.

Recommended Stories

Before you consider Aurora Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aurora Innovation wasn't on the list.

While Aurora Innovation currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.