ASR Vermogensbeheer N.V. decreased its holdings in Autodesk, Inc. (NASDAQ:ADSK - Free Report) by 7.2% during the 2nd quarter, according to its most recent disclosure with the SEC. The firm owned 33,144 shares of the software company's stock after selling 2,570 shares during the period. ASR Vermogensbeheer N.V.'s holdings in Autodesk were worth $10,260,000 at the end of the most recent reporting period.

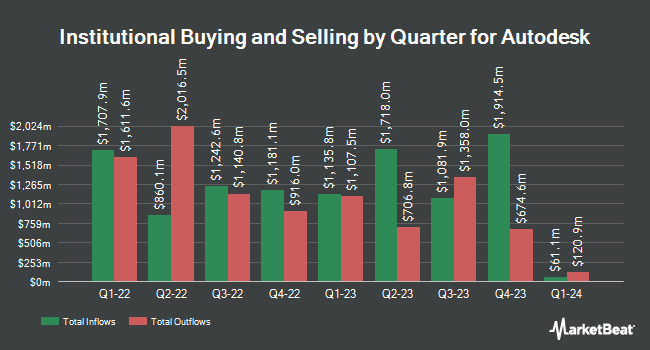

Other institutional investors also recently bought and sold shares of the company. SouthState Corp lifted its holdings in shares of Autodesk by 500.0% during the 1st quarter. SouthState Corp now owns 96 shares of the software company's stock valued at $25,000 after acquiring an additional 80 shares in the last quarter. Costello Asset Management INC acquired a new position in shares of Autodesk during the first quarter worth about $26,000. Close Asset Management Ltd purchased a new stake in shares of Autodesk in the first quarter worth about $27,000. Cheviot Value Management LLC purchased a new stake in shares of Autodesk in the first quarter worth about $27,000. Finally, Flaharty Asset Management LLC acquired a new stake in shares of Autodesk in the first quarter valued at about $27,000. 90.24% of the stock is currently owned by hedge funds and other institutional investors.

Autodesk Price Performance

Shares of ADSK opened at $320.91 on Friday. Autodesk, Inc. has a 52 week low of $232.67 and a 52 week high of $329.09. The company has a current ratio of 0.76, a quick ratio of 0.76 and a debt-to-equity ratio of 0.91. The firm has a market cap of $68.35 billion, a price-to-earnings ratio of 66.44, a PEG ratio of 2.80 and a beta of 1.49. The stock has a 50 day moving average of $307.06 and a 200-day moving average of $292.28.

Insider Buying and Selling at Autodesk

In other Autodesk news, EVP Ruth Ann Keene sold 2,761 shares of the business's stock in a transaction on Wednesday, September 3rd. The shares were sold at an average price of $315.10, for a total transaction of $869,991.10. Following the completion of the sale, the executive vice president owned 80,255 shares in the company, valued at $25,288,350.50. The trade was a 3.33% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Ayanna Howard sold 3,159 shares of the stock in a transaction on Friday, August 29th. The stock was sold at an average price of $325.00, for a total transaction of $1,026,675.00. Following the sale, the director directly owned 4,393 shares in the company, valued at $1,427,725. This trade represents a 41.83% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 35,386 shares of company stock worth $11,433,201. Company insiders own 0.15% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently commented on ADSK shares. Wall Street Zen lowered Autodesk from a "strong-buy" rating to a "buy" rating in a research report on Sunday, September 28th. Citigroup boosted their target price on shares of Autodesk from $376.00 to $393.00 and gave the stock a "buy" rating in a research report on Tuesday, September 2nd. Hsbc Global Res raised shares of Autodesk from a "hold" rating to a "strong-buy" rating in a report on Wednesday. DA Davidson reiterated a "buy" rating and issued a $375.00 price objective on shares of Autodesk in a report on Friday, August 29th. Finally, KeyCorp upped their price objective on shares of Autodesk from $350.00 to $365.00 and gave the company an "overweight" rating in a research report on Friday, August 29th. One research analyst has rated the stock with a Strong Buy rating, eighteen have issued a Buy rating and five have assigned a Hold rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $359.13.

Get Our Latest Stock Analysis on ADSK

Autodesk Profile

(

Free Report)

Autodesk, Inc provides 3D design, engineering, and entertainment technology solutions worldwide. The company offers AutoCAD Civil 3D, a surveying, design, analysis, and documentation solution for civil engineering, including land development, transportation, and environmental projects; BuildingConnected, a SaaS preconstruction solution; AutoCAD, a software for professional design, drafting, detailing, and visualization; AutoCAD LT, a drafting and detailing software; computer-aided manufacturing (CAM) software for computer numeric control machining, inspection, and modelling for manufacturing; Fusion 360, a 3D CAD, CAM, and computer-aided engineering tool; and Industry Collections tools for professionals in architecture, engineering and construction, product design and manufacturing, and media and entertainment collection industries.

Featured Stories

Want to see what other hedge funds are holding ADSK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Autodesk, Inc. (NASDAQ:ADSK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Autodesk, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Autodesk wasn't on the list.

While Autodesk currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.