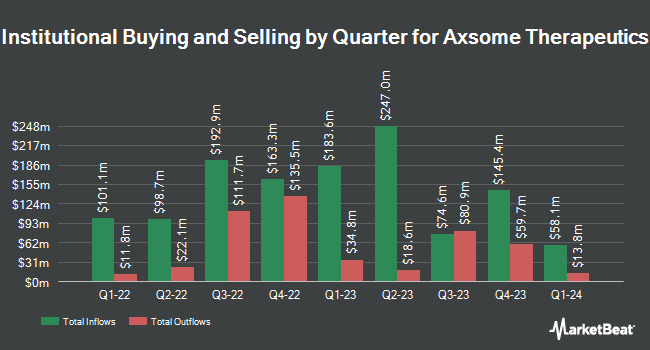

Nationale Nederlanden Powszechne Towarzystwo Emerytalne S.A. lifted its stake in Axsome Therapeutics, Inc. (NASDAQ:AXSM - Free Report) by 746.7% during the 1st quarter, according to its most recent disclosure with the SEC. The institutional investor owned 285,494 shares of the company's stock after buying an additional 251,775 shares during the quarter. Axsome Therapeutics makes up about 6.7% of Nationale Nederlanden Powszechne Towarzystwo Emerytalne S.A.'s investment portfolio, making the stock its 4th largest position. Nationale Nederlanden Powszechne Towarzystwo Emerytalne S.A. owned about 0.58% of Axsome Therapeutics worth $33,297,000 as of its most recent filing with the SEC.

Other hedge funds have also recently modified their holdings of the company. NBC Securities Inc. bought a new stake in Axsome Therapeutics in the 1st quarter worth approximately $31,000. Raiffeisen Bank International AG purchased a new position in shares of Axsome Therapeutics in the fourth quarter valued at $51,000. Aquatic Capital Management LLC purchased a new stake in Axsome Therapeutics during the fourth quarter valued at $76,000. GF Fund Management CO. LTD. bought a new position in Axsome Therapeutics during the fourth quarter valued at $86,000. Finally, Bank Hapoalim BM purchased a new position in shares of Axsome Therapeutics in the 1st quarter worth $204,000. Hedge funds and other institutional investors own 81.49% of the company's stock.

Axsome Therapeutics Stock Performance

Shares of Axsome Therapeutics stock traded down $3.37 during trading on Friday, hitting $101.60. 349,398 shares of the company's stock were exchanged, compared to its average volume of 792,365. The stock has a market capitalization of $5.00 billion, a price-to-earnings ratio of -17.61 and a beta of 0.46. The business has a 50-day simple moving average of $106.48 and a 200-day simple moving average of $109.69. Axsome Therapeutics, Inc. has a 52-week low of $72.21 and a 52-week high of $139.13. The company has a debt-to-equity ratio of 3.48, a quick ratio of 1.96 and a current ratio of 2.03.

Insider Buying and Selling at Axsome Therapeutics

In other Axsome Therapeutics news, COO Mark L. Jacobson sold 25,000 shares of the company's stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $110.44, for a total value of $2,761,000.00. Following the sale, the chief operating officer owned 5,783 shares in the company, valued at approximately $638,674.52. This represents a 81.21% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this link. Also, Director Mark Coleman sold 3,750 shares of the firm's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $105.47, for a total transaction of $395,512.50. Following the sale, the director directly owned 50,387 shares in the company, valued at $5,314,316.89. The trade was a 6.93% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 93,437 shares of company stock worth $9,834,215. Insiders own 22.30% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently issued reports on AXSM. Jefferies Financial Group began coverage on shares of Axsome Therapeutics in a research report on Monday, April 7th. They set a "buy" rating and a $200.00 target price on the stock. Robert W. Baird boosted their price objective on shares of Axsome Therapeutics from $160.00 to $162.00 and gave the company an "outperform" rating in a research report on Tuesday, May 6th. HC Wainwright reaffirmed a "buy" rating and set a $180.00 target price on shares of Axsome Therapeutics in a research report on Tuesday, June 10th. Mizuho increased their price target on Axsome Therapeutics from $212.00 to $216.00 and gave the stock an "outperform" rating in a research report on Thursday, March 27th. Finally, Wells Fargo & Company reaffirmed an "overweight" rating and issued a $165.00 price objective (up from $160.00) on shares of Axsome Therapeutics in a research note on Tuesday, May 6th. One investment analyst has rated the stock with a hold rating, fifteen have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, Axsome Therapeutics currently has an average rating of "Buy" and an average price target of $172.33.

Get Our Latest Stock Report on AXSM

About Axsome Therapeutics

(

Free Report)

Axsome Therapeutics, Inc, a biopharmaceutical company, engages in the development of novel therapies for central nervous system (CNS) disorders in the United States. The company's commercial product portfolio includes Auvelity (dextromethorphan-bupropion), a N-methyl-D-aspartate receptor antagonist with multimodal activity indicated for the treatment of major depressive disorder; and Sunosi (solriamfetol), a medication indicated to the treatment of excessive daytime sleepiness in patients with narcolepsy or obstructive sleep apnea.

Featured Articles

Before you consider Axsome Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axsome Therapeutics wasn't on the list.

While Axsome Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.