Axiom Investors LLC DE bought a new position in shares of HealthEquity, Inc. (NASDAQ:HQY - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund bought 93,654 shares of the company's stock, valued at approximately $8,276,000. Axiom Investors LLC DE owned 0.11% of HealthEquity as of its most recent SEC filing.

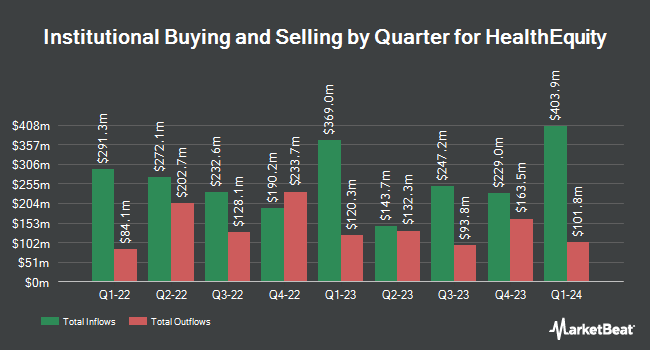

Other institutional investors and hedge funds have also recently modified their holdings of the company. Wealth Enhancement Advisory Services LLC lifted its holdings in shares of HealthEquity by 24.7% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 6,380 shares of the company's stock worth $564,000 after purchasing an additional 1,265 shares during the period. Mirae Asset Global Investments Co. Ltd. lifted its holdings in shares of HealthEquity by 7,983.6% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 24,655 shares of the company's stock worth $2,179,000 after purchasing an additional 24,350 shares during the period. GAMMA Investing LLC lifted its holdings in shares of HealthEquity by 25.9% during the first quarter. GAMMA Investing LLC now owns 1,571 shares of the company's stock worth $139,000 after purchasing an additional 323 shares during the period. Price T Rowe Associates Inc. MD lifted its holdings in shares of HealthEquity by 995.6% during the first quarter. Price T Rowe Associates Inc. MD now owns 639,345 shares of the company's stock worth $56,500,000 after purchasing an additional 580,988 shares during the period. Finally, WCM Investment Management LLC acquired a new stake in shares of HealthEquity during the first quarter worth about $20,230,000. Institutional investors and hedge funds own 99.55% of the company's stock.

HealthEquity Price Performance

Shares of HQY stock traded up $0.15 during trading hours on Friday, hitting $92.49. 616,085 shares of the company's stock were exchanged, compared to its average volume of 1,219,389. The company has a quick ratio of 4.23, a current ratio of 4.23 and a debt-to-equity ratio of 0.47. The firm has a market cap of $7.97 billion, a P/E ratio of 56.05, a P/E/G ratio of 1.32 and a beta of 0.50. The firm has a 50 day moving average of $93.46 and a two-hundred day moving average of $94.50. HealthEquity, Inc. has a fifty-two week low of $74.07 and a fifty-two week high of $116.65.

Insider Buying and Selling at HealthEquity

In other news, EVP Michael Henry Fiore sold 1,794 shares of the company's stock in a transaction that occurred on Monday, July 7th. The stock was sold at an average price of $101.73, for a total transaction of $182,503.62. Following the completion of the transaction, the executive vice president directly owned 53,225 shares of the company's stock, valued at $5,414,579.25. This represents a 3.26% decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. 1.50% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have issued reports on HQY. Royal Bank Of Canada boosted their price target on HealthEquity from $109.00 to $110.00 and gave the company an "outperform" rating in a report on Wednesday, September 3rd. JPMorgan Chase & Co. boosted their price target on HealthEquity from $125.00 to $126.00 and gave the company an "overweight" rating in a report on Wednesday, September 3rd. Deutsche Bank Aktiengesellschaft boosted their price target on HealthEquity from $98.00 to $115.00 and gave the company a "buy" rating in a report on Thursday, June 5th. Jefferies Financial Group boosted their price target on HealthEquity from $130.00 to $134.00 and gave the company a "buy" rating in a report on Wednesday, September 3rd. Finally, Barrington Research reissued an "outperform" rating and issued a $125.00 price target on shares of HealthEquity in a report on Friday, August 29th. One investment analyst has rated the stock with a Strong Buy rating, eleven have given a Buy rating and one has issued a Hold rating to the stock. Based on data from MarketBeat.com, HealthEquity presently has a consensus rating of "Buy" and a consensus price target of $119.77.

Get Our Latest Analysis on HQY

HealthEquity Company Profile

(

Free Report)

HealthEquity, Inc provides technology-enabled services platforms to consumers and employers in the United States. The company offers cloud-based platforms for individuals to make health saving and spending decisions, pay healthcare bills, receive personalized benefit information, earn wellness incentives, grow their savings, and make investment choices; and health savings accounts.

Further Reading

Before you consider HealthEquity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HealthEquity wasn't on the list.

While HealthEquity currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.