B. Riley Wealth Advisors Inc. increased its position in Hewlett Packard Enterprise (NYSE:HPE - Free Report) by 34.3% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 57,274 shares of the technology company's stock after acquiring an additional 14,633 shares during the period. B. Riley Wealth Advisors Inc.'s holdings in Hewlett Packard Enterprise were worth $1,229,000 at the end of the most recent reporting period.

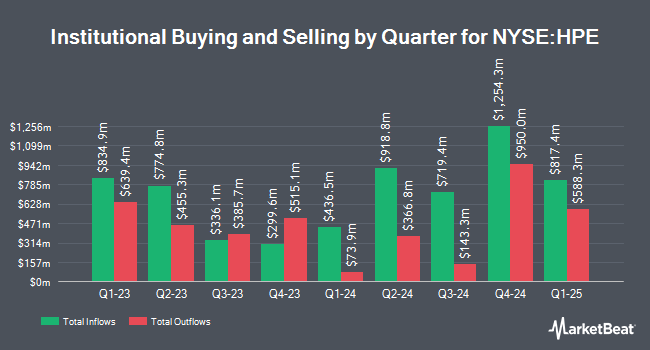

A number of other large investors have also modified their holdings of the company. Ameriflex Group Inc. bought a new position in Hewlett Packard Enterprise in the 4th quarter valued at about $31,000. Ascent Group LLC grew its position in Hewlett Packard Enterprise by 49.2% in the 4th quarter. Ascent Group LLC now owns 26,734 shares of the technology company's stock valued at $571,000 after buying an additional 8,811 shares in the last quarter. Putney Financial Group LLC bought a new position in Hewlett Packard Enterprise in the 4th quarter valued at about $25,000. Perennial Advisors LLC bought a new position in Hewlett Packard Enterprise in the 4th quarter valued at about $235,000. Finally, Forum Financial Management LP grew its position in Hewlett Packard Enterprise by 2.2% in the 4th quarter. Forum Financial Management LP now owns 23,639 shares of the technology company's stock valued at $505,000 after buying an additional 515 shares in the last quarter. Institutional investors and hedge funds own 80.78% of the company's stock.

Hewlett Packard Enterprise Trading Down 2.3%

Shares of HPE traded down $0.40 during midday trading on Friday, hitting $17.25. The stock had a trading volume of 26,150,174 shares, compared to its average volume of 17,273,701. Hewlett Packard Enterprise has a fifty-two week low of $11.97 and a fifty-two week high of $24.66. The business has a 50-day simple moving average of $15.99 and a two-hundred day simple moving average of $19.16. The firm has a market cap of $22.66 billion, a P/E ratio of 9.08, a price-to-earnings-growth ratio of 2.03 and a beta of 1.29. The company has a current ratio of 1.29, a quick ratio of 0.99 and a debt-to-equity ratio of 0.54.

Hewlett Packard Enterprise Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, April 18th. Investors of record on Friday, March 21st were issued a dividend of $0.13 per share. This represents a $0.52 annualized dividend and a dividend yield of 3.01%. The ex-dividend date was Friday, March 21st. Hewlett Packard Enterprise's dividend payout ratio is currently 25.37%.

Analyst Ratings Changes

HPE has been the subject of a number of recent analyst reports. Wells Fargo & Company decreased their target price on shares of Hewlett Packard Enterprise from $22.00 to $17.00 and set an "equal weight" rating for the company in a research report on Friday, March 7th. Susquehanna reduced their price objective on shares of Hewlett Packard Enterprise from $20.00 to $15.00 and set a "neutral" rating for the company in a research report on Friday, March 7th. Bank of America reduced their price objective on shares of Hewlett Packard Enterprise from $26.00 to $20.00 and set a "buy" rating for the company in a research report on Friday, March 7th. Barclays reduced their price objective on shares of Hewlett Packard Enterprise from $27.00 to $20.00 and set an "overweight" rating for the company in a research report on Friday, March 7th. Finally, Morgan Stanley raised their price objective on shares of Hewlett Packard Enterprise from $14.00 to $22.00 and gave the company an "equal weight" rating in a research report on Tuesday, May 20th. Nine investment analysts have rated the stock with a hold rating, seven have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $21.13.

Get Our Latest Research Report on HPE

Insider Buying and Selling

In related news, Director Bethany Mayer sold 6,409 shares of the firm's stock in a transaction that occurred on Friday, April 4th. The shares were sold at an average price of $13.19, for a total transaction of $84,534.71. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. 0.36% of the stock is currently owned by corporate insiders.

Hewlett Packard Enterprise Profile

(

Free Report)

Hewlett Packard Enterprise Company provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. It operates in six segments: Compute, HPC & AI, Storage, Intelligent Edge, Financial Services, and Corporate Investments and Other.

Read More

Before you consider Hewlett Packard Enterprise, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hewlett Packard Enterprise wasn't on the list.

While Hewlett Packard Enterprise currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.