Jump Financial LLC lowered its position in AvePoint, Inc. (NASDAQ:AVPT - Free Report) by 70.3% in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 66,726 shares of the company's stock after selling 157,746 shares during the quarter. Jump Financial LLC's holdings in AvePoint were worth $964,000 at the end of the most recent reporting period.

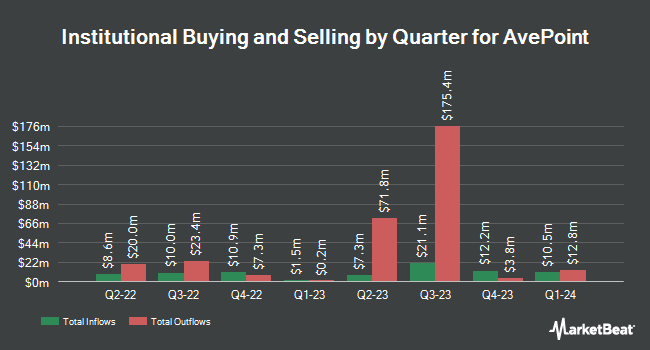

A number of other large investors have also recently added to or reduced their stakes in AVPT. Heck Capital Advisors LLC acquired a new stake in AvePoint in the fourth quarter valued at $29,000. Versant Capital Management Inc acquired a new stake in AvePoint in the first quarter valued at $31,000. Summit Securities Group LLC lifted its stake in AvePoint by 621.7% in the first quarter. Summit Securities Group LLC now owns 2,627 shares of the company's stock valued at $38,000 after acquiring an additional 2,263 shares during the last quarter. Point72 Hong Kong Ltd acquired a new stake in AvePoint in the fourth quarter valued at $40,000. Finally, KBC Group NV acquired a new stake in shares of AvePoint during the 1st quarter worth about $67,000. Institutional investors and hedge funds own 44.49% of the company's stock.

Analyst Ratings Changes

AVPT has been the subject of a number of research reports. Scotiabank raised their target price on shares of AvePoint from $19.00 to $22.00 and gave the stock a "sector outperform" rating in a research note on Friday, May 9th. B. Riley initiated coverage on shares of AvePoint in a research note on Tuesday, August 26th. They set a "buy" rating and a $25.00 target price for the company. The Goldman Sachs Group raised their target price on shares of AvePoint from $15.00 to $17.00 and gave the stock a "neutral" rating in a research note on Monday, May 12th. Cantor Fitzgerald upgraded shares of AvePoint to a "strong-buy" rating in a research note on Friday, July 25th. Finally, Jefferies Financial Group initiated coverage on shares of AvePoint in a research note on Monday, July 21st. They set a "buy" rating and a $22.00 target price for the company. One equities research analyst has rated the stock with a Strong Buy rating, four have given a Buy rating and two have assigned a Hold rating to the company. Based on data from MarketBeat.com, AvePoint currently has a consensus rating of "Moderate Buy" and an average price target of $20.80.

View Our Latest Research Report on AVPT

AvePoint Stock Performance

Shares of AvePoint stock traded down $0.12 during midday trading on Tuesday, hitting $16.24. 1,667,419 shares of the company traded hands, compared to its average volume of 1,358,814. The stock has a market cap of $3.44 billion, a price-to-earnings ratio of -324.74 and a beta of 1.40. The firm's fifty day moving average price is $17.49 and its 200-day moving average price is $16.91. AvePoint, Inc. has a 12 month low of $11.33 and a 12 month high of $20.25.

Insider Activity

In related news, insider Brian Michael Brown sold 35,000 shares of AvePoint stock in a transaction that occurred on Monday, August 25th. The shares were sold at an average price of $15.47, for a total transaction of $541,450.00. Following the sale, the insider directly owned 1,155,443 shares of the company's stock, valued at approximately $17,874,703.21. The trade was a 2.94% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Over the last 90 days, insiders have sold 105,000 shares of company stock worth $1,835,400. Insiders own 26.19% of the company's stock.

AvePoint Profile

(

Free Report)

AvePoint, Inc provides cloud-native data management software platform in North America, Europe, Middle East, Africa, and Asia Pacific. It also offers software-as-a-service solutions and productivity applications. The company offers modularity and cloud services architecture to address critical challenges and the management of data to organizations that leverage third-party cloud vendors, including Microsoft, Salesforce, Google, AWS, Box, DropBox, and others; license and support; and maintenance services.

Featured Stories

Before you consider AvePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvePoint wasn't on the list.

While AvePoint currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.