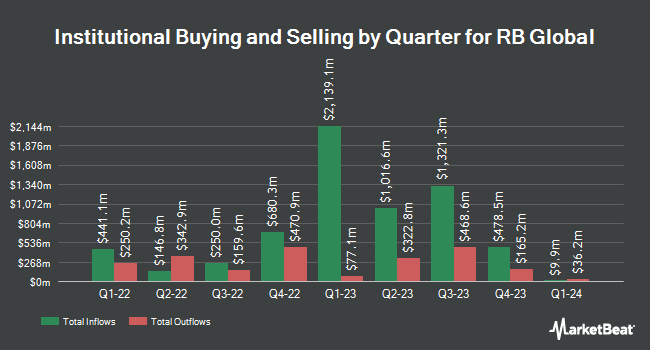

Aviso Financial Inc. boosted its holdings in RB Global, Inc. (NYSE:RBA - Free Report) TSE: RBA by 15.2% in the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 93,276 shares of the business services provider's stock after buying an additional 12,306 shares during the quarter. Aviso Financial Inc. owned 0.05% of RB Global worth $9,365,000 at the end of the most recent quarter.

A number of other hedge funds have also bought and sold shares of the business. Northwest & Ethical Investments L.P. raised its position in RB Global by 2.6% in the 1st quarter. Northwest & Ethical Investments L.P. now owns 193,376 shares of the business services provider's stock worth $19,420,000 after buying an additional 4,886 shares during the last quarter. American Century Companies Inc. grew its stake in shares of RB Global by 0.4% during the 1st quarter. American Century Companies Inc. now owns 48,264 shares of the business services provider's stock valued at $4,844,000 after purchasing an additional 185 shares during the period. Lord Abbett & CO. LLC bought a new stake in shares of RB Global during the 1st quarter valued at about $35,607,000. Russell Investments Group Ltd. grew its stake in shares of RB Global by 16.7% during the 1st quarter. Russell Investments Group Ltd. now owns 60,717 shares of the business services provider's stock valued at $6,069,000 after purchasing an additional 8,675 shares during the period. Finally, AGF Management Ltd. grew its stake in shares of RB Global by 4.0% during the 1st quarter. AGF Management Ltd. now owns 132,935 shares of the business services provider's stock valued at $13,342,000 after purchasing an additional 5,068 shares during the period. Hedge funds and other institutional investors own 95.37% of the company's stock.

RB Global Price Performance

NYSE RBA traded up $0.63 during trading hours on Friday, reaching $116.32. The company's stock had a trading volume of 484,658 shares, compared to its average volume of 1,062,590. The firm's 50-day moving average price is $109.18 and its 200-day moving average price is $103.40. The company has a quick ratio of 1.22, a current ratio of 1.28 and a debt-to-equity ratio of 0.46. RB Global, Inc. has a 1 year low of $78.08 and a 1 year high of $118.23. The company has a market capitalization of $21.58 billion, a price-to-earnings ratio of 57.58, a PEG ratio of 2.69 and a beta of 0.75.

RB Global (NYSE:RBA - Get Free Report) TSE: RBA last posted its quarterly earnings results on Wednesday, August 6th. The business services provider reported $1.07 EPS for the quarter, topping analysts' consensus estimates of $0.95 by $0.12. RB Global had a return on equity of 9.42% and a net margin of 9.46%.The company had revenue of $1.20 billion for the quarter, compared to analysts' expectations of $1.14 billion. During the same period in the previous year, the firm earned $0.94 EPS. The firm's revenue was up 8.2% compared to the same quarter last year. On average, equities research analysts predict that RB Global, Inc. will post 2.5 EPS for the current fiscal year.

RB Global Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, September 18th. Investors of record on Thursday, August 28th will be issued a $0.31 dividend. The ex-dividend date of this dividend is Thursday, August 28th. This represents a $1.24 dividend on an annualized basis and a yield of 1.1%. This is a boost from RB Global's previous quarterly dividend of $0.29. RB Global's payout ratio is presently 57.43%.

Wall Street Analyst Weigh In

RBA has been the subject of a number of recent research reports. National Bankshares boosted their price target on RB Global from $112.00 to $113.00 and gave the company a "sector perform" rating in a research note on Thursday, August 7th. Wall Street Zen upgraded RB Global from a "hold" rating to a "buy" rating in a research note on Saturday, August 9th. CIBC boosted their price objective on RB Global from $118.00 to $121.00 and gave the company an "outperformer" rating in a research note on Friday, July 18th. Raymond James Financial boosted their price objective on RB Global from $125.00 to $135.00 and gave the company an "outperform" rating in a research note on Thursday, August 7th. Finally, National Bank Financial downgraded RB Global from a "strong-buy" rating to a "hold" rating in a research note on Sunday, May 25th. Four analysts have rated the stock with a Buy rating and three have given a Hold rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $119.79.

Get Our Latest Analysis on RB Global

Insider Buying and Selling

In related news, Director Adam Dewitt sold 800 shares of the business's stock in a transaction that occurred on Tuesday, June 10th. The stock was sold at an average price of $106.17, for a total value of $84,936.00. Following the transaction, the director directly owned 5,865 shares of the company's stock, valued at approximately $622,687.05. The trade was a 12.00% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Darren Jeffrey Watt sold 7,400 shares of the business's stock in a transaction that occurred on Monday, July 14th. The stock was sold at an average price of $110.00, for a total value of $814,000.00. Following the completion of the transaction, the insider directly owned 24,874 shares in the company, valued at approximately $2,736,140. This represents a 22.93% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 57,558 shares of company stock valued at $6,314,145. Corporate insiders own 4.32% of the company's stock.

RB Global Company Profile

(

Free Report)

RB Global, Inc, an omnichannel marketplace, provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide. Its marketplace brands include Ritchie Bros., an auctioneer of commercial assets and vehicles offering online bidding; IAA, a digital marketplace connecting vehicle buyers and sellers; Rouse Services, which provides asset management, data-driven intelligence, and performance benchmarking system; SmartEquip, a technology platform that supports customers' management of the equipment lifecycle; and Veritread, an online marketplace for heavy haul transport solution.

Featured Stories

Before you consider RB Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RB Global wasn't on the list.

While RB Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report