Campbell & CO Investment Adviser LLC increased its stake in Axalta Coating Systems Ltd. (NYSE:AXTA - Free Report) by 372.7% during the first quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 43,044 shares of the specialty chemicals company's stock after acquiring an additional 33,938 shares during the quarter. Campbell & CO Investment Adviser LLC's holdings in Axalta Coating Systems were worth $1,428,000 at the end of the most recent quarter.

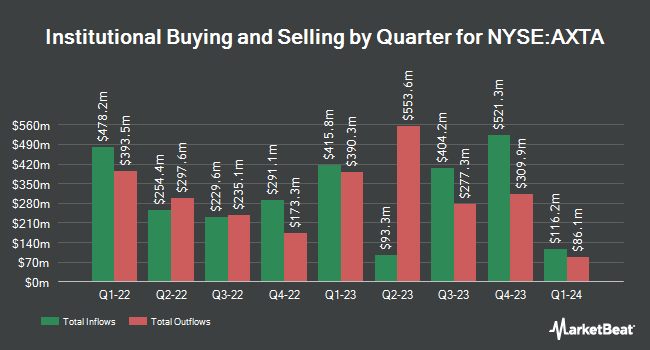

A number of other institutional investors and hedge funds also recently modified their holdings of AXTA. GAMMA Investing LLC boosted its position in shares of Axalta Coating Systems by 3,005.3% in the 1st quarter. GAMMA Investing LLC now owns 76,855 shares of the specialty chemicals company's stock valued at $2,549,000 after purchasing an additional 74,380 shares during the period. Principal Financial Group Inc. boosted its holdings in shares of Axalta Coating Systems by 0.4% in the first quarter. Principal Financial Group Inc. now owns 502,087 shares of the specialty chemicals company's stock worth $16,654,000 after buying an additional 2,099 shares during the period. DAVENPORT & Co LLC acquired a new position in shares of Axalta Coating Systems in the first quarter worth about $204,000. Allspring Global Investments Holdings LLC purchased a new position in shares of Axalta Coating Systems in the first quarter worth approximately $572,000. Finally, New York State Teachers Retirement System raised its holdings in shares of Axalta Coating Systems by 12.1% during the first quarter. New York State Teachers Retirement System now owns 77,859 shares of the specialty chemicals company's stock valued at $2,583,000 after acquiring an additional 8,412 shares during the period. 98.28% of the stock is owned by institutional investors and hedge funds.

Axalta Coating Systems Price Performance

AXTA opened at $31.3650 on Tuesday. The stock has a fifty day moving average price of $29.83 and a 200 day moving average price of $31.82. The company has a current ratio of 2.12, a quick ratio of 1.53 and a debt-to-equity ratio of 1.47. Axalta Coating Systems Ltd. has a 1 year low of $27.58 and a 1 year high of $41.65. The stock has a market cap of $6.79 billion, a price-to-earnings ratio of 15.38, a PEG ratio of 1.85 and a beta of 1.27.

Axalta Coating Systems (NYSE:AXTA - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The specialty chemicals company reported $0.64 earnings per share for the quarter, topping analysts' consensus estimates of $0.61 by $0.03. The company had revenue of $1.32 billion during the quarter, compared to the consensus estimate of $1.33 billion. Axalta Coating Systems had a return on equity of 25.32% and a net margin of 8.58%.The business's quarterly revenue was down 3.4% on a year-over-year basis. During the same period last year, the business earned $0.57 EPS. Axalta Coating Systems has set its FY 2025 guidance at 2.450-2.550 EPS. Q3 2025 guidance at 0.630-0.670 EPS. Analysts forecast that Axalta Coating Systems Ltd. will post 2.55 EPS for the current fiscal year.

Insider Transactions at Axalta Coating Systems

In other Axalta Coating Systems news, SVP Amy Tufano sold 3,194 shares of the business's stock in a transaction that occurred on Tuesday, August 19th. The shares were sold at an average price of $31.06, for a total value of $99,205.64. Following the completion of the sale, the senior vice president directly owned 12,087 shares of the company's stock, valued at $375,422.22. The trade was a 20.90% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. 0.30% of the stock is owned by company insiders.

Analysts Set New Price Targets

A number of equities analysts recently commented on AXTA shares. Mizuho decreased their price objective on shares of Axalta Coating Systems from $39.00 to $35.00 and set an "outperform" rating for the company in a research note on Tuesday, July 15th. The Goldman Sachs Group decreased their target price on Axalta Coating Systems from $46.00 to $40.00 and set a "buy" rating for the company in a research report on Wednesday, May 14th. Wells Fargo & Company dropped their price target on Axalta Coating Systems from $40.00 to $39.00 and set an "overweight" rating on the stock in a research report on Tuesday, July 1st. BMO Capital Markets downgraded Axalta Coating Systems from an "outperform" rating to a "market perform" rating and reduced their price objective for the stock from $51.00 to $33.00 in a research note on Wednesday, July 16th. Finally, Deutsche Bank Aktiengesellschaft cut Axalta Coating Systems from a "buy" rating to a "hold" rating and set a $32.00 target price on the stock. in a research note on Friday, July 18th. One analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating and six have given a Hold rating to the company's stock. Based on data from MarketBeat.com, Axalta Coating Systems presently has a consensus rating of "Moderate Buy" and a consensus target price of $37.71.

Read Our Latest Stock Report on Axalta Coating Systems

About Axalta Coating Systems

(

Free Report)

Axalta Coating Systems Ltd., through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through two segments, Performance Coatings and Mobility Coatings.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Axalta Coating Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axalta Coating Systems wasn't on the list.

While Axalta Coating Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.