Baillie Gifford & Co. grew its holdings in SolarEdge Technologies, Inc. (NASDAQ:SEDG - Free Report) by 17.7% in the first quarter, according to its most recent disclosure with the SEC. The fund owned 125,898 shares of the semiconductor company's stock after buying an additional 18,921 shares during the period. Baillie Gifford & Co. owned 0.21% of SolarEdge Technologies worth $2,037,000 at the end of the most recent reporting period.

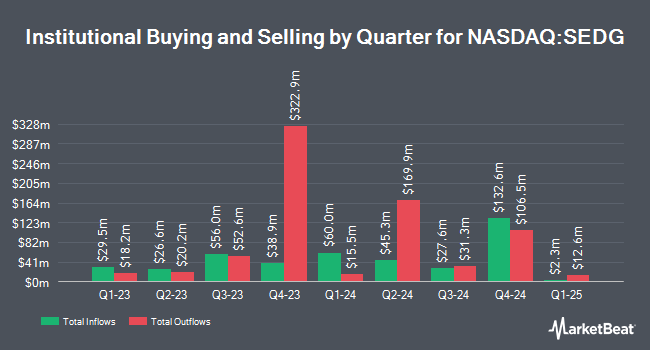

A number of other institutional investors and hedge funds have also made changes to their positions in SEDG. Fifth Third Bancorp grew its holdings in SolarEdge Technologies by 93.7% during the 1st quarter. Fifth Third Bancorp now owns 1,633 shares of the semiconductor company's stock valued at $26,000 after purchasing an additional 790 shares in the last quarter. New York State Teachers Retirement System grew its holdings in SolarEdge Technologies by 1.5% during the 1st quarter. New York State Teachers Retirement System now owns 66,436 shares of the semiconductor company's stock valued at $1,075,000 after purchasing an additional 1,000 shares in the last quarter. Bank of New York Mellon Corp grew its holdings in SolarEdge Technologies by 1.2% during the 1st quarter. Bank of New York Mellon Corp now owns 269,944 shares of the semiconductor company's stock worth $4,368,000 after acquiring an additional 3,171 shares in the last quarter. GAMMA Investing LLC grew its holdings in SolarEdge Technologies by 71.9% during the 1st quarter. GAMMA Investing LLC now owns 9,047 shares of the semiconductor company's stock worth $146,000 after acquiring an additional 3,783 shares in the last quarter. Finally, Deutsche Bank AG grew its holdings in SolarEdge Technologies by 3.8% during the 4th quarter. Deutsche Bank AG now owns 147,968 shares of the semiconductor company's stock worth $2,012,000 after acquiring an additional 5,363 shares in the last quarter. 95.10% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several brokerages have weighed in on SEDG. Glj Research lowered shares of SolarEdge Technologies from a "hold" rating to a "strong sell" rating and set a $6.90 price objective for the company. in a report on Tuesday, June 17th. Wells Fargo & Company decreased their price objective on shares of SolarEdge Technologies from $19.00 to $15.00 and set an "equal weight" rating for the company in a report on Wednesday, May 7th. BNP Paribas raised shares of SolarEdge Technologies to a "strong sell" rating in a report on Wednesday, July 16th. Morgan Stanley reiterated an "underweight" rating and issued a $10.00 price objective on shares of SolarEdge Technologies in a research report on Wednesday, April 23rd. Finally, Jefferies Financial Group lifted their price objective on shares of SolarEdge Technologies from $10.00 to $18.00 and gave the company an "underperform" rating in a research report on Monday, July 14th. Eleven investment analysts have rated the stock with a sell rating and eighteen have assigned a hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $17.92.

View Our Latest Analysis on SEDG

SolarEdge Technologies Trading Up 7.4%

Shares of SEDG stock traded up $1.84 during trading hours on Wednesday, reaching $26.79. 2,086,149 shares of the stock traded hands, compared to its average volume of 4,846,700. SolarEdge Technologies, Inc. has a 1-year low of $10.24 and a 1-year high of $32.45. The business has a fifty day moving average price of $21.84 and a 200 day moving average price of $17.52. The company has a quick ratio of 1.39, a current ratio of 2.04 and a debt-to-equity ratio of 0.62. The firm has a market capitalization of $1.58 billion, a PE ratio of -0.89 and a beta of 1.62.

SolarEdge Technologies (NASDAQ:SEDG - Get Free Report) last issued its earnings results on Tuesday, May 6th. The semiconductor company reported ($1.14) EPS for the quarter, topping the consensus estimate of ($1.26) by $0.12. The business had revenue of $219.48 million during the quarter, compared to analysts' expectations of $205.39 million. SolarEdge Technologies had a negative return on equity of 127.53% and a negative net margin of 182.81%. SolarEdge Technologies's revenue was up 7.4% compared to the same quarter last year. During the same quarter last year, the firm posted ($1.90) earnings per share. On average, equities research analysts forecast that SolarEdge Technologies, Inc. will post -4.54 EPS for the current year.

SolarEdge Technologies Profile

(

Free Report)

SolarEdge Technologies, Inc, together with its subsidiaries, designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally. It operates in two segments, Solar and Energy Storage.

Featured Stories

Before you consider SolarEdge Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SolarEdge Technologies wasn't on the list.

While SolarEdge Technologies currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.