Azzad Asset Management Inc. ADV acquired a new stake in HubSpot, Inc. (NYSE:HUBS - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 4,421 shares of the software maker's stock, valued at approximately $2,526,000.

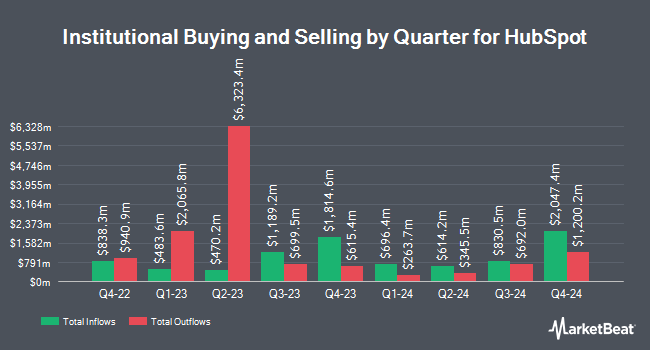

Other hedge funds and other institutional investors have also bought and sold shares of the company. Farther Finance Advisors LLC grew its stake in HubSpot by 5.4% during the 4th quarter. Farther Finance Advisors LLC now owns 255 shares of the software maker's stock valued at $178,000 after purchasing an additional 13 shares during the last quarter. Wedbush Securities Inc. lifted its holdings in shares of HubSpot by 3.4% during the fourth quarter. Wedbush Securities Inc. now owns 393 shares of the software maker's stock worth $274,000 after purchasing an additional 13 shares during the period. First Horizon Advisors Inc. boosted its position in HubSpot by 2.4% in the fourth quarter. First Horizon Advisors Inc. now owns 638 shares of the software maker's stock valued at $445,000 after buying an additional 15 shares during the last quarter. Amalgamated Bank increased its holdings in HubSpot by 0.5% in the 4th quarter. Amalgamated Bank now owns 3,259 shares of the software maker's stock worth $2,271,000 after buying an additional 16 shares during the period. Finally, Principal Securities Inc. increased its holdings in HubSpot by 17.2% in the 4th quarter. Principal Securities Inc. now owns 116 shares of the software maker's stock worth $81,000 after buying an additional 17 shares during the period. Hedge funds and other institutional investors own 90.39% of the company's stock.

Analyst Ratings Changes

HUBS has been the subject of several research reports. Mizuho decreased their price objective on shares of HubSpot from $900.00 to $700.00 and set an "outperform" rating for the company in a research note on Tuesday, April 15th. BMO Capital Markets decreased their target price on shares of HubSpot from $885.00 to $745.00 and set an "outperform" rating for the company in a research report on Friday, May 2nd. UBS Group upped their price target on shares of HubSpot from $675.00 to $820.00 and gave the company a "buy" rating in a report on Friday, May 9th. Morgan Stanley lifted their price objective on HubSpot from $659.00 to $752.00 and gave the company an "overweight" rating in a research note on Friday, May 9th. Finally, Cantor Fitzgerald started coverage on HubSpot in a research note on Tuesday, June 3rd. They issued an "overweight" rating and a $775.00 target price on the stock. Five investment analysts have rated the stock with a hold rating, twenty-five have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $766.71.

View Our Latest Analysis on HubSpot

HubSpot Trading Down 3.0%

NYSE:HUBS opened at $552.68 on Friday. The stock has a 50 day moving average of $596.64 and a two-hundred day moving average of $662.38. HubSpot, Inc. has a 12 month low of $434.84 and a 12 month high of $881.13. The firm has a market cap of $29.15 billion, a P/E ratio of 6,141.57, a price-to-earnings-growth ratio of 41.44 and a beta of 1.70.

Insider Buying and Selling

In related news, insider Brian Halligan sold 8,500 shares of the business's stock in a transaction dated Tuesday, March 18th. The shares were sold at an average price of $607.48, for a total transaction of $5,163,580.00. Following the transaction, the insider now directly owns 527,233 shares in the company, valued at approximately $320,283,502.84. The trade was a 1.59% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CEO Yamini Rangan sold 2,382 shares of the stock in a transaction dated Wednesday, April 2nd. The shares were sold at an average price of $573.92, for a total transaction of $1,367,077.44. Following the completion of the sale, the chief executive officer now owns 72,373 shares of the company's stock, valued at approximately $41,536,312.16. The trade was a 3.19% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 20,062 shares of company stock worth $11,516,757. 4.50% of the stock is owned by corporate insiders.

HubSpot Profile

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.