Martingale Asset Management L P grew its position in Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 3.5% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 57,935 shares of the software company's stock after acquiring an additional 1,961 shares during the quarter. Martingale Asset Management L P's holdings in Autodesk were worth $15,167,000 as of its most recent filing with the Securities and Exchange Commission.

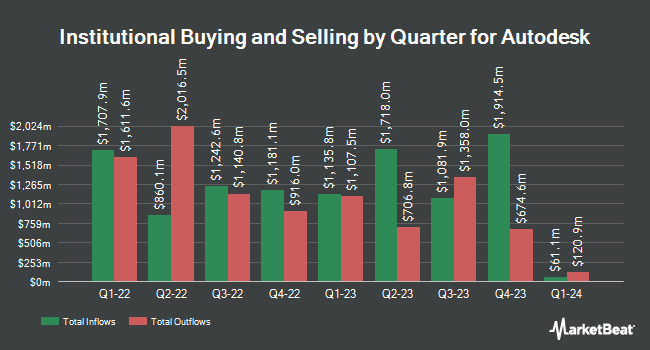

Other institutional investors have also made changes to their positions in the company. Spire Wealth Management boosted its position in Autodesk by 2.5% during the 1st quarter. Spire Wealth Management now owns 2,075 shares of the software company's stock valued at $543,000 after purchasing an additional 50 shares during the period. Sowell Financial Services LLC acquired a new position in Autodesk during the 1st quarter valued at approximately $324,000. Cambridge Investment Research Advisors Inc. boosted its position in Autodesk by 1.7% during the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 13,617 shares of the software company's stock valued at $3,565,000 after purchasing an additional 229 shares during the period. Wealth Enhancement Advisory Services LLC boosted its position in Autodesk by 27.4% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 42,826 shares of the software company's stock valued at $11,212,000 after purchasing an additional 9,222 shares during the period. Finally, GAMMA Investing LLC boosted its position in Autodesk by 5.4% during the 1st quarter. GAMMA Investing LLC now owns 5,617 shares of the software company's stock valued at $1,471,000 after purchasing an additional 290 shares during the period. 90.24% of the stock is currently owned by institutional investors.

Autodesk Price Performance

Shares of Autodesk stock traded up $4.17 during trading on Friday, hitting $290.23. The stock had a trading volume of 1,116,901 shares, compared to its average volume of 1,298,137. The company has a debt-to-equity ratio of 0.76, a current ratio of 0.65 and a quick ratio of 0.65. The firm has a market cap of $62.11 billion, a P/E ratio of 62.15, a PEG ratio of 2.79 and a beta of 1.46. The business has a fifty day moving average of $298.19 and a two-hundred day moving average of $285.08. Autodesk, Inc. has a fifty-two week low of $232.67 and a fifty-two week high of $326.62.

Analyst Ratings Changes

ADSK has been the subject of a number of analyst reports. Oppenheimer reiterated an "outperform" rating and set a $350.00 price target (up previously from $300.00) on shares of Autodesk in a research report on Friday, May 23rd. Robert W. Baird boosted their price target on Autodesk from $335.00 to $345.00 and gave the stock an "outperform" rating in a research report on Thursday. Macquarie reiterated an "outperform" rating and set a $360.00 price target on shares of Autodesk in a research report on Friday, July 11th. Morgan Stanley reiterated an "overweight" rating and set a $370.00 price target (up previously from $330.00) on shares of Autodesk in a research report on Friday, May 23rd. Finally, KeyCorp reiterated an "overweight" rating and set a $350.00 price target (up previously from $323.00) on shares of Autodesk in a research report on Friday, May 23rd. One research analyst has rated the stock with a Strong Buy rating, sixteen have issued a Buy rating and seven have assigned a Hold rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $343.04.

Read Our Latest Stock Report on ADSK

Insider Buying and Selling at Autodesk

In other news, EVP Rebecca Pearce sold 3,251 shares of the company's stock in a transaction on Thursday, July 3rd. The stock was sold at an average price of $315.00, for a total value of $1,024,065.00. Following the completion of the sale, the executive vice president owned 19,440 shares in the company, valued at $6,123,600. This represents a 14.33% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Insiders sold a total of 9,391 shares of company stock valued at $2,909,885 in the last ninety days. Corporate insiders own 0.15% of the company's stock.

Autodesk Profile

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Recommended Stories

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.