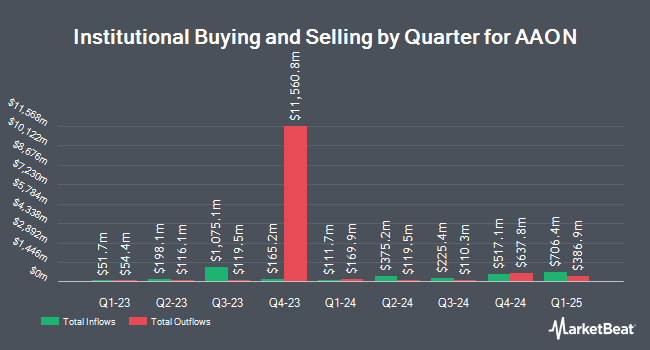

B. Metzler seel. Sohn & Co. AG increased its stake in shares of AAON, Inc. (NASDAQ:AAON - Free Report) by 322.4% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 41,103 shares of the construction company's stock after buying an additional 31,373 shares during the period. B. Metzler seel. Sohn & Co. AG owned 0.05% of AAON worth $3,211,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. Rakuten Securities Inc. lifted its position in AAON by 613.3% during the 1st quarter. Rakuten Securities Inc. now owns 321 shares of the construction company's stock valued at $25,000 after purchasing an additional 276 shares during the period. Versant Capital Management Inc lifted its position in AAON by 652.3% during the 1st quarter. Versant Capital Management Inc now owns 331 shares of the construction company's stock valued at $26,000 after purchasing an additional 287 shares during the period. Quarry LP lifted its position in AAON by 49.0% during the 4th quarter. Quarry LP now owns 313 shares of the construction company's stock valued at $37,000 after purchasing an additional 103 shares during the period. UMB Bank n.a. lifted its position in AAON by 81.2% during the 1st quarter. UMB Bank n.a. now owns 589 shares of the construction company's stock valued at $46,000 after purchasing an additional 264 shares during the period. Finally, Parallel Advisors LLC lifted its position in AAON by 26.3% during the 1st quarter. Parallel Advisors LLC now owns 716 shares of the construction company's stock valued at $56,000 after purchasing an additional 149 shares during the period. Institutional investors and hedge funds own 70.81% of the company's stock.

Wall Street Analysts Forecast Growth

AAON has been the subject of a number of recent analyst reports. Robert W. Baird lowered their price target on AAON from $102.00 to $98.00 and set a "buy" rating for the company in a research note on Tuesday, August 12th. Wall Street Zen cut AAON from a "hold" rating to a "strong sell" rating in a research note on Sunday, August 17th. Sidoti raised AAON from a "neutral" rating to a "buy" rating and set a $95.00 price target for the company in a research note on Monday, June 16th. Finally, DA Davidson lowered their price target on AAON from $125.00 to $105.00 and set a "buy" rating for the company in a research note on Tuesday, August 12th. One equities research analyst has rated the stock with a Strong Buy rating and four have assigned a Buy rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Buy" and an average price target of $102.00.

Read Our Latest Analysis on AAON

Insider Transactions at AAON

In related news, insider Christopher Douglas Eason sold 12,003 shares of the stock in a transaction that occurred on Monday, August 25th. The stock was sold at an average price of $85.08, for a total transaction of $1,021,215.24. Following the completion of the sale, the insider directly owned 5,301 shares of the company's stock, valued at approximately $451,009.08. This represents a 69.37% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Insiders own 18.55% of the company's stock.

AAON Stock Down 2.5%

NASDAQ AAON traded down $2.17 during trading hours on Friday, reaching $82.95. 861,153 shares of the company's stock were exchanged, compared to its average volume of 1,485,071. The company's 50-day moving average is $79.04 and its two-hundred day moving average is $85.12. AAON, Inc. has a one year low of $62.00 and a one year high of $144.07. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.99 and a current ratio of 3.10. The company has a market capitalization of $6.76 billion, a price-to-earnings ratio of 56.43 and a beta of 1.00.

AAON (NASDAQ:AAON - Get Free Report) last posted its earnings results on Monday, August 11th. The construction company reported $0.22 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.31 by ($0.09). AAON had a return on equity of 15.45% and a net margin of 9.70%.The business had revenue of $311.57 million for the quarter, compared to the consensus estimate of $326.15 million. During the same period in the previous year, the company posted $0.62 earnings per share. AAON's revenue for the quarter was down .6% compared to the same quarter last year. On average, analysts forecast that AAON, Inc. will post 2.26 EPS for the current fiscal year.

AAON Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Friday, September 5th will be paid a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a yield of 0.5%. The ex-dividend date of this dividend is Friday, September 5th. AAON's dividend payout ratio is presently 27.21%.

AAON Profile

(

Free Report)

AAON, Inc, together with its subsidiaries, engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada. The company operates through three segments: AAON Oklahoma, AAON Coil Products, and BASX. It offers rooftop units, data center cooling solutions, cleanroom systems, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls.

Further Reading

Before you consider AAON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAON wasn't on the list.

While AAON currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.